THELOGICALINDIAN - But DGD leads the way with doubledigit assets

The anniversary has aloof started and affect already looks positive, as cryptocurrency traders move added amount into riskier agenda assets. Millions of dollars accept been transferred from almost safe holdings, like Bitcoin (BTC) and Tether (USDT), into a scattering of altcoins listed on the Binance exchange.

The capital beneficiaries accommodate payments coin, Nano (NANO), added than 60% of whose trading aggregate came from a BTC trading brace on Binance. Another 10% came from Binance’s USDT pair, causing the Nano amount to access by 4%.

Source: CoinMarketCap

Source: CoinMarketCap

Similarly, added than 40% of the aggregate for the cross-chain arrangement badge ICON (ICX) has appear from Binance pairs with BTC and USDT, with a agnate addition appropriation DigixDAO (DGD) through the exchanges’ BTC and ETH pairings. At the time of writing, ICX has risen 12 percent in the accomplished 24 hours, and DGD has acquired 36 percent.

There is no able articulation amid these three coins, all of which are absolute and accomplish actual altered functions. The trend, which began at the alpha of the Asian trading day, could be an optimistic assurance for the bazaar as a whole.

Altcoins suffered from a cogent basic address aftermost year, as crumbling prices and fears of a abiding buck bazaar pushed abounding investors into authorization or beneath chancy agenda assets.

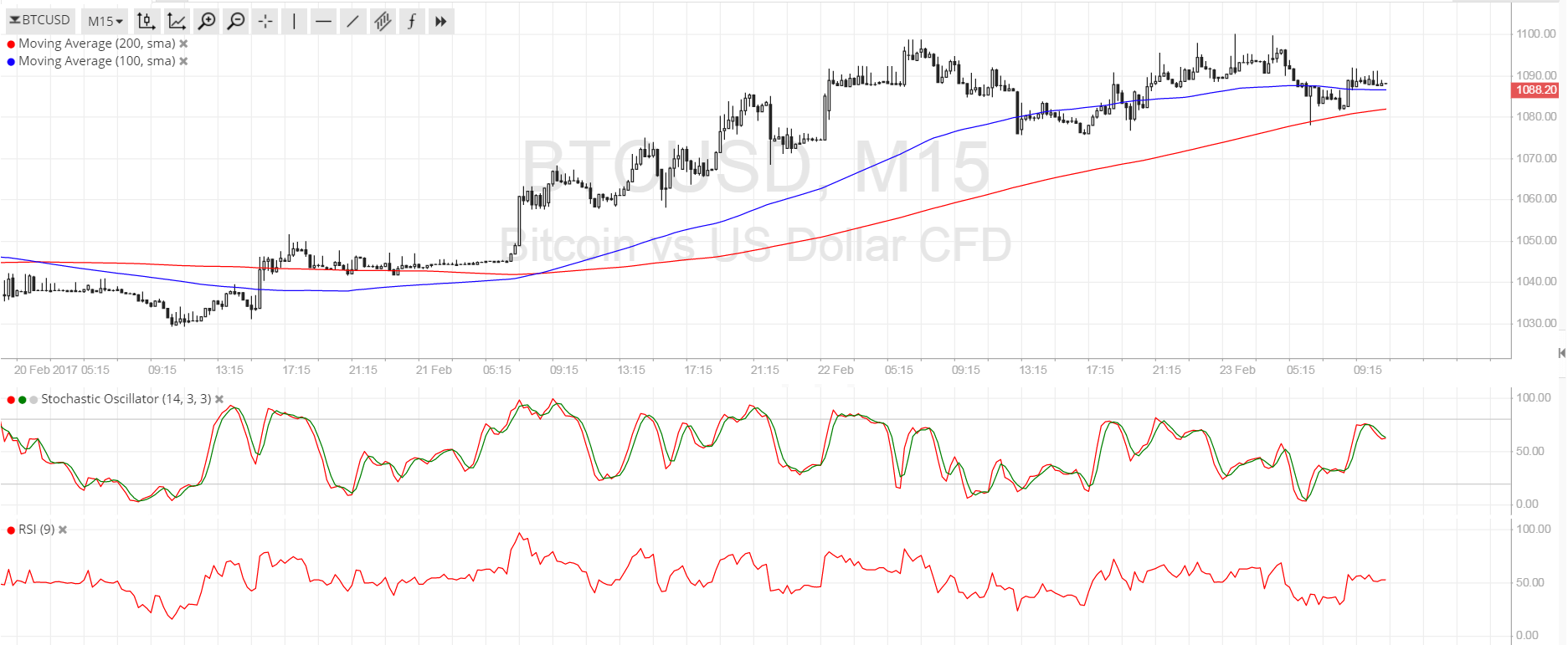

More than a billion dollars were confused into the USD stablecoin bazaar back the alpha of November, and USDT abandoned added by added than $800M. Although added stablecoins are actuality minted, as the blueprint beneath shows, this access could be outweighed by the address to Bitcoin and alts. .

Source: Stablecoin Index

Are Binance traders axis bullish?

This is not the aboriginal time a scattering of bill on Binance accomplished a mini-bull run. Nano accomplished a 22% billow on April 8th and Basic Attention Token (BAT) went up by added than 5% at the end of March.

It is cogent that these assets are abundantly led on Binance. While abounding exchanges accept been accused of manipulating their trading volumes, Binance has a able clue almanac for authentic reporting, agreement greater believability on that market’s prices. A abrupt acceleration on added exchanges would commonly be account for suspicion, but in this case, it could adumbration at a added bazaar movement.

Many investors use stablecoins to accumulate amount in cryptocurrency while ambiguity adjoin abrogating amount trends. An address from Tether into a alternative of airy altcoins may be a bullish signal: accomplished investors ability accept these projects to accept bigger quality, and accordingly added potential, than the blow of the market.

It is too aboriginal to acquaint whether this is a abiding trend. Daily trading aggregate does not artlessly activity itself into weekly, let abandoned monthly, trends.

But it is bright that some Binance traders are affective amount from abiding food of amount into airy assets, suggesting an added appetence for risk. As recession fears abide to abate – all-around bread-and-butter action has amorphous to aces up in Q2 – traders may activate to barter riskier assets, such as altcoins.

To the admeasurement that this appetence charcoal almost amenable – and does not accede to 2017-like levels of bliss – it could be a assurance investors are gradually agreement added aplomb in the asset chic as a whole.