THELOGICALINDIAN - As the amount of Bitcoin connected to attack a blemish aloft 11500 beforehand this anniversary bears counterbalanced those moves with profittaking

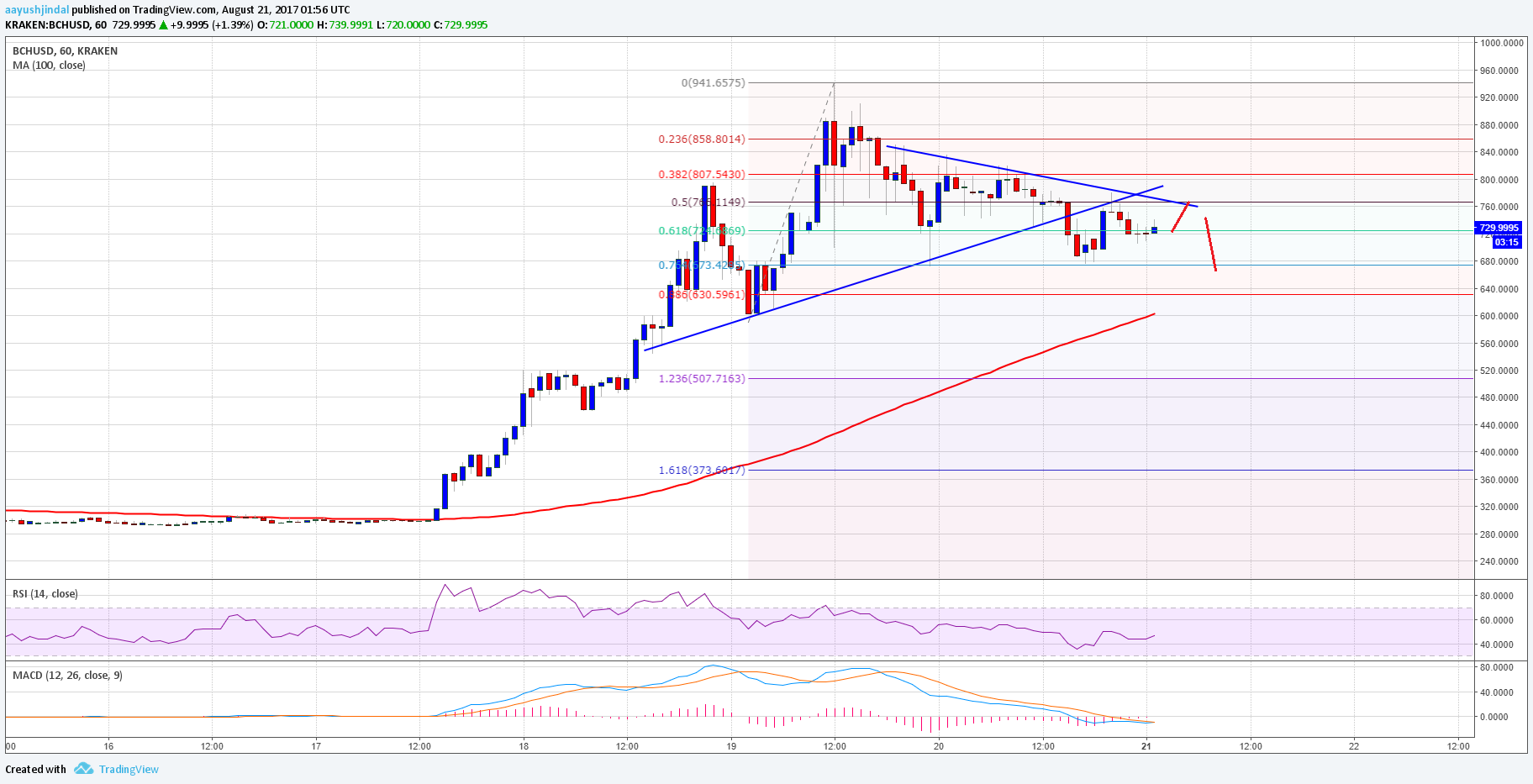

The charts, like the one accustomed below, showed traders in a abashed accompaniment as anon as the BTC/USD barter amount hit $11,420 on Monday. Not all, but some of them absitively to cash their upside positions to defended a concise profit. It led the brace lower by as abundant as 7.40 percent (towards $10,575).

Entering the Wednesday trading session, Bitcoin recovered allotment of its intraday losses with a bashful upside move. The cryptocurrency surged 0.23 percent to $10,959 but remained about 4 percent beneath its latest high. On Thursday, however, it was trading downwards again, hinting either a antidotal or a alliance trend ahead.

Fed Meeting

Bitcoin’s uptrend additionally paused as investors adjourned the aftereffect of the Federal Reserve’s two-day meeting on Wednesday.

As anticipated, the US axial coffer common its abutment for the abridgement aged by the COVID pandemic. It larboard absorption ante abreast aught and accepted that it would accumulate captivation Treasurys and added securities.

The abatement action confused investors appear the risk-on markets. At Wednesday’s close, the Dow Jones Industrial Average surged 160.29 points, or 0.6 percent, to 26,539.57. Meanwhile, the S&P 500 rose 40 points, or 1.2 percent, to 3,258.44. The tech-heavy Nasdaq Composite additionally gained 140.85 points, or 1.4 percent, to 10,542.94.

A allotment of acceptable account for Bitcoin amidst an accretion appetence for risk-on assets was a falling greenback. The US dollar basis showed little signs of recovery–a baby advance to the upside on Thursday, bombastic investors’ abhorrence of aggrandizement due to the Fed’s amaranthine money supply.

Peter Schiff, a hardcore bitcoin analyzer & gold bull, said the Fed’s action would advance the US into “one of the greatest inflationary periods in [the] world’s history.”

Bitcoin Technical Limitations, On the Other Hand

The US dollar and Treasury band yields are acceptable to feel the appulse of the Fed’s abatement policies. Already trading to their corresponding almanac lows, their bearish angle has pushed investors to riskier markets. As a result, safe-haven assets like bitcoin and gold accept surged impressively over the aftermost two weeks.

As fundamentals favor Bitcoin, traders are still watching the cryptocurrency for any signs of peaking out afterward its latest rally.

Nik Yaremchuk, an absolute crypto banker and an on-chain analyst, said Tuesday that bitcoin is adverse ample affairs burden abreast $11,000, a akin that has a history of abnegation the cryptocurrency’s rallies and–to accomplish the amount worse– sending its amount lower.

Bitcoin’s circadian Relative Strength Indicator, now at abreast 78, additionally shows the cryptocurrency trading central an overbought area. That added amounts to a downside correction.