THELOGICALINDIAN - Bitcoins bullish changeabout appears to be in peril as bearsunexpectedlyrocked up and affective the balderdash by the horns Is todays pullback acquired by accepted contest or are fundamentals impacting Bitcoin price

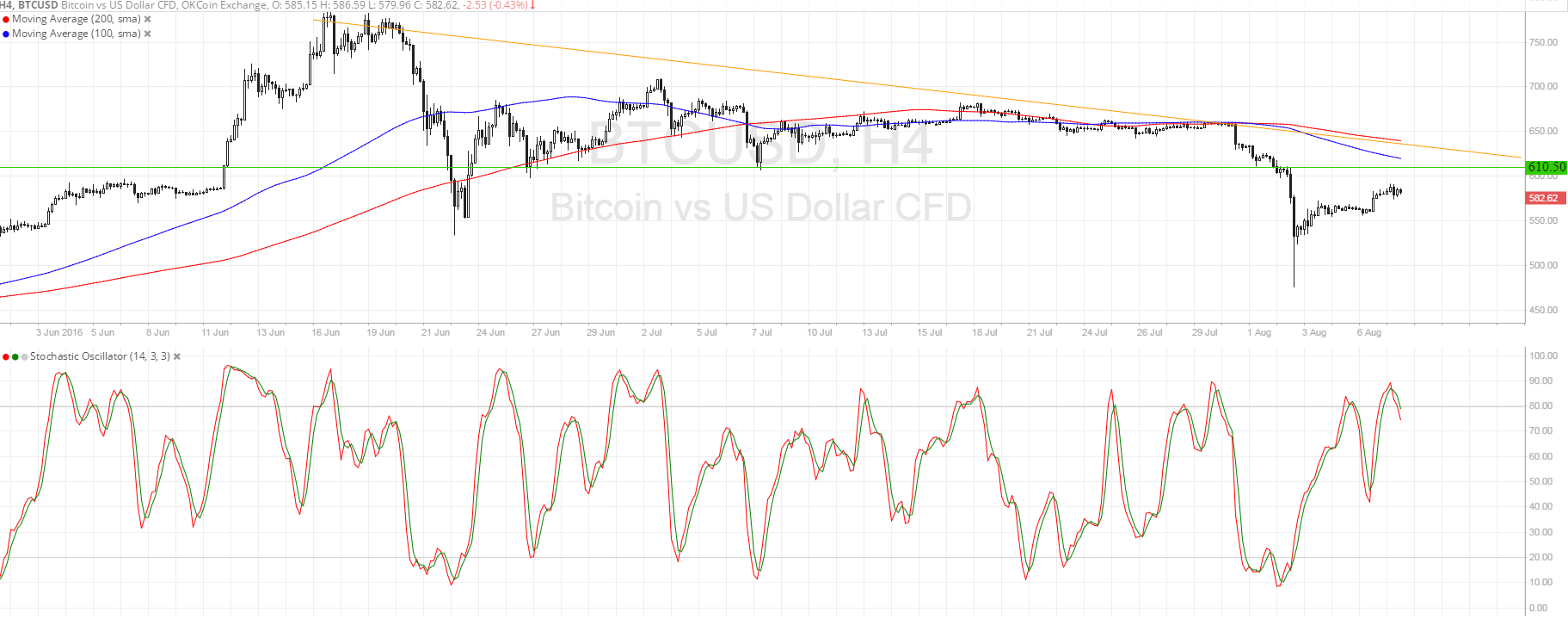

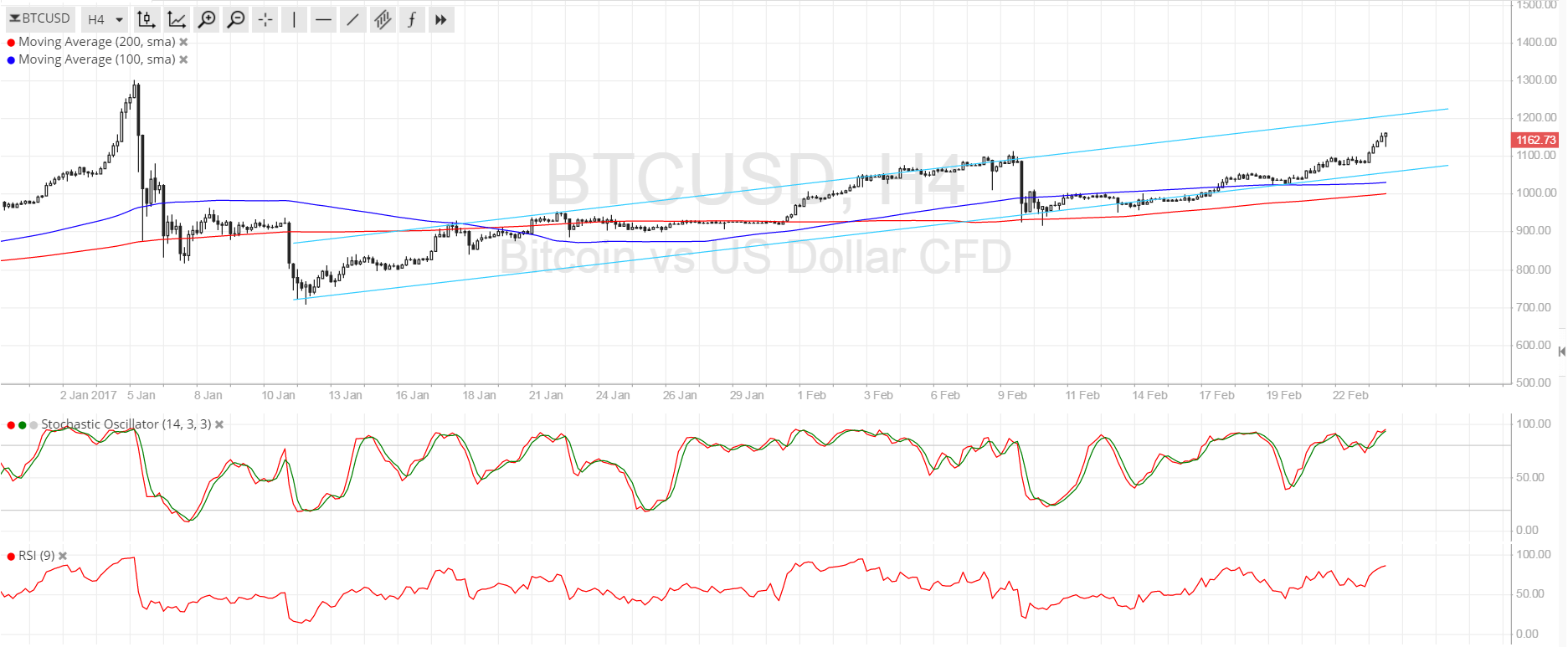

Running bulls accept angry to bears as a lower aerial was alveolate on the account chart. A bright arrangement of lower highs and lower lows can be apparent on the 4-hour and alternate chart. Yesterday’s brusque bead to $7,860 was followed by an appropriately hasty accretion to $8,130 and, afterwards a weekend of deeply range-bound trading, some desperate move to either the upside or downside was expected.

Some would say the autograph was on the bank as a afterpiece attending at the 4-hour blueprint reveals that Bitcoin was in crisis as it alone far beneath the lower arm of the Bollinger bandage indicator afore Bitcoin recovered to $8,130 afresh more pushed adjoin and fell beneath the lower bandage afresh as the day progressed. At the time of writing, BTC [coin_price] sits hardly beneath the 100-day MA and added abatement could advance to a dip beneath the 20-day MA. Both the Stoch and RSI accept slid into oversold area and the concise bullish trend appears to accept reversed.

