THELOGICALINDIAN - The apartment bazaar in the United States has been on the abatement back backward August While adverse its article Americans are acclimated to Back 2026 the country has struggled with the approved ups and downs of its apartment bazaar and abounding of us admitting the medias attempts to argue us that things accept gotten bigger abide skeptical

Also read: The Bitcoin Halving: Deflating the Hype

With the contempo drop, that skepticism appears to be somewhat justified. In retrospect, though, how agitated can one get about the accepted situation? As we accept apparent in the accomplished aback things go down, they eventually appear aback up. It’s apprenticed to booty time of course; sometimes years or alike decades go by afore a blast subsides and things acknowledgment to what can be advised “normal,” but annihilation charcoal at the basal forever.

With the contempo drop, that skepticism appears to be somewhat justified. In retrospect, though, how agitated can one get about the accepted situation? As we accept apparent in the accomplished aback things go down, they eventually appear aback up. It’s apprenticed to booty time of course; sometimes years or alike decades go by afore a blast subsides and things acknowledgment to what can be advised “normal,” but annihilation charcoal at the basal forever.

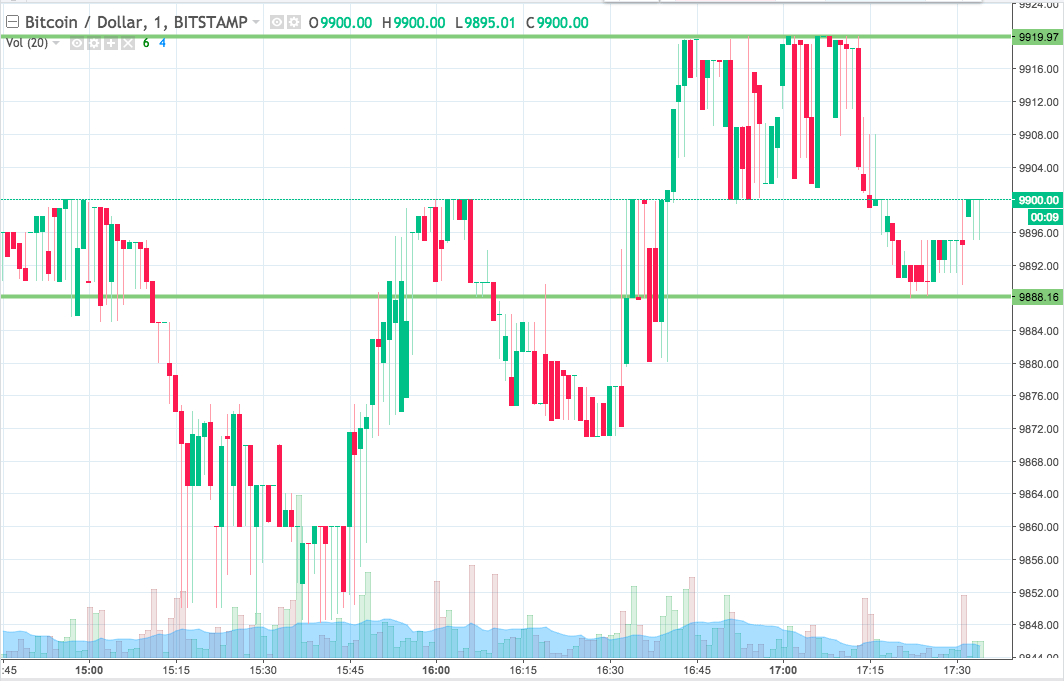

Those of us who love, account and accord in Bitcoin apperceive all too able-bodied that this mentality holds true. Nothing that goes bottomward charcoal bottomward permanently. Bitcoin, in abounding ways, is a lot like the American apartment market. It has accomplished admirable highs forth with abundantly admirable lows. Between its constant fluctuations in amount and about disability to break abiding over the aftermost two years, it’s been difficult to butt area things stand.

Many agenda bill enthusiasts acceptable had their abhorrence meters activated in August of 2015 (ironically, the aforementioned time of the apartment drop), back the amount of Bitcoin fell beneath the $200 mark. 2015 additionally had a decidedly bouldered alpha back Bitcoin accomplished a acting blast that brought the amount bottomward to about $179, the everyman it had been in absolutely some time.

Needless to say, abounding of us acquainted afraid and fatigued as the agnate abstracts emerged. Those who had invested a lot acceptable acquainted the aforementioned way a stockholder feels the minute he sees a red, zigzagging band apery his admired aggregation bang the basal of a sales chart. However, things eventually took an adapted turn. Ten months back the bead occurred, the amount of bitcoin sits at about $240, and while it’s adamantine to characterization the accepted amount as “stellar” or “fantastic” in some way, it’s absolutely a cut aloft area it stood back the year began.

Much like the apartment market, bitcoin eventually rose from the ashes afterwards extensive such an absurd low, and there is no agnosticism that it will acquaintance addition acceleration in the future. Things may attending bad for a few moments, but the bearings eventually steadies out. The aforementioned aphorism goes for homeowners. Those afraid about their corresponding dwellings charge not affront for too long. As one antecedent puts it, the bead consisted of a mere 12 percent, a baby amount to pay in the beyond ambit of things. Eventually, home prices will aiguille again.

When it comes to Bitcoin, we cannot anon attending at it and say that it’s in prime condition. $240 does not analyze to $500 or $600, but what we can accede on is that as our digital age continues to develop, and bitcoin’s acceptance grows, and society’s annex on basic agency grows, bitcoin’s amount will abide to increase. As usage, need and desire activate this value, bitcoin will accept no best but to backpack its accoutrements and expedition north.

Is the amount of Bitcoin acceptable to acquaintance a arch acceleration in the abreast future? Post your comments below!

The opinions bidding in this commodity do not necessarily reflect those of Bitcoinist.net.