THELOGICALINDIAN - Bitcoin absent beef on Wednesday pausing a balderdash run that had accelerated on the backs of Teslas 15 billion advance and optimism over a massive bang amalgamation in the United States

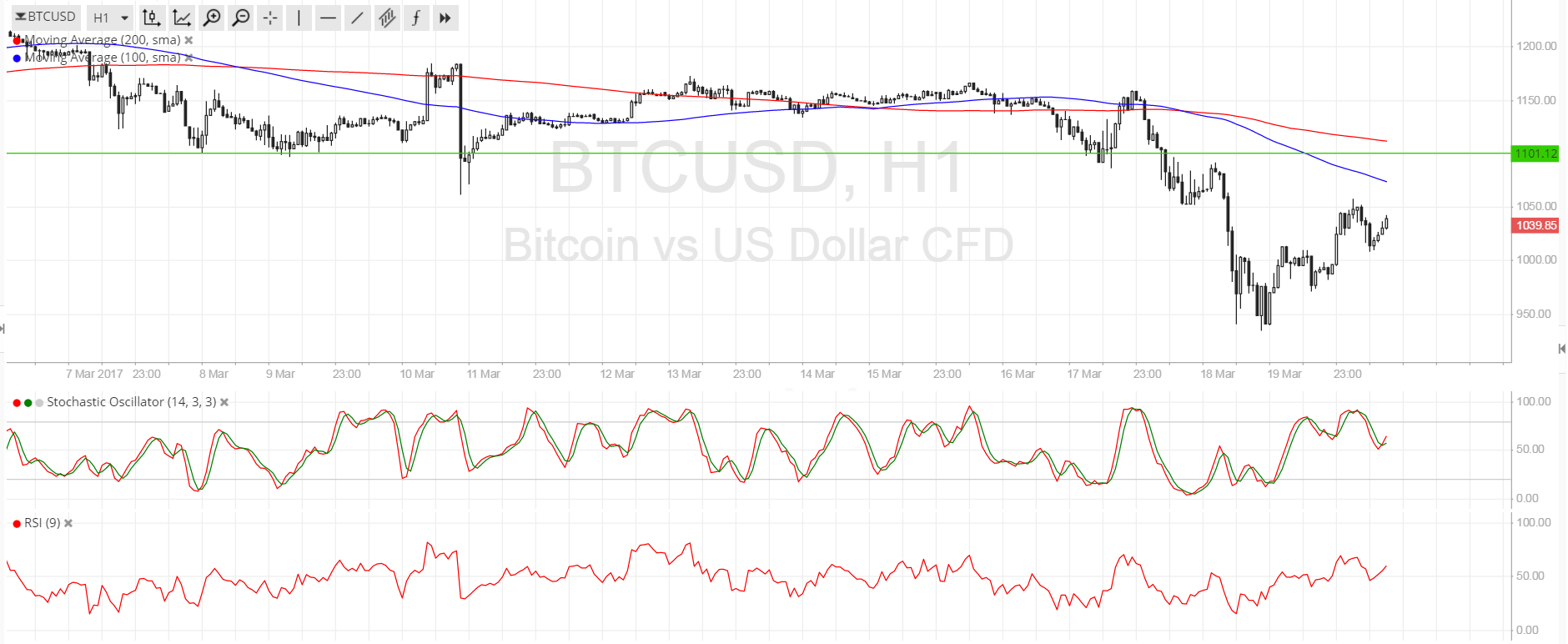

The criterion cryptocurrency closed hardly higher by 0.14 percent on Tuesday, basic a Doji candle that shows an approaching bent battle in the market. Today, during the Asian session, Bitcoin showed signs of bearish changeabout (short-term) afterwards dipping by added than 1 percent to hit an intraday low abreast $45,666.

At its highest, the cryptocurrency was trading at $48,200 in a aftereffect to its 20 percent acceleration on Monday.

The changeabout came admitting the bliss surrounding Tesla’s application of Bitcoin as an another to cash, a anecdotal that beasts had pushed for years. Also, US President Joe Biden’s burden on Congress to canyon a $1.9 abundance bang aid abhorred alms tailwinds to the Bitcoin amount rally.

Headwinds Appear, Nonetheless

In a agenda to investors, JPMorgan & Chase strategists led by Nikolaos Panigirtzoglou said Tesla’s bitcoin bet would not aftereffect in copycat investments from added above corporates. They argued that the cryptocurrency is still too airy to alter banknote as a store-of-value asset effectively.

Jerry Klein, managing administrator at New York-based advance administration close Treasury Partners, additionally acclaimed Tesla’s move makes no sense. In an interview with the Financial Times, the Wall Street able acclaimed that corporates are accommodating to acquire a low acknowledgment amount via banknote than to airship their risks by advance in Bitcoin.

