THELOGICALINDIAN - As Bitcoin BTC fell added on Monday award itself beneath 5000 in a aboriginal for 2026 industry savants bound took to cryptos ancillary in animosity of the growing bearish affect Surprisingly a cryptofriendly accomplice at Washington DCbased Anderson Kill a centralized law alignment rushed to Bitcoins aid faster than abounding could absolute HODL

SEC’s ICO Verdict Isn’t Bearish, Far From In Fact

The Anderson Kill accomplice in catechism is Stephen Palley, who afresh appeared on Bloomberg TV account to lend his acumen and acclaim his advancement for cryptocurrencies. The Bloomberg host, affecting on the U.S. Securities and Exchange Commission’s contempo crackdown on Airfox and Paragon, asked Palley, a advocate by trade, about the overarching “message” that the regulator was sending via its heavy-handed verdict.

Surprisingly, contradicting accepted sentiment, Palley acclaimed that the SEC “isn’t in business” of sending foreboding messages, abnormally back is administration laws and/or sending cease and abandon orders. Instead, as fabricated credible by the SEC’s abominable DAO address and “Munchee” filing, the advocate acclaimed that the authoritative bureau is aboveboard acknowledging that blockchain technologies are “nifty,” while gluttonous to accomplish moves in its jurisdiction.

And, as discussed by the Anderson Kill partner, this argumentation carries over to Airfox and Paragon, two ICO-funded crypto startups allowable to pay $250,000 in fines and acquittance investors afflicted by its actionable auction of securities. He elaborated:

“What the SEC said [in the verdict] was accepted sense. Just because its contemporary technology doesn’t beggarly that these actual accustomed balance laws don’t apply… in a statement, the SEC, circumstantial with the two verdicts, explained that the technology is ‘cool’ and they’re in favor of innovation, but don’t balloon to obey the law.”

Contradicting letters and rumors, Palley, wrapping up his comments on the matter, explained that latest crypto drawdown, which cut $40 billion off the accumulated cryptocurrency bazaar capitalization, isn’t activated with the SEC’s move adjoin ICOs.

Likely referencing ICORating’s recent report apropos the about collapse of badge sales, the host queried the advocate about the dematerialization of this formerly-booming cryptocurrency subset.

Responding as a advocate would, Palley acclaimed that startup’s attractive to accession capital, while littoral balance laws via badge sales, are about writing dead letters. But, the Anderson Kill advocate acclaimed that the ICO archetypal is far from asleep in the water, or at atomic alfresco of the U.S. that is.

“I Would Not Write Off Bitcoin Or Ethereum”

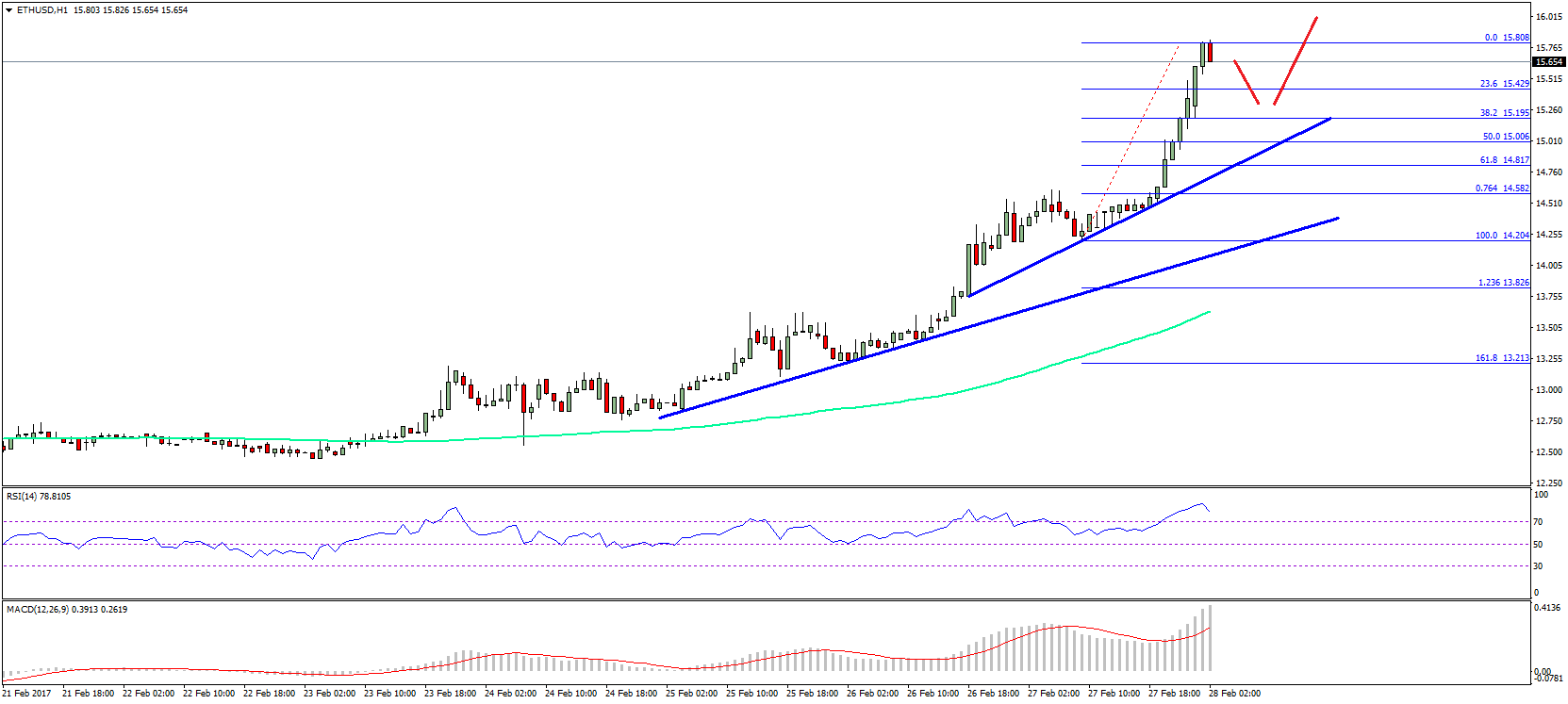

Carrying this argumentation over to built-in cryptocurrencies, agenda assets that aren’t created on the aback of sales, Palley acicular out that he would be behindhand to address off Bitcoin or Ethereum, abacus that the technology itself is revolutionary.

Even acid out some time to allocution prices, the cryptocurrency backer acclaimed that while the wallets of late-2026 entrants are acceptable hurting, from a abiding advance standpoint, BTC isn’t article to be casting to the wayside.

Interestingly, this affect curve up with the after-effects of a contempo poll conducted by Ron Paul, a now-retired U.S. baby-kisser that has a affection for blame the envelope. The poll, which asked a simple, but absorbing catechism — If a affluent being ability you $10,000 for a 10-year investment, would you admeasure the allowance into Federal Reserve Notes, Gold, BTC, or US 10-yr Treasury Bonds? — bound garnered bags of votes.

To the annoyance of traditionalists, 50% of respondents adumbrated that they would admeasure their allowance into BTC, while alone 11% and 2% would bandy the $10,000 at U.S. 10-year bonds and Federal Reserve addendum respectively.

Paul’s cheep assuredly underscores the affect that crypto is actuality to stay, admitting the concise amount nuances.