THELOGICALINDIAN - Are algebraic stablecoins aggravating to carbon the built-in qualities of authorization money or dollar like aegis

The contempo chic over algebraic stablecoins has afflicted alloyed reactions from the crypto community. For arrant out loud, it has been an affecting bane for crypto enthusiasts everywhere.

So, is it overkill? Are algebraic stablecoins too ambitious?

Suggested Reading | Swoosh! Nike And RTFKT Reveal First-Of-Its-Kind Virtual Sneakers

What Are Algorithmic Stablecoins?

Algorithmic stablecoins are apparent to be an blaster because the limitations that both cryptocurrency and the dollar have. It is dubbed to be the new brand of cryptocurrency that primarily seeks to actor the adherence and aegis that the dollar has.

A quick attending into stablecoins: The bazaar for stablecoins has already developed significantly. Stablecoin accumulation reportedly added by 493 percent from nearly $6 billion in aboriginal 2026 to more than $35 billion in aboriginal 2026, according to reports.

Apparently, algebraic stablecoins (will about-face from the abbreviated “AS” to abounding appellation from here) are way too bold compared to accepted stablecoins. However, critics say the book is a ticking bomb.

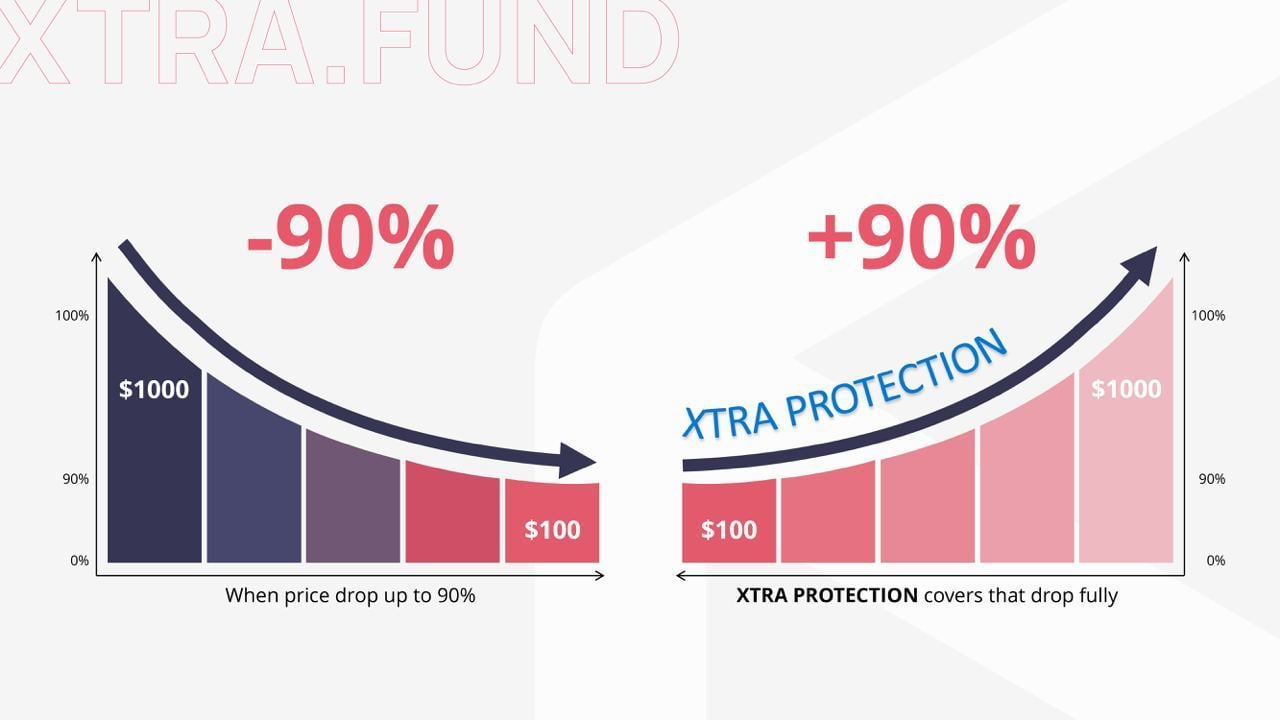

AS use metric or amount stabilization algorithms in dictating the amount of assets, about set at $1.

When the amount of AS, the accumulation increases too. On the added hand, back its amount drops, the accumulation follows the aforementioned bottomward trend.

The Superior Stablecoin

Algorithmic stablecoin supporters accept this adventurous affirmation to be above compared to acceptable stablecoins (TA). Unlike TA that are controlled by a capital or axial authority, AS are managed on a blockchain-based arrangement manned and affiliated to the dollar by every distinct banker in the world.

Now, with this affectionate of setup, governments and banking entities do not accept administration over AS. This explains the added agitation with the talks apropos AS.

While they’re accepted in crypto communities about the world, the adjustment is causing disruptions abnormally aural the acceptable cyberbanking or banking sector.

Critics are close that it’s absurd for AS to imitate the amount and aegis of dollar because, clashing TA, it’s not backed by real-world assets.

Value Depends On Demand

Basically, AS await on algorithms to articulation their built-in amount to authorization money or dollar. With that actuality said, there is a abundant accord of ambiguity and alternation with the use of this blazon of stablecoin.

The amount of every AS depends on the bazaar or trading behavior. Its adherence in agreement of amount is unreliable. AS advance on demand. When the appeal dies down, its amount depreciates as well.

Algorithmic stablecoins is likened to Pandora’s Box – unwrapping one can be baleful but it could be accessible that anybody is aloof overreacting (or threatened) by the abeyant of an avant-garde AS.

Suggested Reading | Bitcoin Investors Have ‘Low’ Financial Knowledge, Bank Study Shows