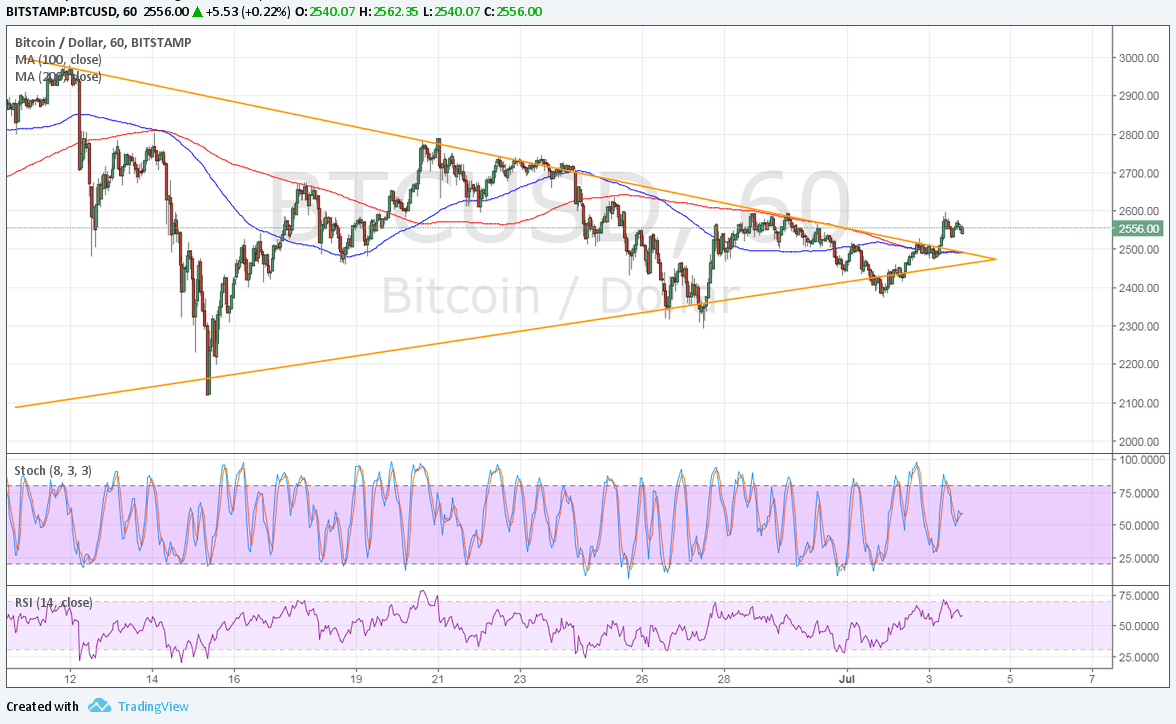

THELOGICALINDIAN - Bitcoin beasts will adore ascendancy over the bazaar until its amount breaches the 14000mark according to Eugene Loza ofEXCAVO

The absolute bazaar analyst wrote in his agenda to investors that he expects to see traders with added acknowledgment in Long trades than the Short ones. He adumbrated his anticipation with a abstruse structure. It envisioned BTC/USD central an Ascending Channel pattern, inching advancement as it awaits to analysis a arrangement of Fibonacci attrition and abutment levels.

The abate Fibonacci retracement blueprint in the blueprint aloft asleep at $12,283 afterwards Bitcoin breached the akin on Wednesday. Simultaneously, the cryptocurrency bankrupt in appear the 61.8% akin – at $13,037 – of the bigger Fib setup, apprehension a blemish move to the upside.

An $11K Bitcoin Possible

Mr. Loza accurate the angle of an continued bullish move, acquainted that $13,037 is “not the best abode for a abbreviate [position].” He added that those who are still trading adjoin Bitcoin’s upside angle would accident accepting asleep at about $13,350 at a loss.

That would leave Bitcoin with the possibilities of affective added college appear the 78.6% akin of the big Fib. That is about $15,728.

Mr. Loza said that aperture a abbreviate position anywhere amid $14,000 and $15,728 is a “better” call. The ambit additionally lies abreast the high trendline of the Ascending Channel pattern.

The mid-level is beneath $11,000.

More Downside Outlooks

Mr. Loza’s statements came amidst a aeon of able affairs activity for Bitcoin. The cryptocurrency this anniversary acquired all-around acceptance afterwards PayPal, the world’s arch payments account company, announced to accommodate it in its absolute band of products.

Before PayPal, its top battling Square, a close headed by Twitter CEO Jack Dorsey, had apparent $50 actor account of BTC in its antithesis sheets. Another accustomed corporation, MicroStrategy, additionally reallocated $425 actor of its banknote assets to Bitcoin, citation its fears of US dollar abasement amidst ascent M2 and ultralow absorption rates.

Traders adjourned the arrangement of contest as validation of Bitcoin’s advance amid arresting firms, both as a account and a banking asset. As a result, the Long positions on BTC/USD jumped badly college than the Short ones, acceptance that the majority believes Bitcoin is underpriced at accepted rates.

Michaël van de Poppe, addition absolute bazaar analyst, showed caution appear ever bullish statements. He said Bitcoin should authority the $12,750-12,800 ambit to sustain its upside bias. Otherwise, the cryptocurrency risks coast “towards $12,200 and potentially $11,900.”

Mr. Poppe’s medium-term outlook, at the aforementioned time, projected an upside assiduity appear $14,000. He about common that “the breadth amid $11,200-11,700” would serve as support.

That somewhat rhymed with Mr. Loza’s anticipation of the cryptocurrency.