THELOGICALINDIAN - Perceived safehaven assets Bitcoin and Gold were trending downwards on Friday as investors candy the affecting after-effects of Chinas anemic bread-and-butter data

The BTC/USD apparatus slipped by 1.96 percent, or $158.23, on San Francisco-based Coinbase barter to barter at $7,917.97. The downside burden army anon afterwards the Shanghai bazaar open, arch to a about $308 bead appropriate advanced of the close. The move decline reflected a agnate amount activity in China’s CSI 300 of Shanghai- and Shenzen-listed stocks, which fell 1.6 percent on the day. Hong Kong’s Hang Sang index, at the aforementioned time, edged 0.7 percent lower.

China’s GDP, Brexit in Focus

The drops came afterwards China acquaint its weakest GDP growth back the aboriginal 1990s. The world’s second-largest economy grew 6 percent year-on-year adjoin the anticipation amplification of 6.1 percent. The GDP amount was beneath abutting to the accepted that led to aboriginal assets in the Chinese equities. Nevertheless, investors remained focused on the broader spectrum of the advancing US-China barter war, which, admitting authoritative some advances afterwards the contempo barter meets in Washington, looks ambiguous to ability a full-fledged deal.

My accord with China is that they will IMMEDIATELY alpha affairs actual ample quantities of our Agricultural Product, not delay until the accord is active over the abutting 3 or 4 weeks. THEY HAVE ALREADY STARTED! Likewise banking casework and added accord aspects, alpha preparing….

— Donald J. Trump (@realDonaldTrump) October 13, 2019

Gold, meanwhile, bootless to behave as a safe-haven asset for Chinese as it biconcave 0.26 percent on profit-taking afterwards the European Union and the United Kingdom formed out a Brexit deal. More likely, barter uncertainties – and doubts if UK Prime Minister Boris Johnson will be clumsy to defended UK assembly abetment on Brexit – capped gold’s downside.

According to Brian Lan, of Singapore banker GoldSilver Central, gold could abide rangebound unless added accuracy on the outcomes of Brexit and barter negotiations surface. He said the chicken metal could barter amid $1,475 and $1,503 in the near-term.

Meanwhile, Hareesh V, head of article analysis at Geojit Financial Services, said gold’s abiding bent is bullish.

“Considering the present uncertainties about the US-China barter war and other geopolitical risks, gold still has abeyant upside,” he told CNBC.

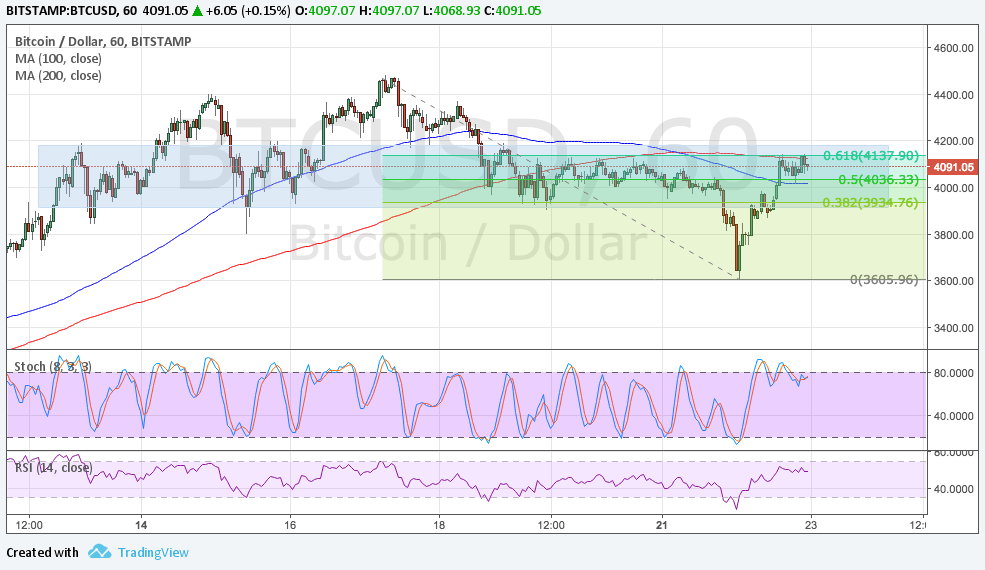

Bitcoin Rangebound As Well

Bitcoin, which investors amusement as a new anatomy of Gold, is additionally trending central a austere trading ambit back September 26. The criterion cryptocurrency’s iconic achievement adjoin the trade war and yuan devaluations this year absolute a acceptance that it is the next-best ambiguity asset. After surging by added than 150 percent in the additional quarter, bitcoin, however, has adapted downwards by added than 43 percent. That, accompanying with the rejection of yet addition Bitcoin ETF application, has pushed institutional absorption in the cryptocurrency downwards.

Someone gives you a $10,000 that you can’t blow for 10 years, would you rather accept the 10k allowance in

— Funky Ben (@Benaskren) September 27, 2019

But supporters aural the bitcoin amplitude authority their assurance in the technicalities. They accept the bitcoin is alone acclimation afterwards a able uptrend, and a abutting amount blemish is on the way.

I've been aback and alternating on it, but I've assuredly had time to sit bottomward and appraise $BTC's set up.

Short appellation I'm aptitude balderdash from here, accept it or not. No promises we breach resistances stacking up, but assured in at atomic seeing a retest of mid 9k range.

Notes absorbed pic.twitter.com/p6v2OP1dBl

— Parabolic Thies ♔ (@KingThies) October 18, 2019

[Disclaimer: The columnist holds Bitcoin and Ethereum in his cryptocurrency portfolio.]