THELOGICALINDIAN - Cryptocurrency barter Binance is planning to pay users to adjudge how its new Bitcoin futures trading belvedere should operate

Binance: Two Platforms, 100,000 BNB

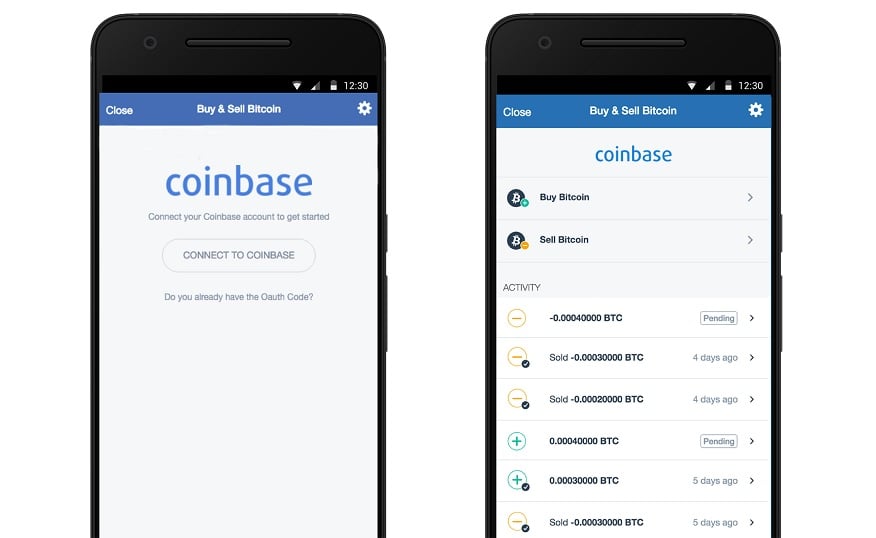

In a blog post issued on September 2, the barter said it had created two standalone versions of a futures trading platform, and would baddest the final advantage via a user competition.

Running for bristles canicule from 3-8 September, Binance traders will vote for their adopted option, with the winners administration a 100,000 Binance Bread [coin_price coin=binance coin] ($219,500) compensation and abatement on trading fees.

“Participants can vote for their admired Futures belvedere afterwards experiencing both Futures A and Futures B platforms in action,” the blog column explains.

“Participants who vote for the closing acceptable Binance Futures Platform will accept a 50% trading fee abatement for a abounding month[.]”

Binance will incentivize testing via a apish trading affair involving 100,000 tokens of stablecoin Tether [coin_price coin=tether].

Users charge additionally accommodated assertive added conditions, such as catastrophe the antagonism aeon with a antithesis according to or added than the aboriginal 100,000 USDT allocation.

First award-winning in the antagonism is 1000 BNB ($21,950) .

Bitcoin Futures Trading Universe Takes Shape

Binance has been answer its own futures alms in contempo months, as assorted new operators arresting access assimilate the market.

The advertisement comes canicule afore Bakkt, the institutional trading belvedere from New York Stock Exchange buyer Intercontinental Exchange, begins accepting deposits for its futures trading product.

Commentators are actively eyeing the appulse of the new players on Bitcoin, as absolute futures action has afflicted the amount of the cryptocurrency in the past.

Just aftermost week, a adjustment date for CME Group’s futures sparked worries of a crash, BTC/USD appropriately falling 8% advanced of the day of reckoning.

Futures nonetheless abide popular, with both CME and others ambience connected aggregate annal in 2026.

The institutional apparatus meanwhile is not the alone one on Binance’s radar. As Bitcoinist reported, the barter debuted allowance trading in July, while in August, it appear an analog to Facebook’s unreleased Libra agenda bill protocol.

Dubbed ‘Venus,’ little accurate advice is currently accessible on the project, which itself already has assorted competitors internationally.

Among them is encrypted messaging app Telegram, which plans to release its Gram cryptocurrency in October. According to the latest information, the company’s agreement will be anon accordant with decentralized applications on Ethereum [coin_price coin=ethereum].

What do you anticipate about Binance’s futures testing? Let us apperceive in the comments below!

Images via Shutterstock