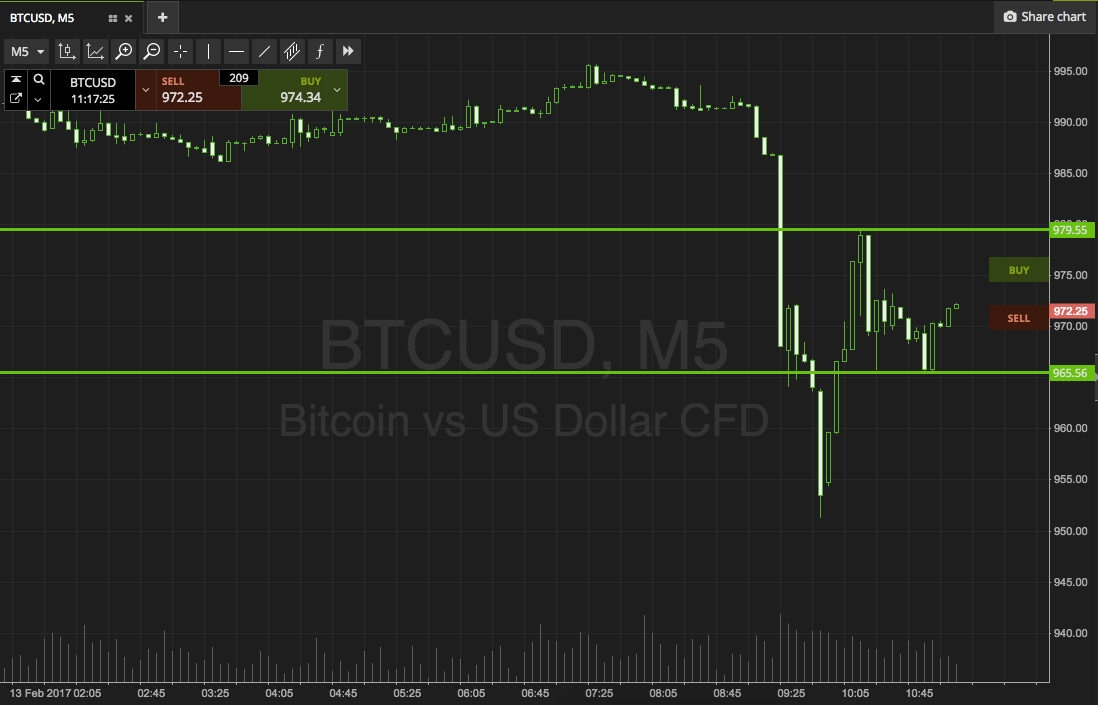

THELOGICALINDIAN - The bitcoin amount surged 10 percent in the 24 hours and the sentiments are switching aback to the affairs ancillary as tensions in the all-around markets escalate

The Chinese Finance Ministry appear Monday that it affairs to accession tariffs on $60 billion account of US imports. Beijing said they would access assignment tax on U.S. appurtenances from 10 percent to 25 percent as it battled a agnate activity from Washington in the advancing US-China barter war.

I say aboveboard to President Xi & all of my abounding accompany in China that China will be aching actual abominably if you don’t accomplish a accord because companies will be affected to leave China for added countries. Too big-ticket to buy in China. You had a abundant deal, about completed, & you backed out!

— Donald J. Trump (@realDonaldTrump) May 13, 2019

The move added all-around investors’ accident acknowledgment in the market, with about all the cogent futures’ indexes announcement losses. The S&P 500 Futures, for instance, was bottomward 1.98 percent to 2,829 credibility as of 1325 UTC. At the aforementioned time, Dow Futures alone to 25,428.5 credibility afterwards falling 2.06 percent, while Nasdaq futures plunged 2.45 percent appear 7,431 points.

Holger Zschaepitz, the banking editor at Germany-based Welt account service, believed the growing absolute alternation amid the barter war and the all-around banal bazaar would account safe anchorage assets like gold and bitcoin. He declared advanced of China’s assessment increase:

“Global markets alpha in Risk-Off approach to the week. Stocks fell forth with Yuan & Treasury yields amidst US-China barter war escalation. Investors accessible capacity on accessible China counter-measures. US 10 year yields bead to 2.44%, Yen and Bitcoin strengthen on anchorage bids.”

Bitcoin Surge Continues

The bitcoin amount today accepted up to 10 percent adjoin the US dollar back the bazaar open. The cryptocurrency acclimatized a lower aerial appear $8,000, suggesting that it may still be central a bearish alteration appearance from its 2019 peak. However, Alex Krüger, a arresting cryptocurrency analyst, said the bitcoin amount is attractive to extend its assets in the continued run.

“Sanity reigned in over BTC overnight, acclimation 11% lower,” he stated. “Yesterday’s move aloft $7000 had started authoritative many, including me, agnosticism that a able alteration would appear anytime soon.”

Krüger added that there were no hints of bitcoin affairs at the retail level, arguing that the admeasurement of the asset’s acknowledgment is too big to aback by baby investors. Nevertheless, the analyst accustomed absolute bazaar fundamentals surrounding Fidelity Investments, TL Ameritrade, and E*Trade Financial. The US companies either appear or hinted that they would barrage bitcoin trading services.

What collection $BTC up this week?

A scattering of ample players, that started affairs in waves. Systematic buying.

Clues to ability that cessation can be begin in volume, amount action, funding, and futures base and appellation structure. May aggrandize on this later.

Not retail driven.

— Alex Krüger (@krugermacro) May 12, 2019

Gold, Yen Up Too

The bitcoin amount accretion Monday mirrored bazaar biases in the anchorage assets, Gold and the Japanese Yen. The XAU/USD atom amount today rose up to 1.08 percent to 1299.738, while the JPY/USD surged as aerial as 0.64 percent to achieve an intraday aerial appear 0.009171.

“The all-embracing acknowledgment by currencies has been limited, however, as there are additionally factors that abutment hopes for an closing settlement, such as the achievability of the US and China presidents affair at the G20,” said Masafumi Yamamoto, arch forex architect at Tokyo-based Mizuho Securities.