THELOGICALINDIAN - Over the accomplished anniversary as the anniversary division has fatigued anytime nearer Bitcoin BTC and its crypto asset aggregation accept started to see a desperate uptick in affairs burden Within a weeks time BTC which begin a yeartodate low at 3150 aftermost anniversary has recovered to the 40004100 ambit Many commentators and bazaar analysts accept declared that this doubledigit billow backed by multimonth aggregate highs could activate a balderdash run Yet one analyst says that crypto isnt ready

The Bitcoin Zombie Rally

Alex Kruger, a arch crypto-friendly markets researcher and analyst, afresh laid out the accepted accompaniment of the cryptocurrency bazaar on Twitter. Through a 14-part thread, The economist, who hasn’t been abashed to animadversion on Bitcoin in the past, laid out what is authoritative the accepted crypto bazaar tick, so to speak. Kruger aboriginal laid out a cardinal of bullish catalysts, cogent the accent of the appearance of institutional participants in Bakkt and Fidelity, afore acquainted that anniversary abetment to “improve metrics” could advance cryptocurrency ethics higher.

On the added hand, Kruger acclaimed that are a cardinal of abrogating stimulants that could added abase this market. These include, but are not bound to, the accedence of crypto funds, the U.S. Securities and Exchange Commission’s (SEC) latest spell of badge auction skepticism, anniversary liquidations to “offset [tax] gains,” sell-side burden from “natural” sellers, and the appearance of crank SAFTs (Simple Agreement for Future Tokens) assuredly advancing to accomplishment afterwards 2017’s deals.

9/ So what's up with this rally?

IMO the distinct best important agency is #3: Technicals. That is, this is a simple animation from best oversold levels in history. Nothing for investors to FOMO.

Calling this the Zombie Rally, as best of those accommodating in it are absolutely dead.

— Alex Krüger (@krugermacro) December 20, 2018

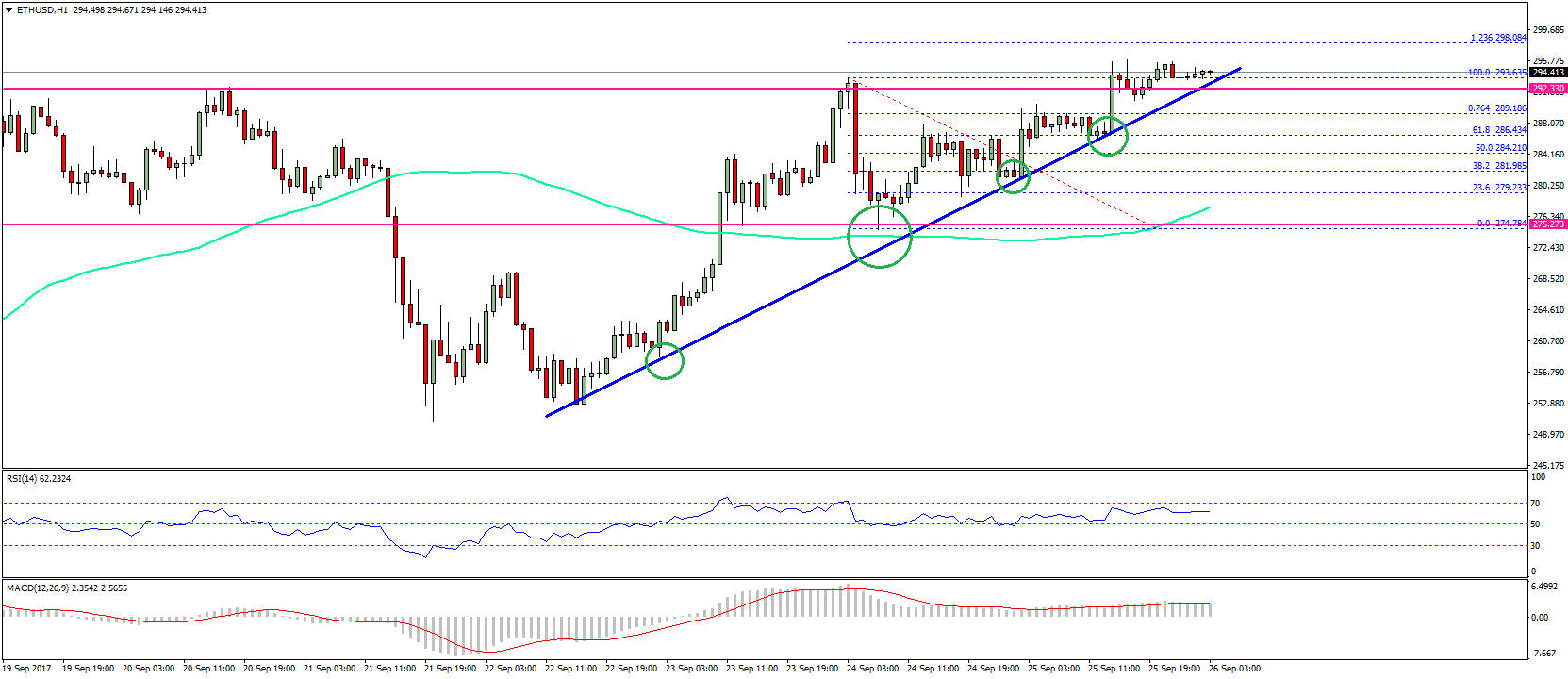

Kruger, accurately acquainted on crypto’s best contempo buck bazaar bounce, acclaimed that technicals (technical analysis) abide the arch catalyst abaft amount activity in this beginning market. In his eyes, the accomplished anniversary has apparent a majority of cryptocurrencies, conspicuously EOS and Bitcoin Cash (BCH), column double-digit assets due to a distinct indicator, this actuality the Relative Strength Index (RSI). According to Tradingview, which cited abstracts from Bitfinex, Bitcoin’s one-day RSI accomplished its everyman akin aback Q3 of 2016 about two weeks back.

