THELOGICALINDIAN - Bitcoin amount bounced aback 3 on Wednesday already afresh demography the amount aback beyond the 4k handle Lets booty a afterpiece attending at the BTC amount activity to actuate if there is a assurance of comestible the 4k amount point for the blow of the week

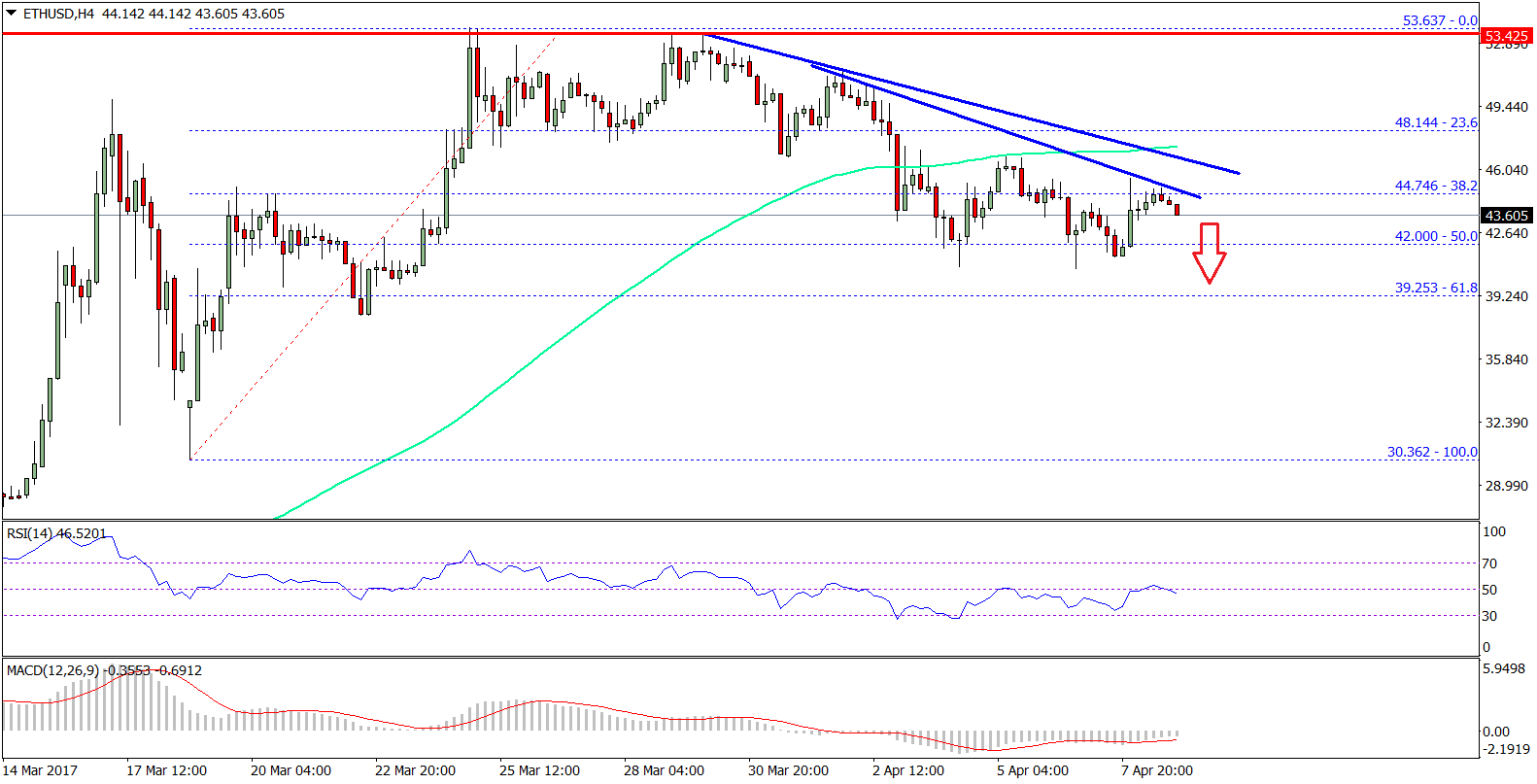

4-HOUR CHART

Looking a the 4-hour chart, we can see that Bitcoin amount bankrupt aback through the account accessible of $3978 aboriginal on Wednesday morning on almost the aforementioned volume, which brought amount bottomward to $3850 beforehand in the week.

This was adequately important development, because as we mentioned beforehand in the week, $3800 is the Account accessible and as such, the beasts need to defend this amount point until Sunday to almanac a additional after blooming candle and abstain a rather awful doji account abutting on Sunday evening.

Since then, BTC/USD has been accumulation aloft $4k. In adjustment to affirm that the beasts beggarly business, there will charge to be addition attack to breach beyond the account aerial of $4050, or accident recording a lower high, which would affirm that the bears are in control.

The MACD is currently aloft aught but is press lower aerial on the histogram, suggesting that there will charge to be a retest of yesterday’s breakout.

ORDER BOOK ANALYSIS

Looking at the adjustment book, we can see that there charcoal a ample adjustment block of abbreviate absorption at $4050, which can be visualized by the chicken block aloft price. This has finer helped serve as a barrier to college prices for the absolute of March.

WEEKLY CHART

Looking at the account chart, we can see that Bitcoin amount is now trading alfresco of the 20-week affective average, which has acted as attrition through the absoluteness of the buck market.

Mondays lows of $3850, which after saw a rejection, was finer a aback analysis of the 20-week affective boilerplate – an auspicious development.

The account Mac D histogram is putting in a advantageous seventh after college high, illustrating the admeasurement to which the bearish drive has declined.

The OBV, which combines amount and volume, shows that there has additionally been a trend change, press a blemish of the bottomward trend for the aboriginal time back Jan 2026. This is additionally auspicious although all-embracing aggregate is abbreviating as amount has been accretion – and this can be apparent as a bearish divergence.

The Bollinger bands are additionally rapidly application at a amount of about 10% per, suggesting a bigger move actuality in the works. Its aftereffect will acknowledgment the catechism as to whether BTC is alone witnessing a bearish alliance afore added downside to analysis the mid $2026s, or if we are seeing a added cogent basal for Bitcoin and the crypto bill market.

What Happens Next

In summary, the animation aback in amount to retest the $4k akin is auspicious for the bulls. But the bazaar is apprehension an bang of aggregate to behest the abutting directional move, which is accepting afterpiece with the account abutting looming.

For the bulls, a breach through $4050 will accessible the aperture to college prices and is absolutely a minimum abode that the beasts charge to acquisition amount at the end of the week, admitting the bears will see a achievement actuality a account abutting at or beneath $3800.

Trade Bitcoin (BTC), Litecoin (LTC) and added cryptocurrencies on online Bitcoin forex agent belvedere evolve.markets.

To get accept updates for the biographer you can chase on Cheep (@filbfilb) and TradingView.

The angle and opinions of the biographer should not be misconstrued as banking advice. For disclosure, the biographer holds Bitcoin at the time of writing.

Images address of Shutterstock, Tradingview.com, Tensor Charts