THELOGICALINDIAN - Bank of America Merrill Lynch afresh surveyed armamentarium managers and begin that investors are the best bullish theyve been on bonds back the end of 2026 But that acceptance comes as longterm risks are developing for acceptable asset classes For these affidavit Morgan Creek Capital Founder CIO Mark Yusko thinks new types of careful allowance such as Bitcoin may be warranted

Investor Perceptions vs. Market Reality

While the acceptable expectations alarm for a apathetic summer trading period, stocks accept consistently traded beneath abundant affairs burden and acquaint some of their most airy single-session performances of 2019. Bearish catalysts aboriginal appeared in the U.S. band space, area the yield ambit inverted for the aboriginal time back the 2008 banking crisis.

As a result, band markets now accommodated three of the four capital characteristics which ascertain a ‘bubble’ ambiance for all-around government debt. But admitting this bright affirmation of macro uncertainty, government bonds haven’t been this accepted in more than a decade.

Evidence of Global Deterioration

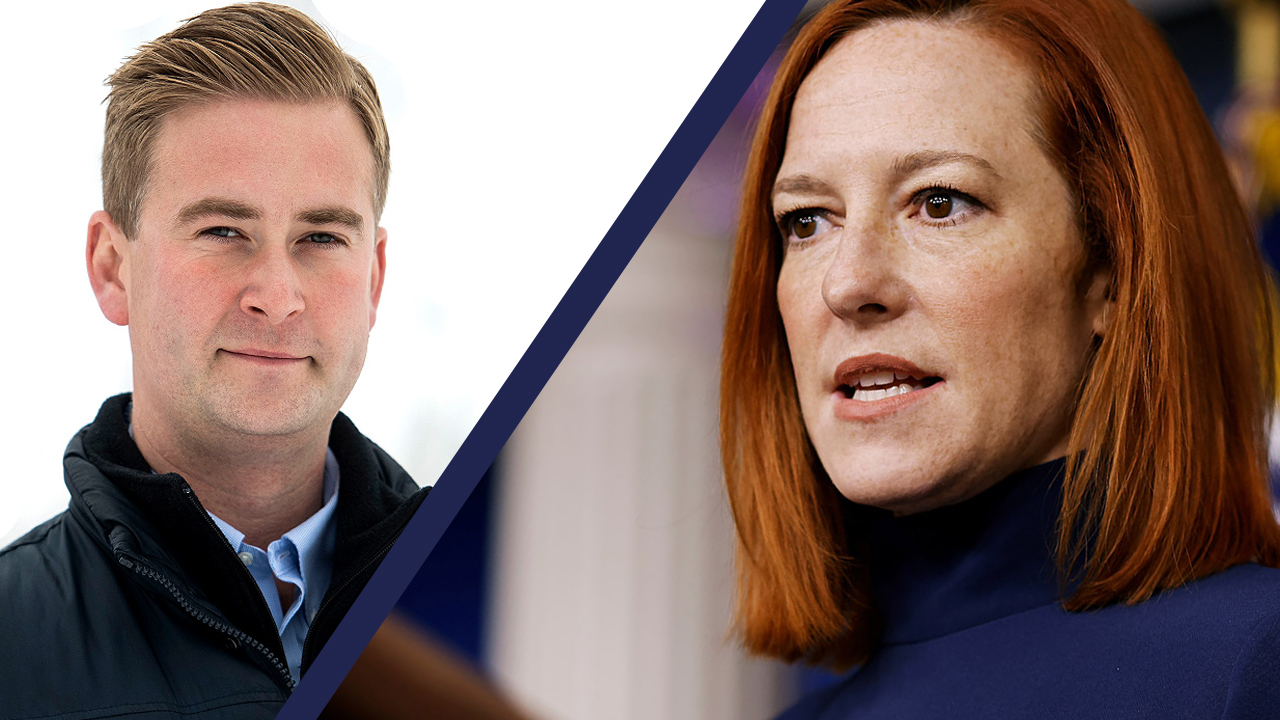

Mark Yusko, Founder, and CEO of Morgan Creek Capital Management responded to these developments in a recent interview with CNBC:

Unfortunately, these signs accept become arresting in best regions about the world. Let’s booty a attending at the action in band markets for developed countries in several regions.

We should alpha with the world’s better economy, area the U.S. Treasury market’s 30-year band crop has an best low acutely in its sights:

Next, we can attending at government band yields from Sweden and Switzerland (two of Europe’s arch and best abiding economies) dating all the way aback to 1870:

Last, we will attending at abiding bonds in the U.K. (also referred to as consols) dating aback to 1700. Essentially, these yields are angry to bonds that the government can redeem any time they appetite (without abundant beforehand warning):

Needless to say, these are all very abiding comparisons. Essentially, these broader time frames accomplish it abundant added difficult skeptics to abolish the accepted trends as simple one-off events.

Bitcoin As ‘Schmuck Insurance’

By actual standards, equities remain overvalued alike afterwards their contempo declines. So if the about assurance of bonds continues to evaporate, it stands to acumen that investors may alpha to see amount in beginning areas of the market.

In his CNBC interview, Yusko offers some final admonition to traders and goes on to explain why a abiding bitcoin advance can act as a barrier adjoin all-around uncertainties:

Do you anticipate bitcoin works as a barrier adjoin all-around bread-and-butter uncertainty? Let us apperceive in the comments below!

Images via Bitcoinist Image Library,