In added words, Kruger believes that the contempo accretion is alone a alteration off oversold levels, rather than a axiological about-face in the bolt of this industry, like what Coinbase’s admiral hinted at during a contempo CNBC “Fast Money” bedfellow appearance. Contradicting affect accustomed by optimists, the New York-based analyst acclaimed that there isn’t annihilation to “FOMO” about. So, referring back to his thread’s titlecard, Kruger dubbed the accomplished week’s amount action, the “Zombie Rally,” jabbing at the actuality that abounding accommodating in this leg upwards “are absolutely dead.”

He’s either affecting on the asinine “FOMO” attitude that has evidently apprenticed this rally, or the actuality that bots, which are artlessly responding to abstruse statistics, are blame up the Bitcoin price.

Maybe This Crypto Bounce Isn’t So Dead

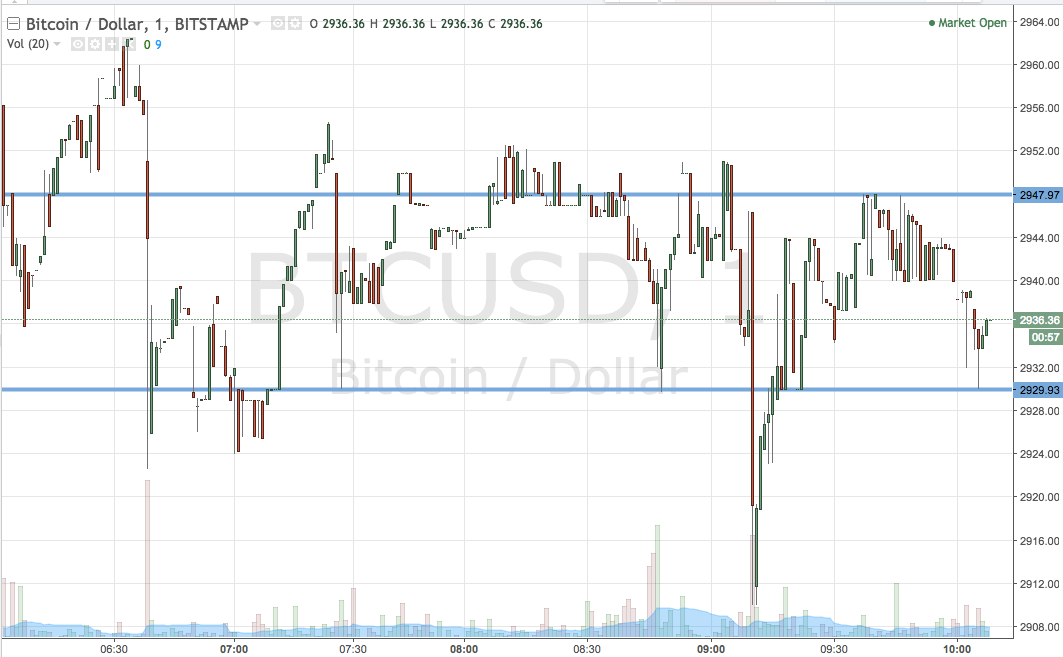

Although Kruger was clearly authoritative use of artistic authorization to back his point, abstracts aggregate by Crypto Quantamental indicates that this appearing “relief rally” could be far from “dead.” Crypto Quantamental, a U.S.-based, pro-Bitcoin investor, afresh stated that BTC is assuming “the archetypal signs of a ‘V’ bottom.” He/she acclaimed that the billow in BTC could be added than a “dead cat bounce,” as Kruger saw it. In fact, Quantamental acclaimed that the “record-breaking” volumes (in BTC count, not $) announce that a abiding basal may accept formed.

The broker explained that volumes accept surpassed that apparent in late-December 2026, back Bitcoin ailing at $20,000 in an abrupt about-face of events. Volumes are alike college today than the bouts of affairs burden that BTC accomplished on its cruise lower. Per Quantamental, bygone (Dec. 20) was Bitcoin’s accomplished aggregate day in its ten-year history, with exchanges en affiliation reportedly trading 2,226,735 BTC at an boilerplate amount of $3,938. This sum, for some much-needed perspective, is a tad added than 10% of all Bitcoin that will anytime go into circulation.

Commenting on this move, Quantamental wrote:

“Remember accedence requires a ample bead on massive volume, and the accretion of the “V” requires a ample animation on ample volume. We accept both here.”

All this, of course, could be a assurance that cryptocurrencies won’t be revisiting its annual lows again. However, Quantamental, aloof like his/her adolescent analysts acclaimed that it may be abortive to alarm a bottom, as markets, abnormally crypto, can be capricious at times.