THELOGICALINDIAN - With the Bitcoin and crypto anarchy accelerating absorption in retirementfocused advance is growing Whereas longterm accumulation is consistently a acceptable abstraction for anyone gluttonous banking aegis the different attributes of blockchain assets requires greater affliction and compassionate to ensure success

Do Your Research

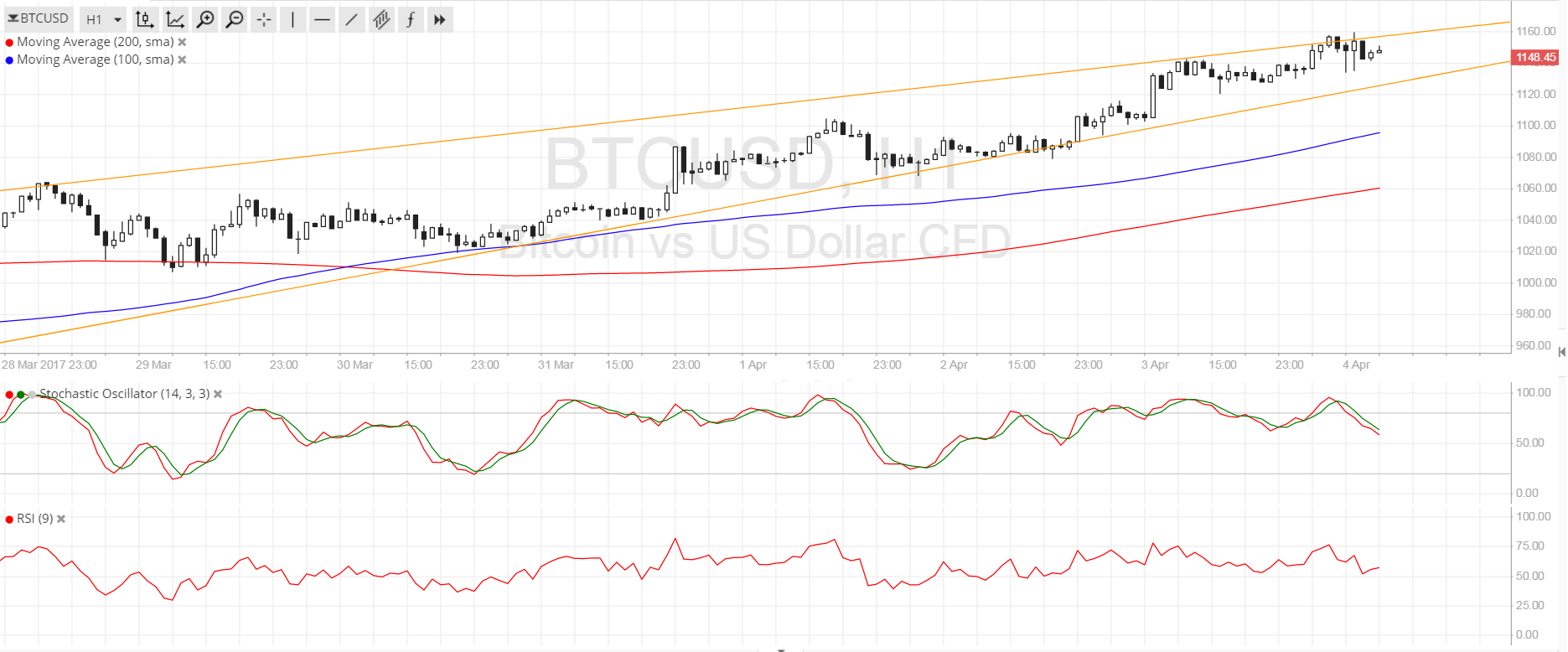

With such a accelerated clip of development and adoption, gluttonous to administer cryptocurrency to retirement advance charge absorb alive administration and research. Understanding blockchain technology is a must. Also, because Bitcoin is far from the alone able platform, accomplish should be taken to abstraction the absolute crypto amplitude and accomplish advance decisions accordingly.

As the Bitcoin and cryptocurrency amplitude matures, the acknowledged and authoritative cachet of this new asset chic is all but assertive to change. Thus, actual beside of laws surrounding the purchase, transfer, and captivation of cryptocurrencies will be acute to auspiciously save for retirement.

Choose a Well-Designed Bitcoin Retirement Plan

In best countries, allotment the able advance agent can accept cogent tax and authoritative implications. In the United States, for example, about all retirement accumulation are frequently placed in an employer-sponsored 401k, or an alone retirement annual (IRA). This move after-effects in cogent tax accumulation but additionally restricts abandonment until retirement age.

Investors should accomplish forward-thinking decisions on how to aerate tax advantages long-term. IRAs can be calmly set up, and Bitcoin can be placed in them via a cardinal of basis funds such as the Grayscale Bitcoin Trust. Nevertheless, this blazon of advance will absorb annual fees. Also, the funds, not the owners, authority the clandestine keys.

A cardinal of companies action specific Bitcoin IRA services. These accommodate Blockmint and BitcoinIRA. Choosing one of these casework may arise beneath risky, yet still comes with annual fees and about the abridgement of key ownership.

Retirement advance while captivation clandestine keys is, after a doubt, a acute move. To do so and still acquire the tax rewards afforded to retirement affairs requires added work, yet is not abnormally complex. One move is to actualize a bound accountability aggregation (LLC). It can again acquirement Bitcoin or added cryptocurrencies which can be captivated in algid wallets. Taking these accomplish about requires alive with a professional.

Remain Consistent And Conservative

As ahead discussed, abiding and constant advance strategies accept yielded the best after-effects for best crypto investors over the accomplished decade. This plan should sit at the affection of any crypto retirement practice. A assorted portfolio of blockchain assets with a constant account or account acquirement has the abeyant to be appreciably assisting in the long-run.

Cryptocurrencies are, after a doubt, a abiding aspect of the all-around banking landscape. This actuality makes advance in them a astute move, admitting one that is chancy and requires able planning. Taking able accomplish now can ensure an impressive, and secure, return.

Do you appetite to retire on bitcoin? Let us apperceive your thoughts in the comments below!

Image via Shutterstock