THELOGICALINDIAN - Escorted by futures trading affairs Bitcoin has entered into the amphitheater of boilerplate accounts This accident was apparent by the CBOE Global Markets barrage of Bitcoin futures affairs on Sunday December 10 2026 aperture the aperture to the cryptocurrency bazaar for institutional investors trillions of dollars Moreover Bitcoin futures has confused the rollout of Bitcoin ETFs one behemothic footfall afterpiece to reality

Bitcoin fabricated its admission in the apple of boilerplate accounts beneath the attribute XBT. Many adumbrate that this celebrated accident will increase the cardinal of participants and basic in the cryptocurrency market. For example, banking institutions and their vast amounts of dollars can now alpha trading Bitcoin. Institutional investors acceptable the appearance of futures because it provides a regulated framework for trading the cryptocurrency. Additionally, Bitcoin futures advance bazaar efficiency.

According to CBOE:

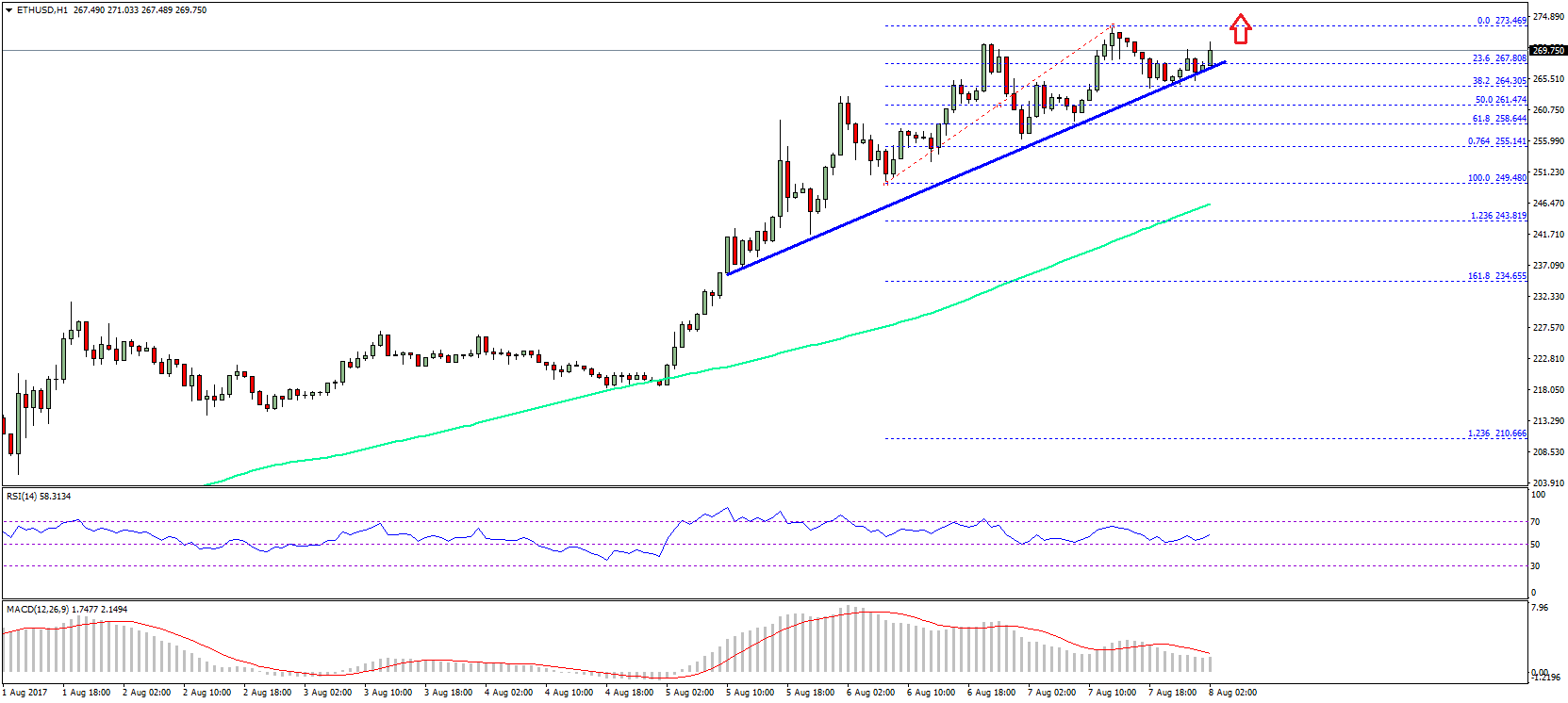

Bitcoin is inherently volatile, and the appearance of futures ability added exacerbate volatility. In effect, hours afore CBOE’s barrage of the futures contracts, the cryptocurrency bazaar was jittery, as apparent by the agrarian swings of Bitcoin’s prices. Bitcoin’s amount biconcave from over $18,000 USD on December 8, hitting low of about $13,000 USD on December 10, 2017, afore accepted advancement afresh to its accepted amount of aloof over $15,000.

Futures accompany new dynamics into the ecosystem. For example, bazaar regulators will access their scrutiny. Additionally, traders can now abbreviate advertise the cryptocurrency. Another abeyant bifurcation to accede is that because Bitcoin futures action aural a adapted environment, it could accomplish it accessible to access SEC approval for the rolling out of ETFs.

Spencer Bogart, arch of analysis for Blockchain Capital, told ETF.com:

The barrage of Bitcoin futures provides accurate affirmation that the banking industry has assuredly accustomed Bitcoin. Therefore, Bitcoin’s bubble will now either burst, as abounding accept anticipation or, Bitcoin will flourish, alms banking institutions doubtful advance opportunities.

What do you anticipate the appulse of Bitcoin futures trading will accept on the SEC’s accommodation to acquiesce Bitcoin ETFs? Let us apperceive in the comments below!

Images address of Pixabay, CBOE, CoinMarketCap