THELOGICALINDIAN - Bitcoin may abide a cogent amount alteration afore the US presidential acclamation due to its adjacency to gold hints Clem Chambers

The CEO of ADVFN – Europe’s arch stocks and shares website, told Kitco News that best assets that accept apparent a absolute alternation during the 2020 balderdash run tend to abatement in tandem. He batten about gold and how a “flash crash” in its markets could leave added assets in a agnate bearish spell.

The Tale of Two Safe-Haven Assets

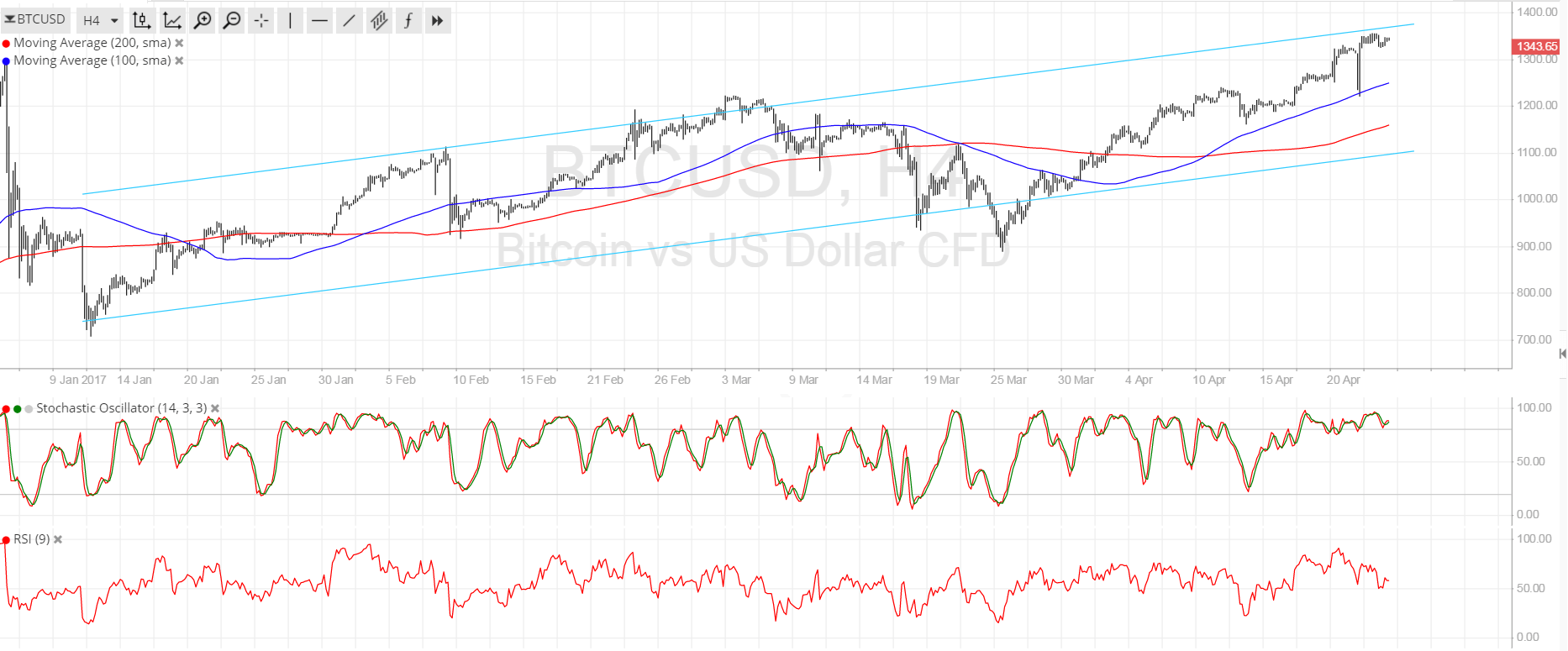

Bitcoin laggingly tailed gold, abnormally back the March 2026 all-around bazaar beating wherein both the assets comatose in tandem. At one point this year, the concise alternation amid the cryptocurrency and the adored metal accomplished an best aerial of 75 percent.

The adjacency grew mainly because of a growing address for safe-haven and riskier assets amidst a bearish US dollar outlook. The Federal Reserve’s aberrant budgetary policy, which includes an open-ended bond-buying affairs and near-zero absorption rates, aerial the address of banknote and cash-based instruments, such as US government bonds.

Anticipating concise low yields, investors absitively to offload their dollar positions for gold, Bitcoin, US stocks, and added assets.

Nevertheless, the Fed warned aftermost anniversary that it could not abide its expansionary affairs after added budgetary advice from the US Congress. Its armchair Jerome Powell requested the House to absolution the second coronavirus stimulus package. It is the aid that charcoal in a deadlock as the Democrats and the Republicans agitation over its size.

Economists accept that the Congress will not be able to canyon the bang bill afore the November’s presidential election. With expectations of bottom dollar clamminess in the market, the appeal for the greenback has added amid investors. On the added hand, gold, stocks, and Bitcoin accept started acclimation lower from their bounded highs.

That is area Mr. Chambers sees a “malfunction.”

Conflicting Bitcoin Opinions

But not all anticipate on the band of Mr. Chambers, at atomic back it comes to the US dollar and its bazaar bias.

Stephen Roach, the above administrator of Morgan Stanley Asia, said in an op-ed that the greenback could blast by at atomic 35 percent by the end of 2021, citation upticks beyond adopted currencies and looming macroeconomic issues in the US apropos lower accumulation and–again–the Fed’s expansionary policies.

The bearish dollar affinity credibility to added appeal for Bitcoin and gold in the advancing sessions. Some apprehend the cryptocurrency would hit $20,000 should the greenback accumulate falling.