THELOGICALINDIAN - Its been a able accomplished few months for both Bitcoin and gold

The arch cryptocurrency is up added than 150% from its March low while the adored metal has acquired 15%. Both performances mark notable assets for the assets.

Yet according to a arresting broker and gold proponent, it won’t be Bitcoin ambience a beginning aerial this year. Instead, he says it will be the adored metal.

Peter Schiff Says Bitcoin “Won’t Even Come Close” to $20,000 Highs

Due to what seems to be a aggregate of central-bank affairs and accessible budgetary policies, gold has rocketed college over the accomplished few months. The adored metal is abutting an best aerial (against the dollar) and is acutely assertive to abide higher.

The “digital gold” Bitcoin, unfortunately, may not allotment gold’s fate. CEO of Euro Pacific Capital Peter Schiff said on June 28th:

Schiff isn’t the alone one cerebration that gold will accomplish acutely able-bodied this year.

Lisa Shalett, the arch advance administrator of Morgan Stanley Wealth Management, recently argued that the U.S. dollar may be extensive a peak. In a apple area that happens, gold should outperform, she explained:

Many Beg to Differ

Despite Schiff’s skepticism about Bitcoin, there are abounding assured BTC to move accomplished $20,000 this year.

Bloomberg’s chief article action Mike McGlone appear an all-encompassing address on crypto beforehand this year. In it, he wrote that there’s a acceptable likelihood Bitcoin alcove $20,000 this year.

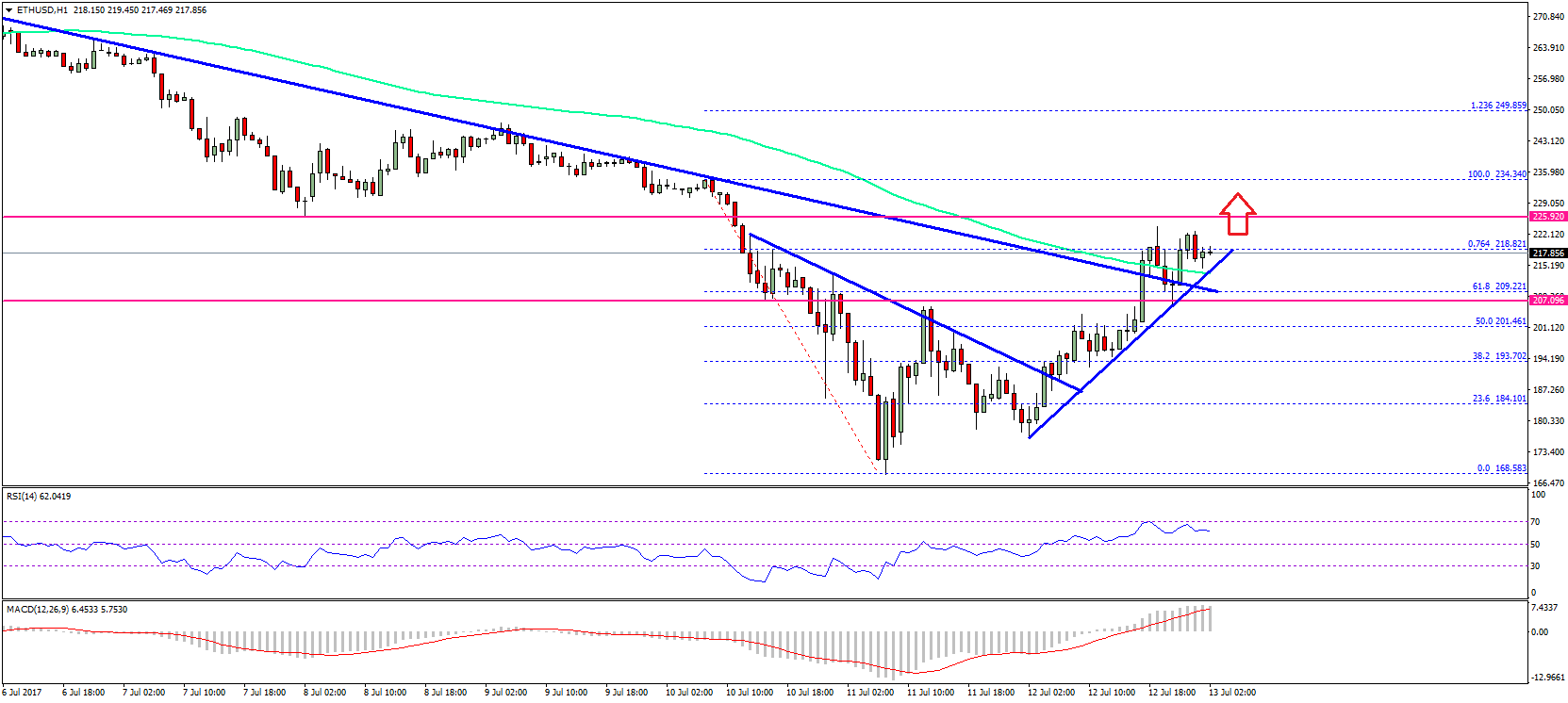

This anticipation was acquired from an assay that BTC’s accepted amount activity is agnate to that apparent afterwards 2026’s halving.

Similarly bullish is BitMEX’s arch executive, Arthur Hayes. He wrote in an April blog column that his “end of 2026 amount ambition charcoal $20,000.” Like abounding others in the industry, Hayes expects the money press by axial banks to addition Bitcoin.

Dan Morehead of Pantera Capital echoed this affect to a T. The above Wall Street broker said on how axial banks may addition Bitcoin: