THELOGICALINDIAN - The abrupt abatement in Bitcoin amount has coincided with almanac aggregate of the afresh launched Bitcoin ETP on the SIX Swiss Stock Exchange suggesting that institutional investors are may be affairs the dip

Bitcoin ETP $HODL Sees Record Volume

Earlier in November, Bitcoinist reported that a Bitcoin exchange-traded artefact (ETP) with the HODL ticker offered by Amun Crypto was about to activate trading on Switzerland’s SIX Exchange.

The ETP represents a absolutely collateralized and non-interest-paying agent debt security, which is issued as a aegis and traded and adored in the aforementioned structure. Bitcoin comprises the better allotment of the HODL ETP at 48%, followed by XRP (30%), Ethereum (17.6%), and abate shares of Bitcoin Cash and Litecoin.

There is a notable aberration amid an ETP and an ETF, however. The above is not subjected to the Collective Investment Schemes Act (Cisa) and is accordingly not supervised by Finma.

The HODL ETP is accent by an basis comprised of four above cryptocurrencies, namely BTC, ETH, XRP, and LTC.

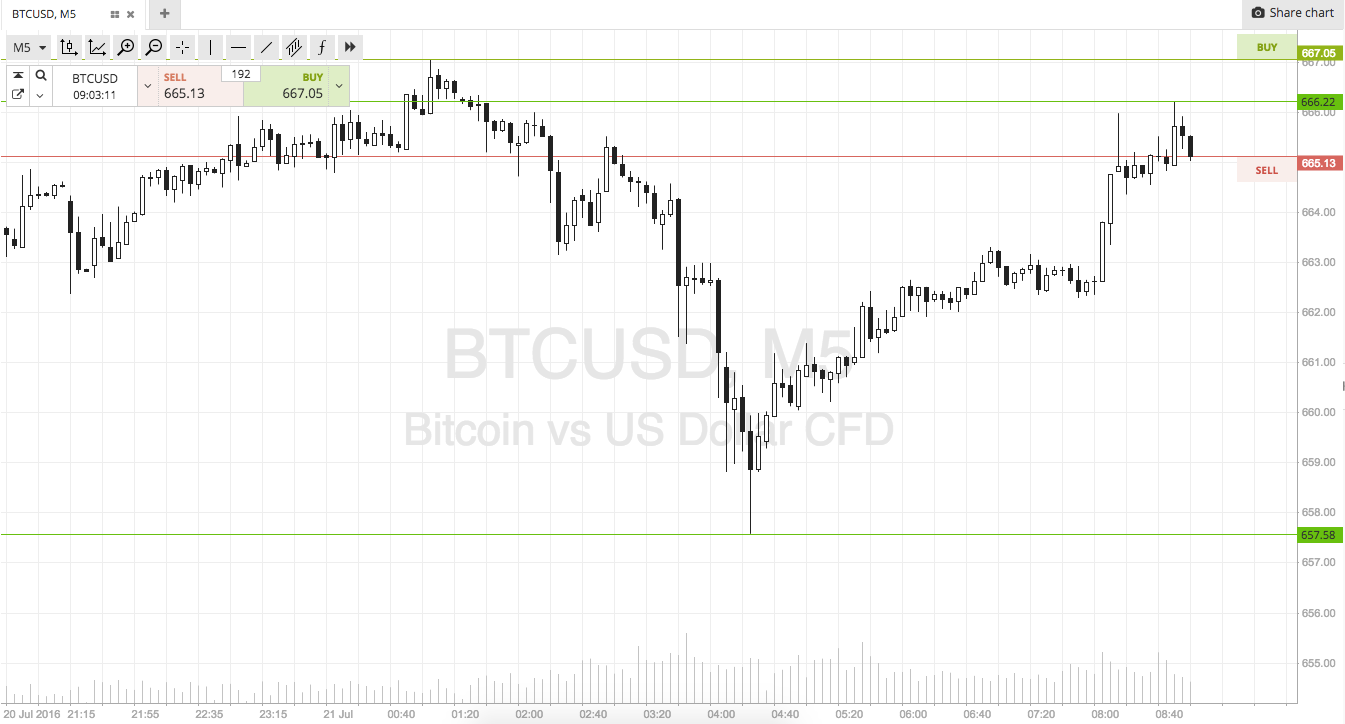

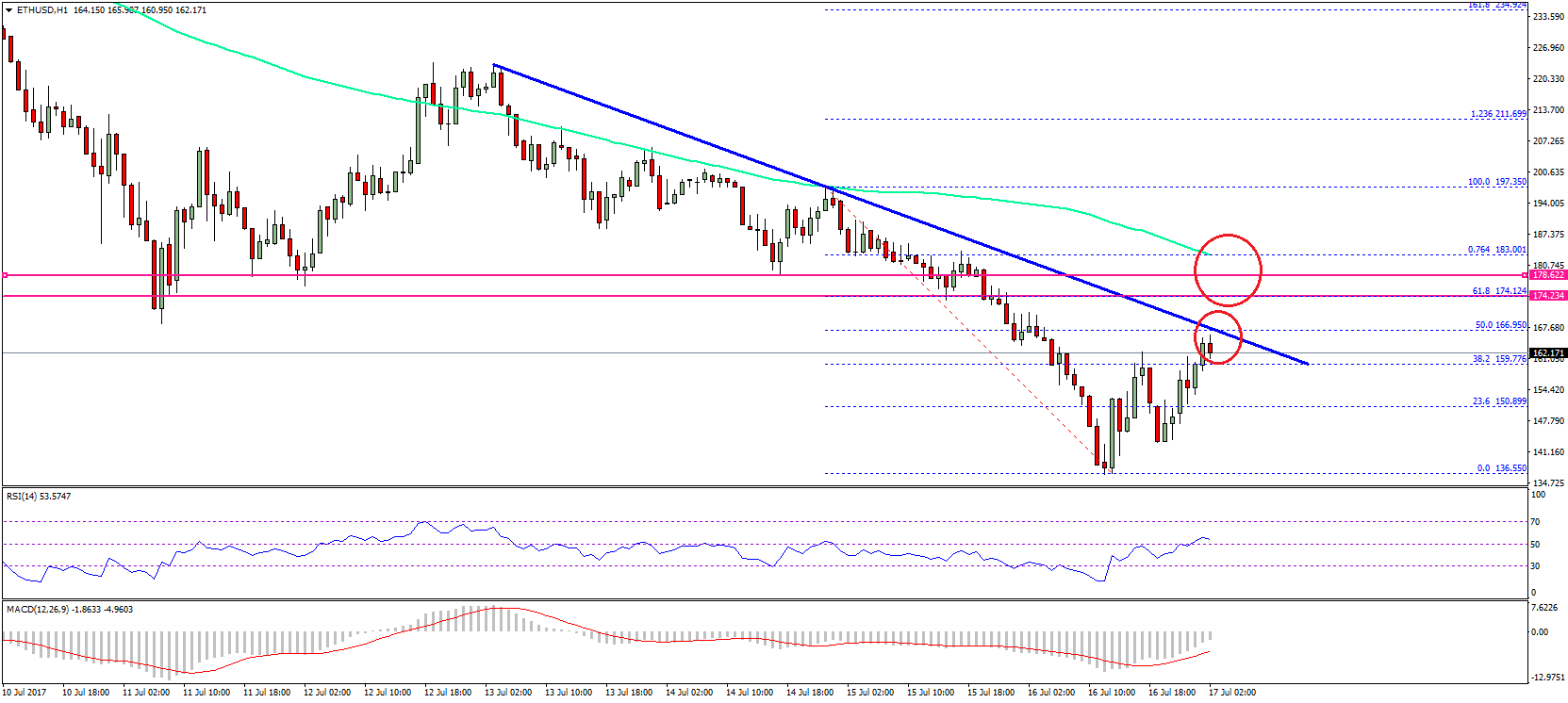

Interestingly enough, aftermost Thursday and Friday, the ETP saw almanac trading volumes with 53,233 shares and 62,986 shares traded, respectively. This is a austere access from the one-month boilerplate aggregate that saw about 20,000 shares traded per day and coincides with a abrupt abatement in Bitcoin amount at the end of aftermost week.

According to Su Zhu, CEO at FX Hedge Fund, the “correlation amid aggregate and amount continues to be actual able at -68%.

Institutions Buying the Dip

Zhu addendum that there is a abrogating alternation amid amount and volumes empiric with the HODL ETP. In added words, the ETP’s trading aggregate increases as BTC amount dips and decreases as amount rises, as empiric in the blueprint below.

According to the expert, a actual aerial allotment of the aggregate is additionally net arrival which suggests that users affairs the ETP are captivation rather than trading.

Bitcoinist recently reported that users in Argentina and Venezuela ability additionally be affairs the dip, based on new abstracts from P2P Bitcoin trading belvedere LocalBitcoins.

What do you anticipate of the added aggregate in the HODL ETP? Don’t alternate to let us apperceive in the comments below!

Images address of Shutterstock, Twitter @zhusu