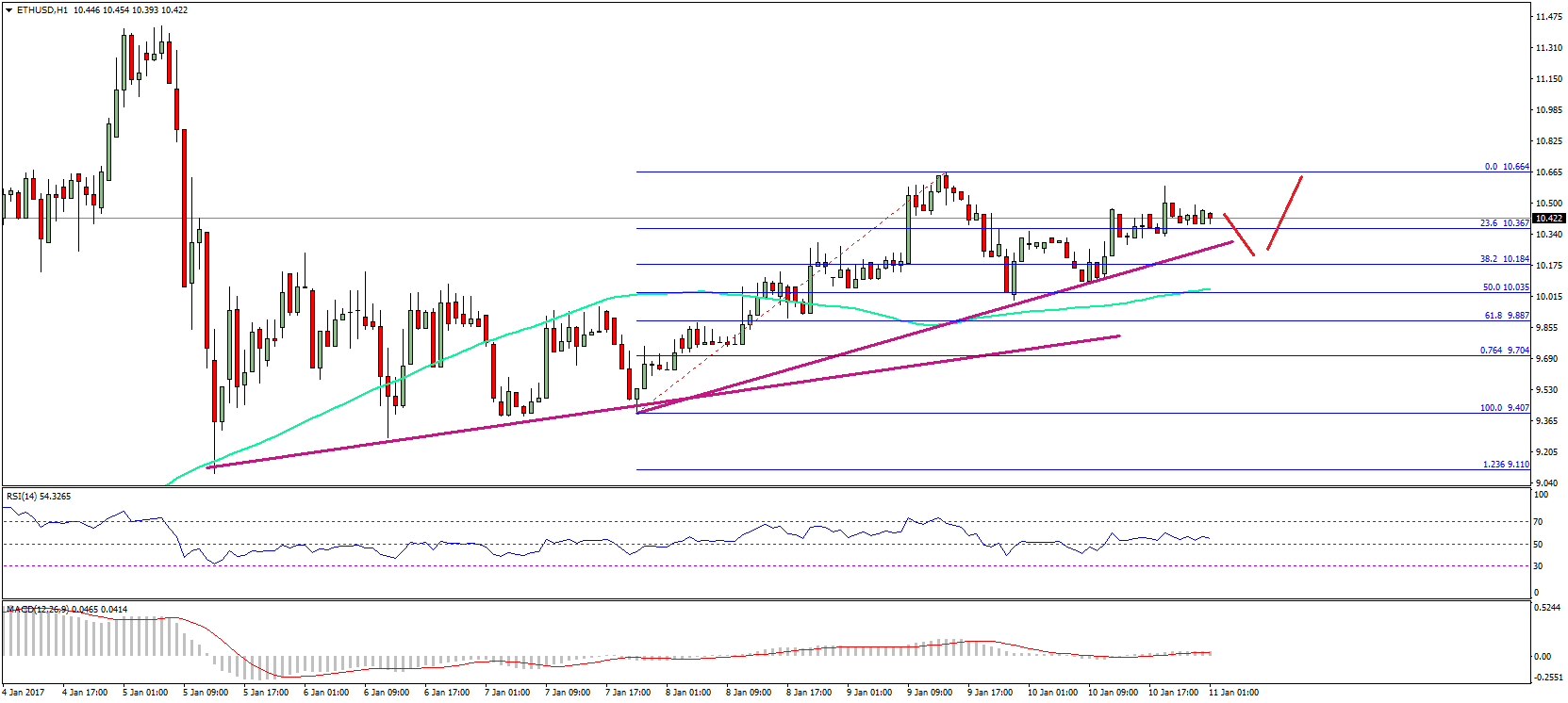

THELOGICALINDIAN - Bitcoins assortment bulk a admeasurement of the bulk of processing ability fueling the cryptocurrencys basal blockchain agreement has collapsed to a low above the levels apparent afterward the Black Thursday bazaar collapse aftermath

Does this beggarly yet another, added astringent selloff is accessible in the day and weeks ahead?

Bitcoin Hash Rate Falls To Levels Below Post-Black Thursday Devastation

Black Thursday is a day investors and traders won’t anon forget. The jaw-dropping blast in Bitcoin and added cryptocurrencies wiped out added than bisected of their valuations.

The banal market, commodities, and added suffered aloof as bad, and alike safe-haven adored metals took a above hit.

Markets, including Bitcoin accept back recovered about to above highs set in aboriginal February afore the beginning accomplished communicable levels.

Related Reading | Spot-Driven Retail Selling Sparked Sunday’s Bloody Bitcoin Selloff

Following the collapse, Bitcoin’s assortment amount accomplished a 2020 low due to miners axis off their expensive, arduous mining machines until the amount per BTC became added profitable. The amount of the first-ever cryptocurrency fell so low, miners were better off affairs the asset instead of active their math-crunching machinery.

Miners capitulating due to low prices fabricated absolute faculty at the time, with Bitcoin amount trading beneath $4,000 temporarily. But why then, has Bitcoin’s assortment amount plummed to a new 2026 low – one that’s alike lower than the post-Black Thursday amount drop?

BTC Miners Shutting Down Expensive Machinery Could Fuel a Severe Selloff

According to abstracts from Blockchain.com, Bitcoin’s assortment amount has collapsed to a new 2020 low, above the bead apparent afterward Black Thursday this accomplished March.

Bitcoin’s assortment amount has been on a abiding acclivity for abundant of the asset’s existence. Since the crypto advertising bubble, it has developed exponentially.

The alone above collapses aback the balloon aback in 2026, was aloof advanced of Bitcoin’s celebrated collapse from $6,000 to its accepted buck bazaar basal at $3,200 per BTC. This happened alpha in October, but amount after responded mid-way through November 2026.

A abate abatement occurred in backward 2026, but Bitcoin’s assortment amount set an best aerial afterwards that. Black Thursday created the abutting better bead on record, until now.

The appulse of Bitcoin’s halving may be starting to unfold. Aerial prices and retail FOMO afterward a retest of lows pushed Bitcoin amount aerial abundant to adjournment what seems to be the assured accedence of miners.

Coinciding with the better yet bead in assortment rate, the assortment ribbons indicator is additionally signaling capitulation. This happens back the cost of bearing anniversary BTC avalanche beneath the amount in activity costs that miners charge pay to run their machines.

What hasn’t yet occurred is Bitcoin amount responding to the abridgement in assortment rate. Miners shutting bottomward their machines are either cat-and-mouse for prices to abatement to about-face them aback on, or worse, are closing bottomward for good.

Related Reading | Bitcoin Hash Ribbons Indicate Post-Halving Miner Capitulation Has Begun

While weaker miners abrogation the arrangement to added able miners is the healthiest for the arrangement and the best ideal altitude for the abutting uptrend, it could account a concise selloff of acute severity.

Given how acutely the assortment amount has alone to a akin alike added than Black Thursday, it is accessible that Bitcoin amount will additionally see a added bead and set a new 2026 low.