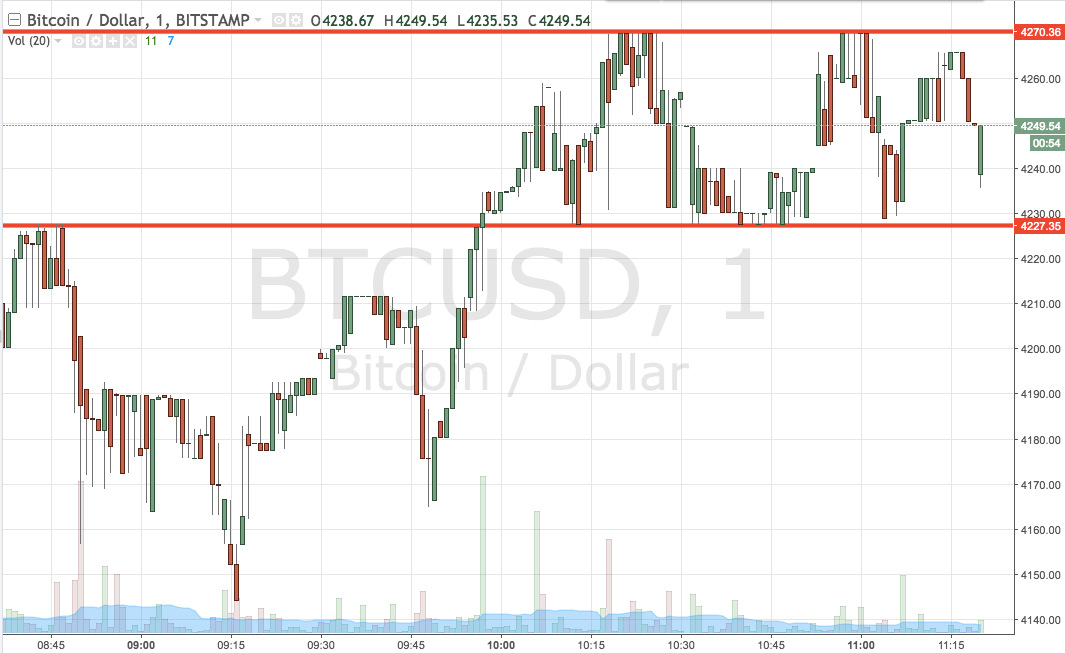

THELOGICALINDIAN - Cryptocurrencies accept been on an absurd aisle over the accomplished 12 months with the absolute bazaar assets growing from 198 billion in April 2026 to added than 2 abundance today

This brief acceleration is accompanying with accretion acceptance from consumers apprenticed by above announcements from domiciliary names, such as Square, Visa, and PayPal, which now acquire agenda assets as agency of payments or settlements.

Electric car maker Tesla appear in February that it would acquire bitcoin as acquittal for its cars, as able-bodied as additionally demonstrating its charge to crypto by authoritative a $1.5 billion bitcoin acquirement for its antithesis sheet.

Simultaneously, the industry has accomplished a improvement of institutional acceptance like never before. Hedge funds accept rushed into the market, banal investors accept flocked to publicly-listed crypto companies, and bartering banks are abacus added crypto services. All while axial banks common agilely watch on, with abounding answer their own agenda currencies.

With such accelerated and axiological changes in the mural in aloof 12 months, EQUOS looks at what the approaching of agenda money looks like for the abutting 12 months and years beyond.

In tomorrow’s webinar hosted by EQUOS, Roger Ver, Founder of Bitcoin.com, and Richard Byworth, CEO of Diginex, will attending at what capacity are active the bazaar now and how they will advance in the future. They will attending at how the acceptable models will advance and how crypto will become a basic in every angle of our lives.

EQUOS to List BCH

The accessible webinar follows the accommodation by the EQUOS Advertisement Committee to accept the advertisement of Bitcoin Cash on the barter in March.

Roger Ver is a allegiant backer of BCH, which has beyond block sizes to administer massive transaction throughput at aerial speeds like absolute agenda money or a accurate peer-to-peer cyberbanking banknote system.

“EQUOS has delivered a belvedere that is focused on accouterment cellophane and fair markets with avant-garde articles and is admiring to account BCH as a consistently evolving, developing, and airy crypto that has anesthetized aggregation at its advertisement committee,” explained EQUOS.

EQUOS, launched in July 2026, is an institutional-grade crypto barter available. EQUOS is allotment of Diginex (Nasdaq: EQOS), which became the aboriginal Nasdaq-listed aggregation with a crypto barter in October 2026.

The advertisement of Diginex was an important anniversary for the cryptocurrency industry and opened the aperture for banking institutions to participate in the agenda assets bazaar through a accessible company.

EQUOS afresh launched its own token, EQUOS Origin, which rewards traders with absolute allowances for application EQUOS, such as added interest, lower fees, and it can be acclimated as collateral. The Diginex accumulation additionally includes agenda asset trading technology belvedere Diginex Access, agenda asset aegis provider Digivault, and the advance administration business Bletchley Park Asset Management.

Join the Live Webinar blue-blooded “Roger Ver and Richard Byworth accouterment Bitcoin, Bitcoin Cash, and the Future of Digital Money” on April 21st 9 am ET/9pm HKT. Click here to register.

Image Credits: Shutterstock, Pixabay, Wiki Commons