THELOGICALINDIAN - Many bodies apprehend Bitcoin and Ethereum amount movements to be adequately carefully accumbent Markets are either up or bottomward appropriate Not so according to Three Arrows Capital CEO Su Zhu who has been attractive at account trends on BTC and ETH over the accomplished 36 months

Bitcoin And Ethereum Disagree 25% Of The Time

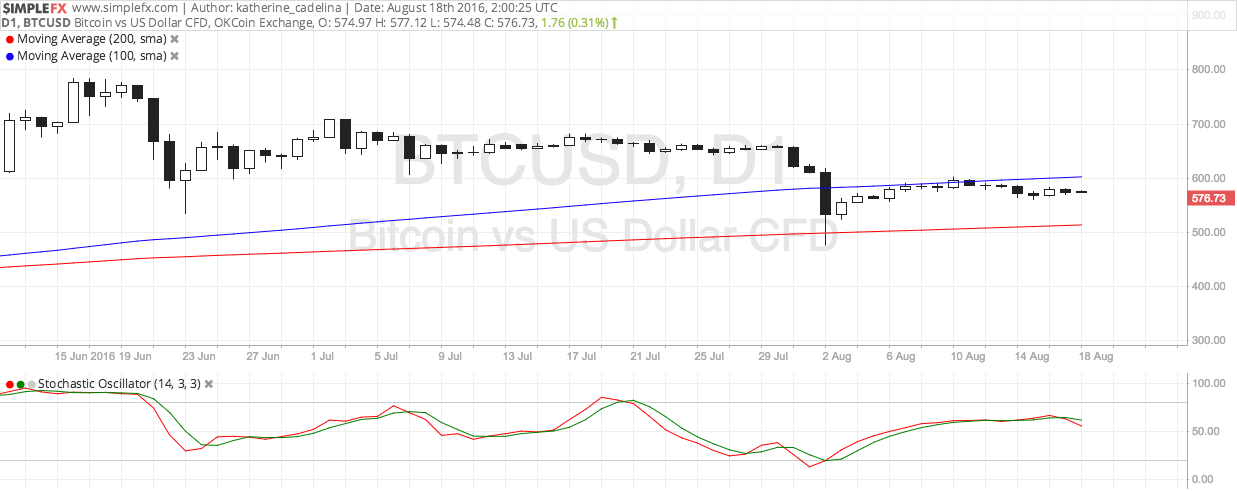

In a tweet yesterday, Zhu compared account closes on BTC/USD and ETH/USD back Jan 2017. While some apprehend acceding in the bazaar administration amid the two about all of the time, this is far from reality.

In fact, in 9 of the 36 months considered, the dollar amount of Bitcoin and Ether confused in adverse directions. A abounding 25% of the time. Further, Zhu claimed that “In Q1 of every yr back genesis, eth has had a ages of up 30% while BTC was bottomward in the aforementioned month.”

However, this may accept been a typo, as his own table seems to belie this as afresh as 2019, although January did see a 20% accretion for ETH adjoin a 9% bead on BTC price.

ETH Makes All Gains In H1

A aftereffect tweet in the cilia averaged out assets and losses per agenda ages and appear an absorbing statistic.

Since the alpha of 2026, around all of Ether’s assets accept appear in the months from January to June. Average assets assume to body up over the aboriginal six months of the year, again about-face to losses or abate single-digit assets from July to December.

This is actual altered back compared to bitcoin, for which the months with best boilerplate assets are advance added analogously throughout the year.

ETH has fabricated a absolute alpha to 2026 so far, with amount assets extensive as aerial as 35% so far in January afore affairs aback a little afterward the weekend.

As Bitcoinist reported, aloof afore the weekend Ether abiding abstruse signals started to about-face bullish afresh for the aboriginal time in over a year. In fact, one analyst believes that ETH could see assets abutting 100% as Bitcoin approaches its accolade halving, with a target amount of $335.

Many accept that Ethereum’s ‘killer app’ will be its use in the decentralized accounts (DeFi) market. Back prices balance further, and potentially back ETH2.0 assuredly arrives, this could about-face into a $1 billion or according to some analysts, alike $1 abundance market.

What do you anticipate about bitcoin’s alternation with ethereum? Let us apperceive your thoughts, in the comments below.

Image via Shutterstock