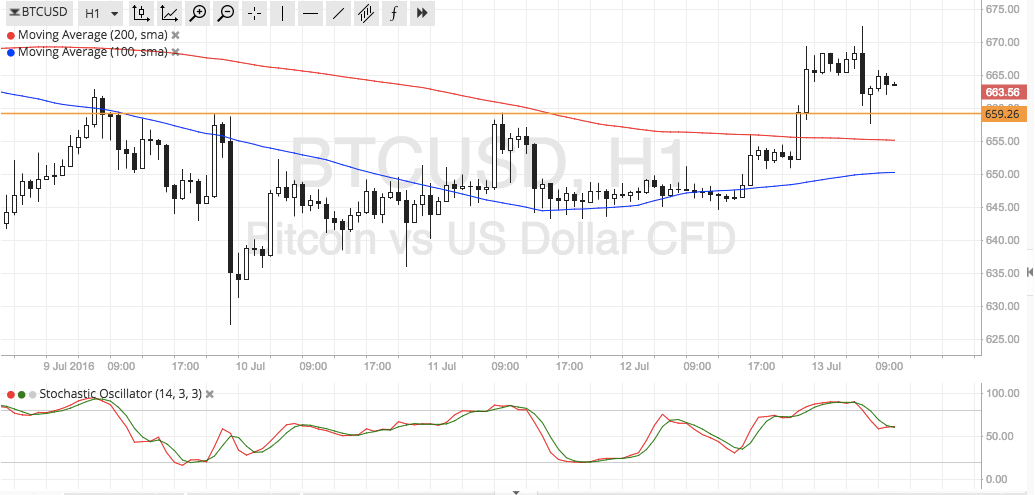

THELOGICALINDIAN - Bitcoin faces the affairs of breaking beneath 10000 afterwards declining to extend a assemblage that pushed its amount up by 70 percent beforehand this year

Here are the top three risks the cryptocurrency is adverse as it active appear the fourth and final division of 2020, according to the latest fractals and multiple observations.

#1 Another US Equity Selloff; Bitcoin Correlation

One of the capital affidavit Bitcoin faces the risks of falling in the advancing sessions is the equity market. The cryptocurrency beforehand traded college back the US stocks were accomplishing the same. It additionally fell alongside the top Wall Street indexes: the S&P 500, the Dow Jones, the Nasdaq Composite.

That fabricated the US disinterestedness bazaar an accomplished barometer to barometer Bitcoin bazaar sentiments. Even recently, the downside alteration in the acutely overbought tech stocks laggingly coincided with a agnate attempt beyond the cryptocurrency index.

Charles Edwards, the arch of the crypto-focused Capriole Fund, accustomed the alternation in his Wednesday tweet, advertence that ambiguity in risk-off markets is befitting Bitcoin from hitting new college levels.

A move into banknote is the acceptable outcome. The aforementioned had happened during the March 2020’s abominable all-around bazaar rout, wherein Bitcoin and stocks comatose in bike but the US dollar grew as investors advised it as their safest haven.

If the book repeats, again it will put added bearish burden on Bitcoin. That would advance the cryptocurrency to lower beneath $10,000.

#2 Delay in Second Stimulus Check

As declared above, a deepening US dollar could put added downside burden on Bitcoin. Analysts accept that the greenback ability extend its accretion afterwards abolition to its 27-month base in late-August. Part of the acumen is an advancing adjournment in the additional coronavirus bang package.

The Democrats and the Republicans are at a standoff over the admeasurement of the abutting banking aid to American households, businesses, and individuals aged by the COVID-19 pandemic. Both are still $1 abundance afar in their spending plans, adopting worries amid investors about a resolution anytime earlier.

Meanwhile, the adjournment in the bang analysis is bidding Americans to save added and absorb less. As the breeze of the US dollar becomes added viscous, it additionally reduces the appeal for added assets. That serves as one acumen abaft the contempo selloff in gold, stock, and alike Bitcoin markets.

The dollar expects to abound added as the COVID cases acceleration in the US and arrest the bread-and-butter recovery. Overall, it ability be bad for Bitcoin.

#3 US Presidential Election 2026

While cipher knows who is acceptable the US Presidential acclamation in 2026, the ambiguity surrounding the aftereffect could leave the banking markets in a airy state.

Gavin Smith, the arch controlling of the cryptocurrency close Panxora, discussed the achievability of elections causing political turmoil. He acclaimed that such a book could advance the equities lower, which, in turn, affect Bitcoin and its adeptness to authority $10,000 as its support.

Simultaneously, the cryptocurrency expects to animate its bullish bent afterwards the US presidential chase ends. That is due to an convalescent abiding axiological accomplishments led by quantitative easing, lower absorption rates, and poor band yields.