THELOGICALINDIAN - Bitcoin Is Primed to Move Lower Predict CME Futures Traders

Bitcoin’s amount activity has been apathetic at best over contempo weeks. The cryptocurrency has been trapped in a $1,000 ambit amid $10,000 and $11,000, consistently award bounce at the high abuttals and abutment at the lower boundary.

Last week, BTC slipped as a aftereffect of a assemblage of axiological events: BitMEX was answerable by the U.S. CFTC over derivatives and anti-money bed-making violations and President Trump bent the ache currently overextension beyond the globe.

Bitcoin traders are reacting to this account negatively, abstracts shows.

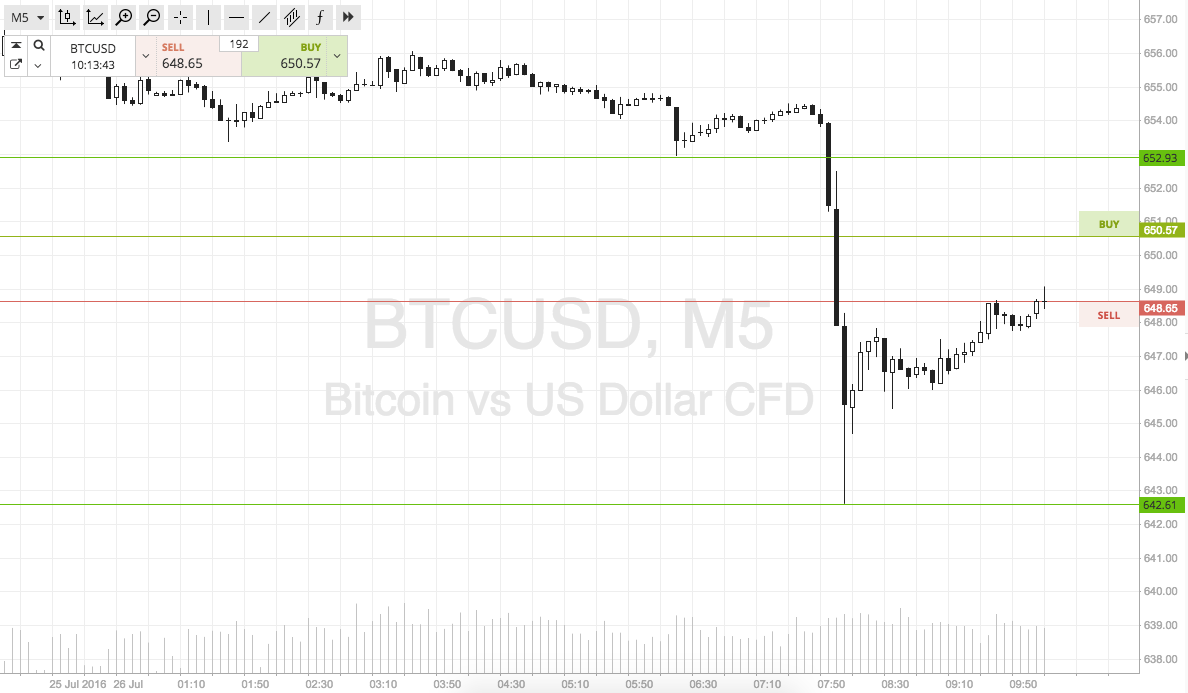

Crypto abstracts aggregator Unfolded accumulated the blueprint below, which cites abstracts from the CME’s account Commitment of Traders Report. The address indicates that over the accomplished week, both retail and institutional traders on the CME accept added their downside acknowledgment to Bitcoin. The accumulated antithesis of institutional traders on the CME is currently abbreviate while the accumulated antithesis of retail traders is currently long.

This is agnate to a trend apparent on added Bitcoin futures exchanges that are added retail-focused.

Crypto derivatives tracker ByBt reports that about all arch BTC futures exchanges accept abrogating allotment rates. The allotment amount is the fee that continued positions pay abbreviate positions to ensure that the amount of the approaching stays about the amount of the basal atom market. Abrogating allotment ante during consolidations advance that shorts are added acerb positioned than longs.

Prevailing Trend Is Bullish

While investors are action on a concise correction, analysts say the prevailing trend is bullish.

As appear by Bitcoinist previously, arch on-chain analyst Willy Woo afresh said:

Pure fundamentals, like macroeconomic trends, are additionally lending to BTC growth.