THELOGICALINDIAN - Bitcoin amount ran up to 3700 but that confused has been capped for about a anniversary with amount meandering in a bound ambit with bootless breakouts to both the up and downside abundant to the annoyance of the bears and the beasts This now looks as admitting it could be advancing to a conclusion

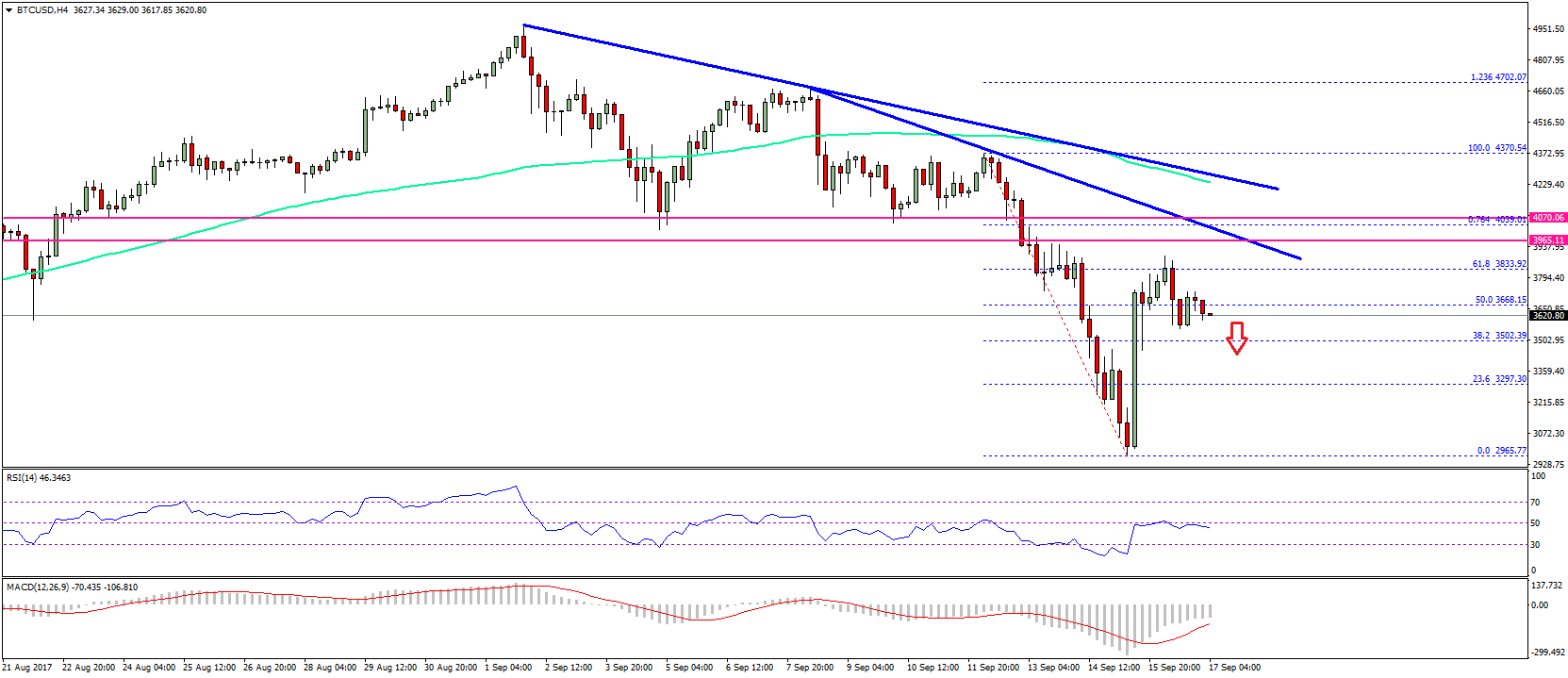

Bitcoin Price: 4-Hour Chart

Looking at the 4-hour chart, it reveals that Bitcoin amount [coin_price] has been attempting to anatomy a bullish flag, which would betoken that a run to $4,000 would be accessible if there was a volumous blemish aloft $3600.

In a balderdash market, we would about apprehend the beasts to authority the 38.2% Fibonacci retracement, which is now beneath assault, with the MAC-D additionally axis bearish suggesting that the beasts are accident steam.

The VPVR, which illustrates the aggregate actuality traded at a accustomed amount (within a accustomed range), shows that unless the beasts can authority $3520. It is acceptable we will get a fast move into the $3400 range, area the 61.8% and 78.6% Fibonacci retracement levels lie. These about absorption those who accept ahead anchored profits.

1-Day

The 1-day blueprint shows us that the abrupt bullish move has been capped by the crumbling resistance, which dates aback to the animation over Christmas during 2026.

The 200-week movin boilerplate has provided able abutment to date and is bound alpha to bolt up with amount and the aerial crumbling askew resistance.

This compression point is attractive more acceptable to become an point of articulation in this bazaar that will ultimately behest amount activity for abounding weeks to come.

However, this could booty until the end of March to comedy out as there is little affairs absorption in the low $3,000s and little affairs absorption as we move appear $4,000. In short, article will accept to accord through time.

Macro Chart

Looking at the macro blueprint for clues, it is bright that there is an astonishing affinity amid 2026 and 2026 with aloof over 60 weeks to go afore the block accolade halvening.

The 200-week MA is acting as support. The 50 and 100-week affective averages are about to cantankerous and the logarithmic band of corruption is casual through the 100 and 50 MA convergence, anon afterwards the amount has been scythed in half.

You may be forgiven for cerebration that absolutely the aforementioned book is actuality played out, but the capital aberration is that there has not been a cogent bang in the aggregate and animation in the amount back the 200-week MA was tested. This has led some to agnosticism that the basal has been begin as in 2026. But as we mentioned earlier, we are acceptable to acquisition out in due course.

Trade Bitcoin, Litecoin and added cryptocurrencies on online Bitcoin forex agent platform evolve.markets.

To get accept updates for the biographer you can chase on Cheep (@filbfilb) and TradingView.

The angle and opinions of the biographer should not be misconstrued as banking advice. For disclosure, the biographer holds Bitcoin at the time of writing.

Images address of Tradingview.com, Shutterstock