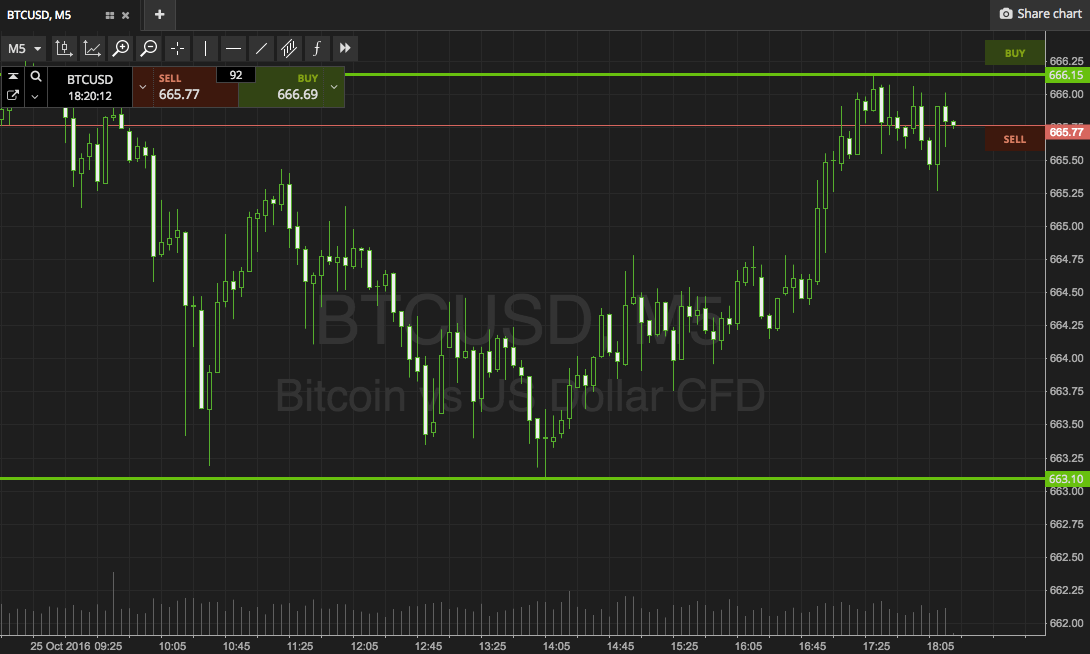

THELOGICALINDIAN - The bitcoin amount has collapsed Probably not in the aforementioned address as Olympus or London but it has acutely taken a cruise bottomward south to the 453 ambit at columnist time equaling a 15 bead back ourprevious amount study

Also read: Bitcoin Price Inches Towards $470, Will $500 be Next?

Bitcoin Price Takes A Dive, But Should We Be Worried?

Some may booty this as a time to panic; that acknowledgment may be premature. Things can arise alarming at first, and we’re acceptable to be reminded of the alarming year that was 2026 and bitcoin’s antecedent bead in 2026 from $1,000 to $600, but there’s not abundant affirmation to advance such a bead is advancing again. Bitcoin is still captivation its ground, and as we’ve apparent in the past, bitcoin’s amount is alone as acceptable as its publicity.

Previously, discussions of bitcoin’s affiliation with Steam and the advertising surrounding Segregated Witness meandered through Internet babble boxes, and they haven’t disappeared. People are still talking, and the account is still advised a high-mark in bitcoin’s controversial, but different career.

One affair to consider, however, is the abundant bead experienced by ether aftermost month. Thought to be one of the agenda world’s added arresting altcoins, ether could acceptable accept a beyond duke in the cryptocurrency amphitheatre than we think. Cryptocurrencies are generally interwoven; they advance the aforementioned technology, and can accompany anniversary added anon to the top, or bottomward to the everyman accepted denominator depending on the circumstances. It’s adamantine to say for abiding if ether’s cachet is affecting that of bitcoin’s. Ether’s accident was aboriginal witnessed in March while bitcoin has endured an agitative few weeks, but it’s not article we can aphorism out entirely.

Others are actuality absolutely adamantine on Bitcoin, predicting a massive drop that will acceptable accompany it bottomward to the basal rung (some say $300) afore it begins any added escalation. As we’ve all apparent in the past, this can appear at around any point in time. Cryptocurrencies, for the best part, are like stocks — they’re capricious and depend abundantly on alfresco bazaar access to sustain flow, abundance and stamina.

But there is some acceptable account to consider. Even if bitcoin were to acquaintance a accelerated abatement shortly, we could apprehend things to acknowledgment to their “bullish” means by mid-summer. Through the aid of Bitstamp, absorption in bitcoin is accepted to acceleration heavily in Europe, and with an absolute abstemious boring agenda bill and acquisitive to get in on the action, we’re acceptable to attestant bitcoin’s amount fasten afresh aural aloof a few months.

So let’s not get afraid appropriate away. This is alone a accessory blunder in a continued expedition up the banking Everest, and bitcoin hasn’t sprained any ankles as of yet.

Do you adumbrate added avalanche in bitcoin’s future, or will it aces itself aback up soon? Post your comments below!

Images address of Dentons, bitcoindoc.com