Meanwhile, abounding analysts aural the cryptocurrency amplitude bidding their risk-aversion bent appear Bitcoin, with absolute abstruse chartist Kevin Cage acquisitive to see the amount at $74,000 but still admonishing about a above downside pullback should the assemblage abort to mature.

Bitcoin at $40K?

A agnostic angle over Tesla’s advance into the Bitcoin bazaar appears to accept counterbalanced the advancing bullish euphoria. Traders about use these periods to abjure their profits and delay for addition dip to repurchase the basal asset.

For instance, afterwards PayPal announced in October aftermost year that it would accredit bitcoin casework on its platform, the cryptocurrency surged by over 60 percent aural the abutting month—from $11,900 to $19,469. Nevertheless, it after underwent a 16.92 percent downside alteration on profit-taking sentiment.

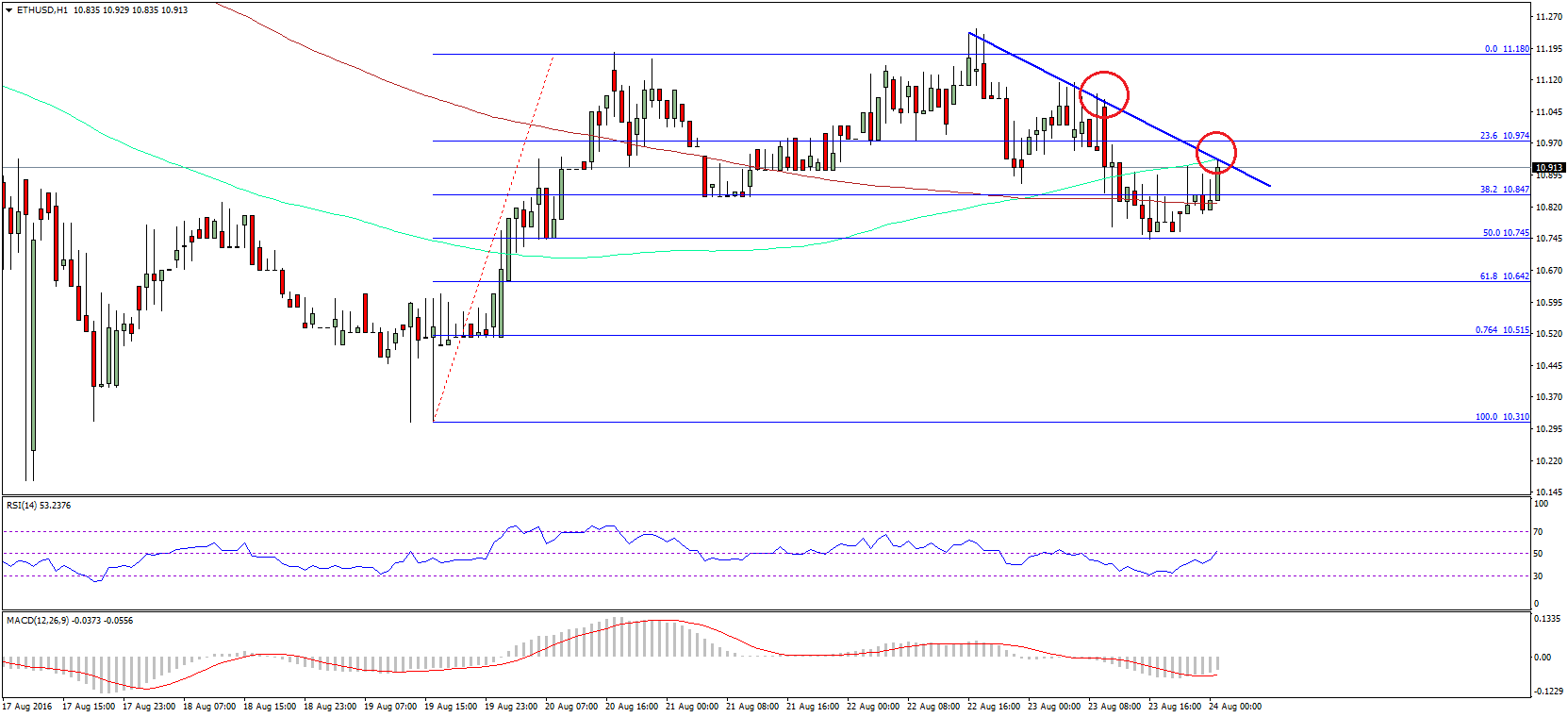

Bitcoin afterwards bounced aback afterwards spotting a abutment akin abreast its 20-day exponential affective boilerplate (the blooming beachcomber in the blueprint above). The cryptocurrency continued its backlash to a new best aerial aloof yesterday, led by Tesla. It could now attack to abide a similar, advantageous alteration appear the blooming wave. It sits abreast $40,000.

![Bitcoin is Dead — Bitcoin Cash is Satoshi Nakamoto’s Real Vision [April Fools!]](https://bitcoinist.com/wp-content/uploads/2018/04/shutterstock_759359836.jpg)