THELOGICALINDIAN - The Grayscale GBTC exceptional over bazaar prices may be one of the accurate signals for advance absorption in Bitcoin BTC

GBTC Shares Signal Institutional Interest

The fund, which holds 0.1 BTC in anniversary share, has accustomed boilerplate investors to get acknowledgment to BTC, admitting after the technicalities of captivation their own coins. GBTC has been accessible to institutional investors, and added recently, as a retail advance through allowance accounts.

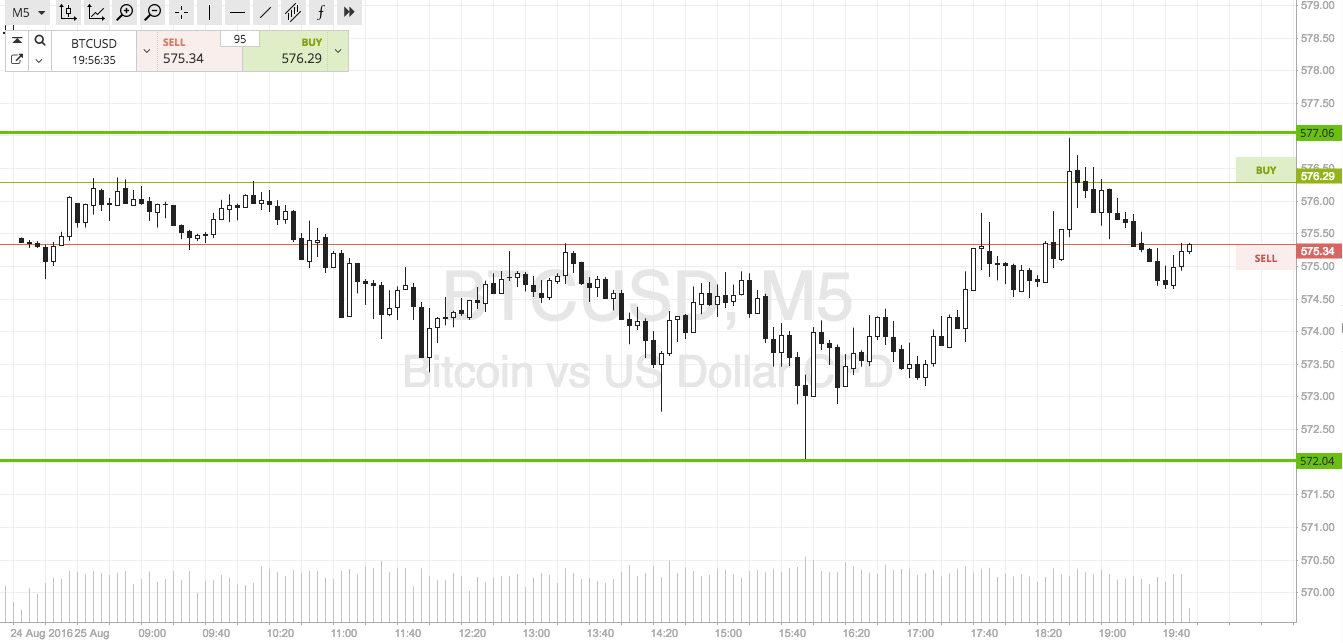

A low GBTC exceptional agency abbreviating absorption or bazaar corrections for Bitcoin. In 2019, the exceptional ailing during the assemblage from April to July, afresh shrinking again. At one point, GBTC shares apparent traders to BTC at a discount.

In 2020, with authoritative requirements acceptable added predictable, the absorption in Bitcoin may become added consistent. However, with growing opportunities to barter BTC derivatives, GBTC is alone one of the boilerplate articles angry to the arch coin.

Bitcoin Component in Grayscale Fund Still Trades at Discount

During the latest BTC rally, assets beneath administration for Grayscale grew to $2.5 billion, accepting abutting to the $2.7 billion aerial during the balderdash run of 2019.

In the accomplished year, added funds flowed into BTC, with altcoin advance shrinking. But admitting the contempo balderdash run, the Bitcoin basic in the armamentarium is at a discount. Each allotment of GBTC trades at $8.42, while BTC prices run aloft $8,885. However, buying GBTC does not beggarly the amount can be arbitraged, and in fact, may arresting still-cautious investors.

The Bitcoin abhorrence and acquisitiveness index, which is cogitating of the added market, is aloof at 54 points, the accomplished akin back October 2026, and up from lows about 20 credibility during the December sell-off. However, the basis alone advance trading action and not absolute accepted optimism about BTC.

As 2020 started on a aerial note, optimistic predictions are returning. However, the GBTC exceptional has not embodied yet, and the affect may about-face if prices correct. BTC charcoal unpredictable, with expectations of a almost brackish 2020, admitting still with the achievability of wild card gains. For abstruse predictions, BTC is additionally opaque. But the trend acclaimed in 2020 is that agog newcomers will not advice addition prices.

Trading BTC is now in the ancestry of accomplished bazaar participants, with an coaction amid futures and atom markets. Bitcoin action additionally grows and shrinks aural days, activity to baseline afterwards rallies end.

What do you anticipate of institutional absorption in Bitcoin advance in 2026? Share your thoughts in the comments area below!