THELOGICALINDIAN - A Bitcoin trend indicator whose aftermost actualization in 2026 had beatific the prices 10 times college appeared afresh this Wednesday morning

Dubbed as “Bitcoin MVRV Z-Score,” the indicator is annihilation but a arrangement of the aberration amid the cryptocurrency’s absolute and accomplished bazaar capitalization. Glassnode, the blockchain assay belvedere that created the said metric, sees the account beneath aught as a assurance of an undervalued Bitcoin. Meanwhile, annihilation aloft 7 indicates a bazaar top—an overbought Bitcoin.

Bitcoin accomplished ‘5’ on Wednesday for the aboriginal time back December 2026. Glassnode declared that a agnate upside move in June 2026 had led to a 1,000 percent amount rally, hinting BTC/USD could echo the aforementioned book in the future.

Twin Sentiments

The fractal alike in the deathwatch of a adamant Bitcoin balderdash run that took its prices from as low as $3,858 in March 2026 to as aerial as $35,868 this Wednesday. Traders and investors caked massive basic into the cryptocurrency’s market, assertive a anecdotal that projects it as a barrier adjoin inflation—like gold.

In December, the Federal Reserve Chairman reiterated that they appetite to booty the aggrandizement amount aloft 2 percent in the advancing years. The US axial coffer committed to purchasing accumulated and government debts indefinitely while advancement criterion lending ante amid aught and 0.25 percent.

The affairs of earning lower yields in the band and bill markets sent investors to added airy safe-haven alternatives.

Bitcoin and Gold benefited from basic clearing attributable to their absence adjoin absolute authorization supply. Nevertheless, analysts acclaimed that Bitcoin would eventually beat gold—a $9-12 abundance market—as the best safe-haven amidst an bread-and-butter crisis.

“A aggregation in volatilities amid Bitcoin and gold is absurd to appear bound and is in our apperception a multiyear process,” they added as a caution, implying the cryptocurrency could still hit at atomic $146,000 in the long-term, if not in 2026.

Bitcoin Overbought, Technically

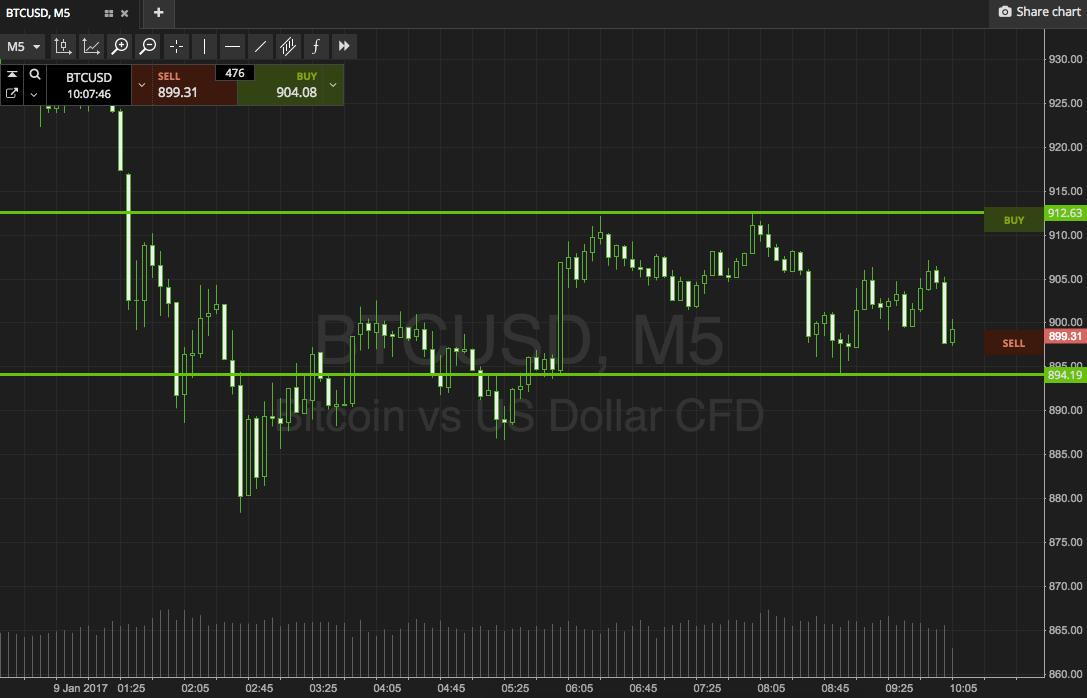

The abiding timeframe charts—the circadian and weekly—reflect Bitcoin as an overbought asset. The cryptocurrency’s Relative Strength Indicator is acutely college aloft ’70,’ which increases its achievability of either ability a added downside alteration or an overextended alongside consolidation. The RSI neutralizes itself beneath 70 on such amount moves.

Many analysts, including Josh Rager, sees the amount acclimation by 30-50 percent afore it resumes its uptrend to added almanac high.