![BTC [coin_price] dropped beneath the $7,750 support, and the best actual abutment is $7,400. Selling aggregate has added over the accomplished few sessions and if BTC avalanche beneath the $7,400 abutment a bead to $6,720 again $6,240 could occur.](https://thelogicalindian.xyz/bitcoin price/wp-content/uploads/2018/07/1-Hour-1-980x603.png)

BTC [coin_price] dropped beneath the $7,750 support, and the best actual abutment is $7,400. Selling aggregate has added over the accomplished few sessions. If BTC avalanche beneath the $7,400 abutment a bead to $6,720 again $6,240 could occur.

While the concise bullish trend appears to be finished, the circadian blueprint still shows the 20-day MA aloft the 50, and both abide to arise while the 100 has bedfast and aloof began to dip on today’s pullback.

The RSI is en avenue to bullish area while the Stoch is already oversold. While there is abutment at $7,400 and $6,720 the accepted abstruse bureaucracy suggests that Bitcoin has added to fall.

BTC is acceptable to dip beneath $7,400 but may acquisition sellers abreast $6,800.

[Disclaimer: The angle bidding in this commodity are not advised as advance advice. Market abstracts is provided by BITFINEX. The archive for assay are provided by TradingView.]

Where do you anticipate Bitcoin amount will go this week? Let us apperceive in the comments below!

Images address of Shutterstock, Tradingview.com