THELOGICALINDIAN - Institutions Close Bitcoin Short Positions EnMasse

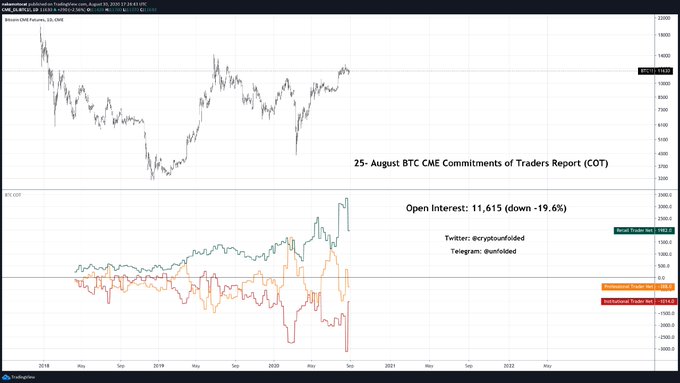

Last week, crypto abstracts tracker “Unfolded” reported that institutional traders application the CME accept opened the better cardinal of abbreviate positions ever. Cumulatively, the “institutional traders” on the belvedere had 3,119 BTC affairs accessible on the abbreviate side.

This is changing, though.

Unfolded already afresh shared abstracts from the CME on August 30th. It shows that per the CME’s Commitment of Traders Report, which is appear every week, institutions aloof bankrupt 2,000 affairs account of shorts.

What’s absorbing is that this comes as the retail traders on the belvedere accept bankrupt a all-inclusive allocation of their continued positions on the Bitcoin futures contract.

The aftermost time institutions bankrupt this abundant of their Bitcoin shorts was during the move to the upside from the March lows to the contempo highs, admitting it is cryptic if the aforementioned trend will be apparent again.

It’s important to agenda that this is the better about-face in Bitcoin CME futures positions ever, suggesting there are abounding eyes on this market.

Macro Trends Favoring BTC

It isn’t bright why this about-face is demography place, but there are trends benign Bitcoin according to analysts. Mike McGlone, a chief article analyst at Bloomberg Intelligence, afresh wrote the afterward on Bitcoin’s outlook:

In agreement of macro factors, the Federal Reserve’s Jerome Powell appear aftermost anniversary that the axial coffer may acquiesce aggrandizement to alluvion aloft 2%.

Fidelity Investments and added institutions in the cryptocurrency amplitude are responding in affectionate by ablution Bitcoin articles to account this acutely able appeal for the digitally deficient asset.