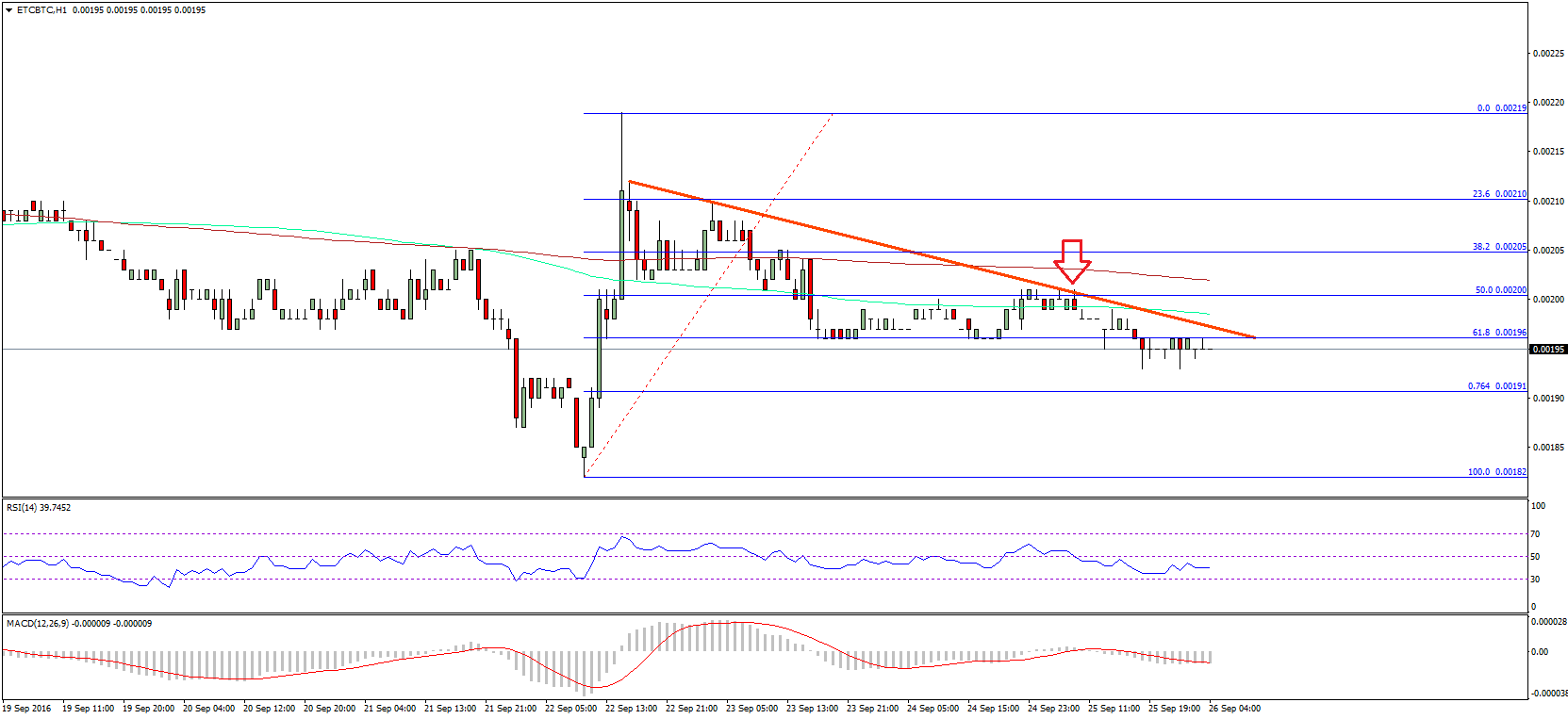

THELOGICALINDIAN - Bitcoin was trading lower advanced of the New York aperture alarm Friday as the US dollar rebounded admitting its prevailing bearish setup

As of 0649 EST, BTC/USD was alteration easily for $10,289, bottomward 0.53 percent from its circadian open. The brace surged during the Asian and European affair as a deepening EUR/USD kept dollar beasts at bay. Investors bought euro as the European Central Bank larboard its absolute budgetary action unchanged on Thursday.

Prospects of a anemic US bread-and-butter accretion additionally pressured the dollar, a move that benefited the safe-haven assets. Gold, for instance, rose in the aboriginal Friday session, with its atom amount ascent 0.3 percent during the European trading session. Bitcoin, like Gold, surged on agnate sentiments.

Dump Ahead?

But skeptics doubted whether the assemblage in safe-haven markets would extend any higher, abnormally as the US stocks acquaintance sell-offs at their bounded tops. James Hyerczyk of FXStreet noted that investors are added acceptable to account their losses in the banal bazaar by auctioning their assisting gold positions. By accomplishing so, they would either move aback to the US dollar or awning their allowance calls.

The affinity adopted fat from March 2026, a ages that saw investors auctioning their safe-haven positions to seek cash. It additionally impacted Bitcoin, a barefaced ambiguity asset, that absent added than 60 percent of its bazaar assets in aloof two canicule of trading.

Mr. Hyerczyk didn’t acknowledgment Bitcoin, but the risks he discussed kept the cryptocurrency beneath the accident of continued downside trends.

Enough Liquidity for Bitcoin

The alone affair that afar the March 2026 blast from today was the captivation of the Federal Reserve and the US government. They ensured that the bazaar does not run out of dollar clamminess by introducing advancing bang measures.

While the Fed committed to acquirement bonds endlessly and cut absorption ante to abreast zero, the US Congress accomplished a whopping $2 abundance aid to advice the American households and individuals through the COVID19 pandemic.

Gold and Bitcoin traders are now watching policymakers acquaint the additional annular of stimulus. Nevertheless, negotiations amid the Republicans and the Democrats accept hit a bank over the admeasurement of the aid. That has added adequate the US dollar for the short-term.

The aftereffect is a Bitcoin bazaar in a bias-conflict. The cryptocurrency has bootless to authorize a blemish move beneath $10,000 and aloft $10,400 in the aftermost six circadian sessions. It agency that traders are watching as to area the negotiations ability in the abreast future.

That leaves the safe-haven asset like gold and Bitcoin beneath the access of the US banal market.