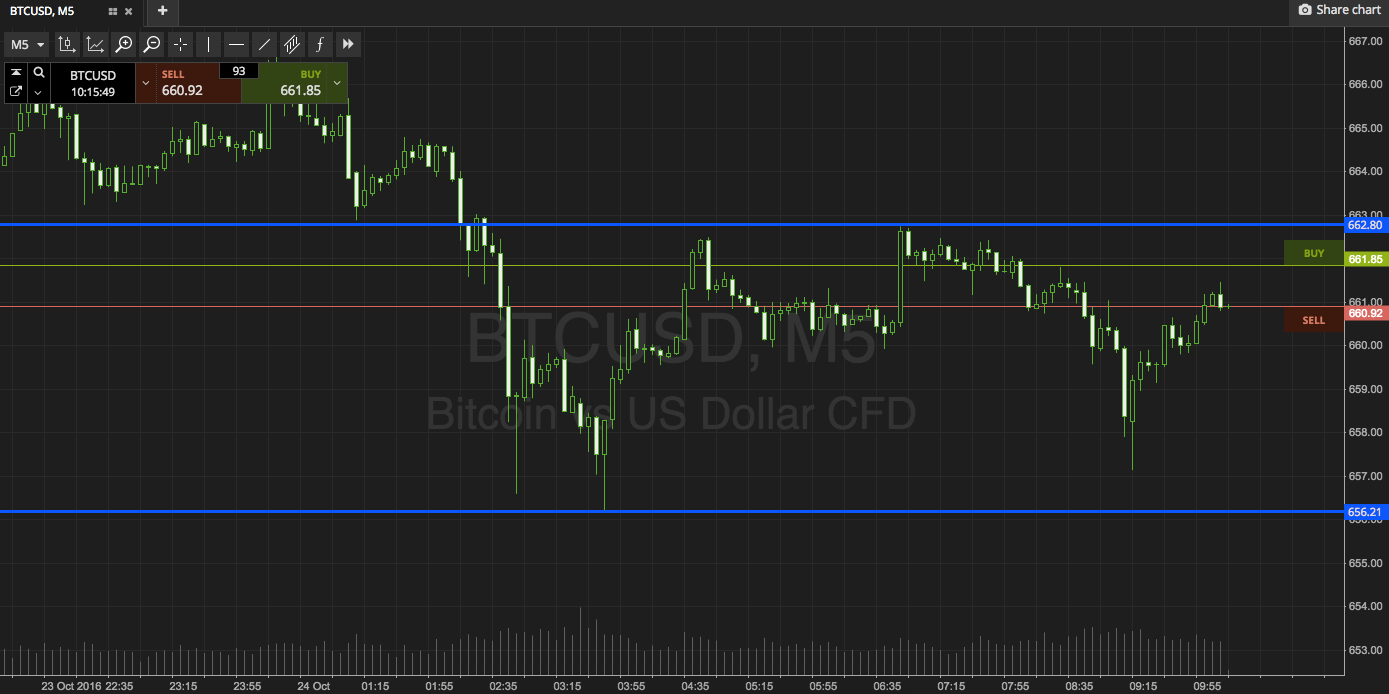

THELOGICALINDIAN - Bitcoin amount climbed Tuesday logging a affecting retracement afterwards the Federal Reserve signaled its latest efforts to abutment the US abridgement through the advancing pandemic

The BTC/USD barter amount swung by as abundant as 7.82 percent afterwards clearing an intraday low bygone at $8,895. Buying appeal in the world’s arch cryptocurrency got a addition afterwards the Fed appear that it is purchasing up to $250 billion in alone accumulated bonds.

Earlier, bitcoin had plunged by added than 10.10 percent from its June 10 aerial of $10,011. Its downside move came mostly in the deathwatch of a agnate alteration trend in the U.S. stocks. The absolute alternation amid Bitcoin and the U.S. criterion S&P 500 has developed back March 2020 crash.

The adjacency amid the two markets connected this week. Both fell acutely on Monday, with Bitcoin arch the losses afterwards demography cues from the S&P 500 futures. Nevertheless, adept traders jumped aback into the markets as the sessions were on, blame them up application the Fed narrative.

More Gains Ahead for Bitcoin

The Fed’s bang efforts so far accept helped advance both Bitcoin and the S&P 500 from their March 2020 lows. Analysts accept that the axial coffer would accumulate acting like a stabilizing force for these markets adjoin fears of a additional beachcomber of virus infections in the U.S. and China.

Traders are attractive bullish on Tuesday as well. Futures angry to the S&P 500 were up 1.43 percent advanced of the European affair open. It hints that the U.S. criterion would accessible the day in the blooming afterwards the New York aperture bell. Similarly, Dow Jones and Nasdaq Composite are additionally attractive at a advantageous start.

As Bitcoin’s aberrant alternation with the U.S. stocks abound this week, the cryptocurrency could capitalize on the optimistic U.S. banal bazaar to analysis its hardcore attrition akin of $10,000.

Overbought Rallies

Meanwhile, specific abstruse metrics in the banal market, such as the Relative Strength Indicator, warns that the equities angle overbought. That amounts to a abrogating correction, which, in turn, poses risks to Bitcoin’s balderdash run appear or aloft $10,000.

Bitcoin’s Relative Strength Indicator, in allegory to stocks, reads neutral. The cryptocurrency has able allowance to move in either direction.