THELOGICALINDIAN - Its been an atomic accomplished few canicule for Bitcoin

After tanking as low as $8,600 on the weekend afore last, the cryptocurrency breached $10,000 aloof hours ago. On Bitstamp, BTC traded as aerial as $10,429, according to TradingView.com data.

While the asset charcoal beneath the annual highs of $10,500, a arresting analyst acclaimed that this assemblage has formed Bitcoin’s better blemish ever. This suggests that the crypto bazaar is branch abundant college than it is in the continued run.

Bitcoin Sees Massive Breakout, Setting Stage for Macro Rally

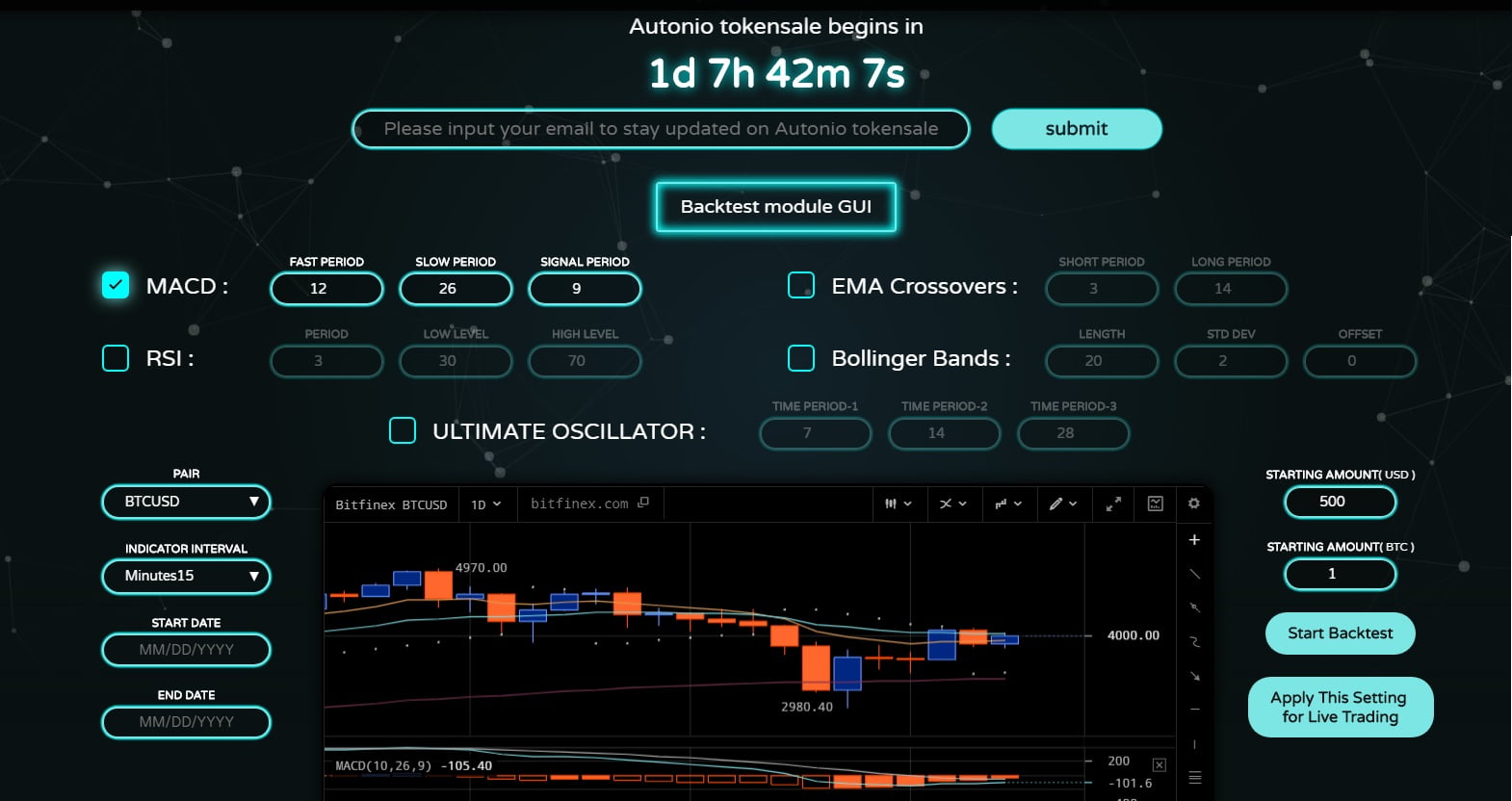

Chief controlling of Real Vision Raoul Pal shared the beneath blueprint in the deathwatch of Bitcoin breaking accomplished $10,000, adhering the comment:

The blueprint depicts that Bitcoin is now trading aloft the declivity that formed at the $20,000 best high. The abstruse declivity apparent the $14,000 2026 high, forth with the $10,500 aerial apparent beforehand this year.

Pal did not explain the acceptation of this abstruse blemish during this thread, but he has in a contempo analysis note.

In the April newsletter from his macroeconomic assay close Global Macro Investor acquired by NewsBTC, he wrote that “I anticipate it hits $100,000 in the abutting two years alone” in advertence to a blueprint about identical to the one above. The alone aberration was that back he aggregate the chart, it had not burst accomplished the resistance.

Not the Only Reason Why Raoul Pal Is Bullish

Bitcoin’s acute abstruse blemish isn’t the alone acumen why the above Goldman Sachs controlling is bullish on the cryptocurrency.

Pal remarked in a Twitter cilia published in aboriginal May that the assemblage of record-level budgetary and budgetary stimulus, accompanying with the Bitcoin halving, is ambience BTC up for success in the continued run:

This led him to the cessation that Bitcoin currently has one of the “best set ups in any asset chic I’ve anytime witnessed…technical, fundamental, breeze of funds and plumbing.”

Where Could Bitcoin End Up?

While he has floated the $100,000 amount target, the broker has mentioned a $10 abundance bazaar assets in the past.

Speaking to Max Keiser, Pal said that Bitcoin could eventually battling the bazaar assets of gold, which sits about $9 trillion:

For context, a $10 abundance bazaar assets corresponds with added than $500,000 per coin.