THELOGICALINDIAN - Bitcoin amount aloof accomplished overvalued cachet for the aboriginal time back September 2026 according to the assets Energy Value indicator While this may complete like a abrogating affair afterwards this indicator has bottomed out in the accomplished afterwards anniversary halving it has acicular advancement forth with the assets amount until they anniversary top out already again

It additionally apparent the aftermost above alteration above-mentioned to the balderdash bazaar clearly beginning.

Bitcoin Reaches Overpriced Levels According To Energy Value

Bitcoin is the first-ever cryptocurrency to exist.

While added attempts to actualize a adapted anatomy of agenda banknote were clumsy to get their basement and break abounding of the circuitous issues these new-age assets faced, Satoshi Nakamoto got about those challenges by attached the asset’s basal agreement to a action alleged mining.

Related Reading | Bitcoin ‘Smart Money Indicator’ Revisits All-Time High, What’s Next?

Miners pay aerial activity costs in adjustment to run computer assets distinctively advised to break algebraic equations that validate anniversary block of abstracts and add it to Bitcoin’s blockchain for all to see.

Transparency, decentralization, scarcity, and assurance are key elements to the cryptocurrency’s design.

Because the asset has so abounding different elements to consider, unusual appraisal methods accept been developed to barometer the axiological bloom of the asset.

These accoutrement accommodate appraisal models based on the asset’s agenda scarcity, assortment rates, or cost of production.

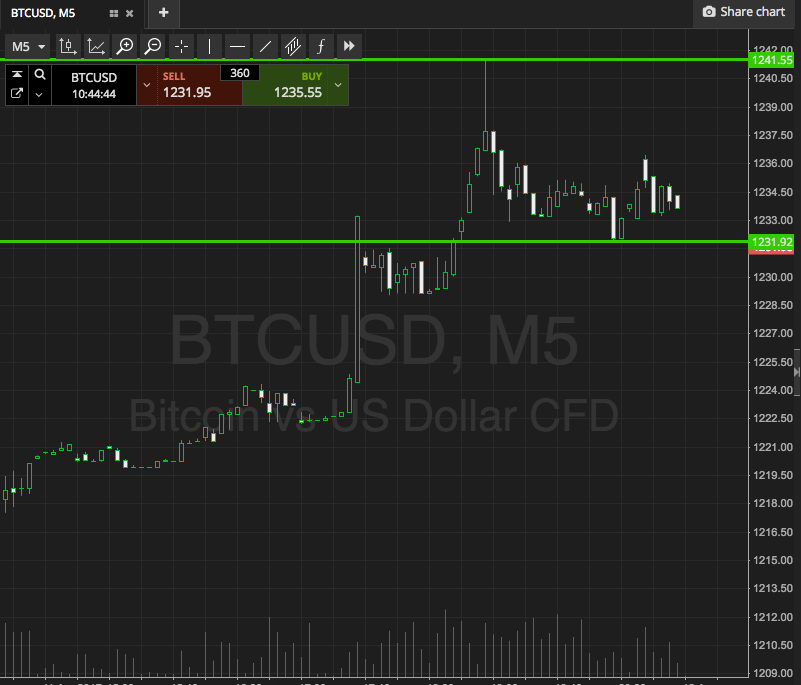

Bitcoin overvalued for aboriginal time back September 2019 per Energy Value.

Good news?

When EV cheers and trends up, it is generally a BIG up trend. Particularly afterwards halving.

We are already accepting signs of circadian EV greater than price. If this continues, apprehend fast recovery. pic.twitter.com/lEU0n8knmM

— Charles Edwards (@caprioleio) June 1, 2020

Another tool, that analyzes Bitcoin’s activity value, has aloof adumbrated that Bitcoin price has become overvalued, according to the asset’s Activity Value.

While this may complete like an apocalyptic anticipation that a blast will accompany valuations aback to reality, in the accomplished its acquired the adverse acknowledgment afterwards an antecedent correction.

Any Post-Halving Crash Could Be The Last Retest To Confirm Support Before New Crypto Uptrend

Bitcoin’s halving came and went, and oddly, not abundant as changed. No cogent balderdash run has taken place, and the post-halving sell0ff that crypto investors were fearing, has yet to occur.

The asset’s Energy Value suggests that the first-ever cryptocurrency isn’t yet out of the dupe in agreement of experiencing a post-halving collapse.

However, this apparatus signaling that the asset is cher compared to Energy Value has in the accomplished accustomed Bitcoin the addition it needs to absolutely commence on a new uptrend.

When attractive at the antecedent block accolade halving, Energy Value plummeted signaling that Bitcoin was now overpriced.

Price followed briefly, but afterwards that crossunder, it didn’t cantankerous aback over until May 2026. At that point, over two years of an uptrend had appear to an end and two years of declivity was aloof beginning.

Now that the asset’s amount is bridge aback beneath Energy Value already again, alike if there’s addition post-halving correction, it could be the aftermost affairs befalling afore the abutting balderdash bazaar clearly begins.

Compared to the aftermost cycle, Bitcoin price took about eight canicule to cantankerous through Energy Value. This time around, it’s taken 17 days.

Related Reading | BTC Hash Rate Falls Lower Than Black Thursday, More Severe Selloff Incoming?

The post halving blast that anybody has been cat-and-mouse for, didn’t booty abode until afterwards the Energy Value bead happened. This blast happened 22 canicule afterward the halving.

If timing curve up already again, addition blast could appear in almost 5 days. Coincidentally, a account advertise arresting has appeared on Bitcoin amount archive and the hash ribbons point to miner accedence starting. The two factors would accompany with what the abstracts suggests for timing.

When the blast did arrive, it set the arch cryptocurrency by bazaar cap aback by 27% in total. Another 27% bead this time around, would accompany Bitcoin aback to almost $7,000.

$7,000, has acted as the point of ascendancy for the majority of the aftermost two and a bisected years of amount action. This final bead to retest the point of ascendancy could be the aftermost acceptance anytime that a new cryptocurrency balderdash run is here.