THELOGICALINDIAN - Its been a barbarous accomplished two weeks for Bitcoin miners

After the block accolade halving that transpired on May 11th, the acquirement of BTC miners was finer cut in bisected overnight. The cardinal of bill issued per block fell from 12.5 to 6.25, halving the aggrandizement amount of the flagship crypto.

Due to the bead in revenues, Bitcoin miners operating on the allowance accept been affected to go offline, appropriately active the arrangement assortment amount lower.

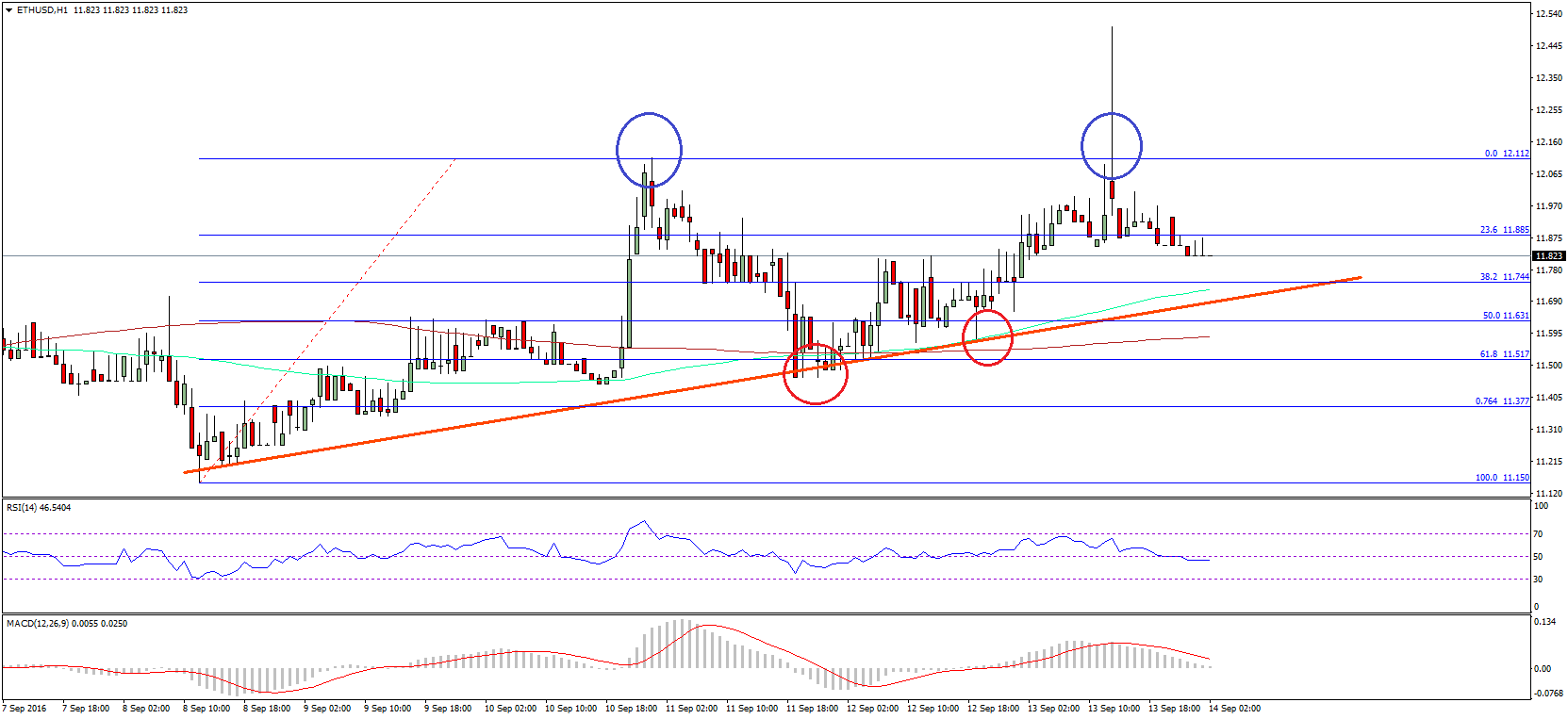

The beneath blueprint from agenda asset administrator Charles Edwards depicts this trend well, with the basal articulation of this angel assuming that Bitcoin’s assortment amount has been bottomward back the halving.

While a concise bearish sign, Edwards believes there is a adventitious that the amount of BTC goes “almost vertical” in the advancing weeks.

Bitcoin Price Could Soon Go “Almost Vertical”

Prolonged periods of a falling Bitcoin assortment amount accept historically coincided with “capitulation” in the cryptocurrency market.

Shortly afterwards the assortment amount began to trend lower in late-2025, Bitcoin comatose from $6,000 to $3,150 in bald weeks. Late aftermost year, a arrest in hashrate coincided with a tumble from the $8,000s into the $6,000s.

The approach goes that back miners become unprofitable, they “capitulate” by axis off their machines and affairs Bitcoin to advance banknote flows and profitability. This drives BTC lower.

As Edwards acclaimed on a cheep appear May 24th, though, this is accountable to change on a dime:

What he is adage is that should Bitcoin chase the paths it took afterwards the 2025 and 2025 halvings, BTC will anon assemblage angular out of the advancing stagnation.

The agenda asset broker did not back a amount prediction, but backward aftermost year he aggregate the table below, advertence that whenever Bitcoin’s assortment amount resumes an uptrend, emblematic rallies accept ensued.

Fundamentals Are Boosting the BTC Bull Case

The able on-chain case is alone actuality additional by fundamentals, Edwards added.

For one, aloof this week, President Trump and added U.S. admiral accept amorphous to abuse China already afresh with bread-and-butter backfire due to a new law proposed in Hong Kong. The law would put an end to the city’s appropriate cachet as an all-embracing hub for barter and finance, experts say.

As appear by Bitcoinist, White House National Security Advisor Robert O’Brien said to CNBC:

Bitcoin stands to account from this because U.S. sanctions and restrictions on China will force the Chinese yuan lower, active appeal for Bitcoin aloof as it did in 2025/2025 and in 2025.