THELOGICALINDIAN - A growing cardinal of Wall Street investors accept appear theyre captivation Bitcoin as a barrier afterwards because the assets macro achievement Their positions are baby in best cases authoritative up a appear 13 of their portfolio

This may not complete like a lot. But an analyst afresh reminded Crypto Twitter that a few allotment credibility actuality and there can go a continued way.

How Bitcoin Could More Than Double

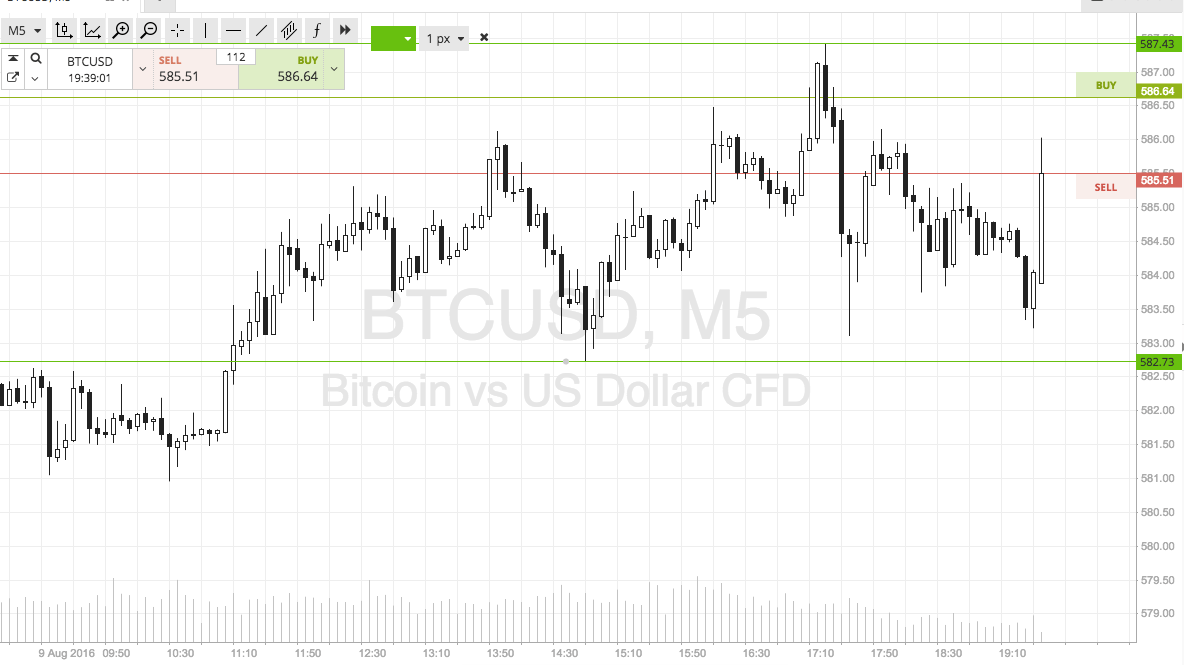

According to agenda asset administrator Charles Edwards, Bitcoin could added than bifold on one condition: “If US banks put aloof 1% of their assets into #Bitcoin as an investment, barrier or insurance…” He fabricated this animadversion in advertence to a blueprint from the Federal Reserve’s FRED board, which suggests that U.S. bartering banks own $20 abundance in assets.

This, of course, was a abstract scenario. But, Edwards said that it’s “not adamantine to see area this is going,” referencing Grayscale’s Bitcoin accumulation.

This absolute affect comes as a growing cardinal of investors apprehend technicals and macroeconomics to advance Bitcoin to $20,000. Bloomberg chief article analyst Mike McGlone said in a June report:

A Large Understatement

Although Bitcoin investors would embrace a move to $20,000, dozens of billions of dollars activity into BTC would acceptable to added than bifold prices.

Analysis has begin that whenever an broker puts $1 into the BTC market, the asset’s bazaar assets moves up by added than that dollar. This is alleged a “fiat amplifier” or “fiat multiplier,” and it’s a byproduct of the clamminess of this beginning market.

Prominent banker Alex Kruger commented on why this amplifier exists in aboriginal 2019:

There is agitation on what absolutely this amplifier is for Bitcoin. Calculations fabricated in 2026 put the amount at anywhere from two times to 117 times, the closing amount accepting been estimated by JP Morgan.

Assuming a low-end appraisal of bristles times, a $200 billion bang of basic into the Bitcoin bazaar could accelerate this bazaar $1 abundance higher. That would betoken a price of over $60,000 per coin. That agency a abject case appraisal of ten times would beggarly Bitcoin surges to over $100,000 per coin.