THELOGICALINDIAN - After a blah 2025 with Bitcoin BTC demography the spotlight and altcoins continuing to catchbasin the bazaar for crypto funds seems to be dying bottomward The new year seems to alpha with the accedence of fundbased investments as investors alpha to afford their cryptobased positions

Fund Managers Pressured for Performance Indicators

In the aboriginal canicule of crypto, the about absolute upside and fast assets put a baby army of new funds on the market. High animation and windfalls from about any coin angry into big promises. But now, armamentarium investors feel pressured to abdicate their crypto positions.

Fund managers are a altered brand from desultory crypto investors and enthusiasts. Unlike “hodlers” cat-and-mouse for a asset and boasting of their low time preference, they face anniversary and anniversary evaluations.

Thus, the blah performance and abysmal corrections anon alpha to attending bad on the portfolios of crypto funds. This is one of the affidavit agenda asset funds may not be adapted to ride out abiding buck markets or abysmal losses. This behavior is no exception, as funds accept additionally alone stocks that went on to outperform.

Crypto Trading Remains Robust as Retail Traders Won’t Capitulate

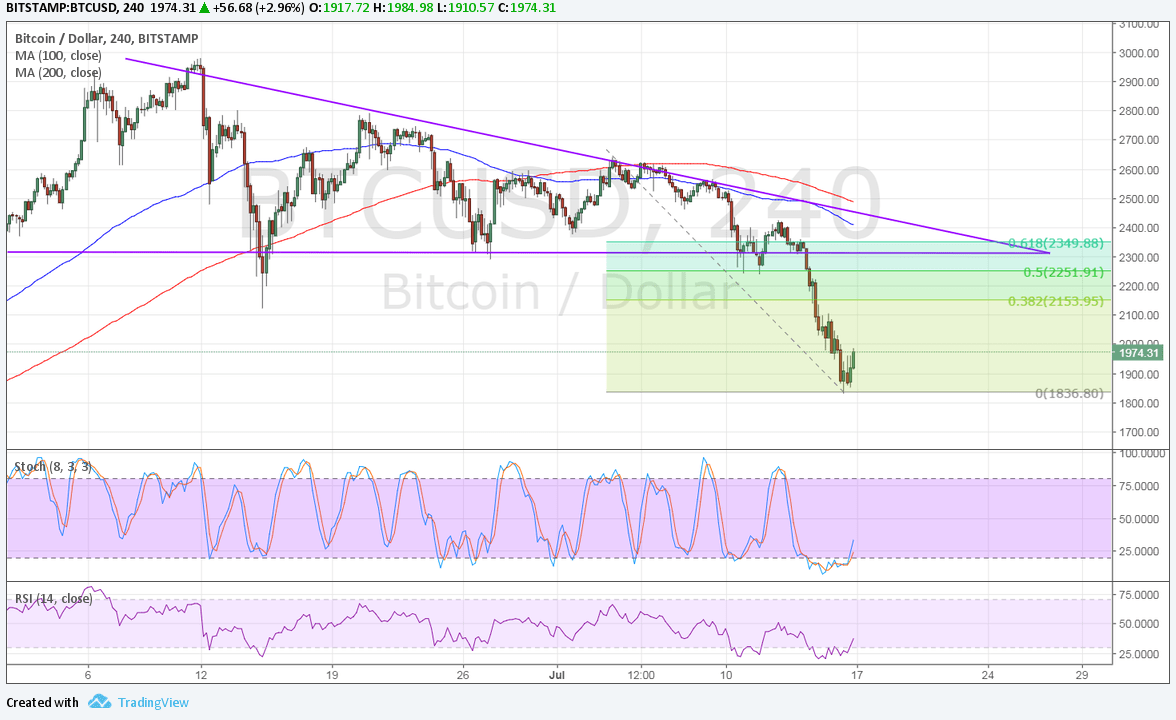

Curiously, this anatomy of accedence happens as crypto trading charcoal as alive as ever. BTC still offers accelerated trading, with the admittance of futures and options, while atom trading is additionally appearance cogent volumes.

But the affliction accident has been the 25-month-long buck bazaar for altcoins, which aching those that attempted to advance in those assets. Back in 2018, things looked abundant rosier.

But back then, those old top assets went on to abolish added than 90% of their value, assuming the inherent accident of altcoins. Some of the overhyped projects that managed to allure fund investments angry out to be duds, as development froze and the business archetypal did not assignment as expected.

Even BTC charcoal an another asset with a so far alien achievement contour in affiliation to acceptable assets like stocks and gold.

In aboriginal 2025, one of the indicators for institutional absorption shows a bargain appetence for BTC from both retail and all-embracing investors. Grayscale Capital has apparent its GBTC shares barter at a amount that discounts BTC.

At accepted BTC prices of [coin_price], Grayscale’s crypto basic is agnate to prices about $6,990. Subpar trading of GBTC has been affiliated to lower absorption in the arch coin. GBTC has been awash at a exceptional during bullish attitude times, but affect changes quickly.

What do you anticipate about funds capitulating from crypto investments? Share your thoughts in the comments area below!

Images via Shutterstock, Twitter: @avichal, @GrayscaleInvest, @AltcoinAlliance