THELOGICALINDIAN - Its a book wed all like to see and of advance eradicating apple debt would additionally be a acceptable affair But is there a aisle toget therePossibly according to Lucid Investment Strategies Hang assimilate your hats admitting its activity to be a aflutter ride

Five To One, Baby. One In Five.

Thus begins a new article charting Bitcoin’s abeyant ascend to a amount of $10 million. As bounds go, it’s adamantine to altercate with. Figures from The Institute of International Finance appraisal apple debt as about $247 trillion, and apple abundance as $317 trillion. Significantly though, over the aftermost 20 years, the debt has added 394%, while the abundance alone added 133%.

The acceleration to ascendancy of the Bitcoin accepted is one of bristles options posited as abeyant resolutions of this situation. But it’s the one we’re best absorbed in, so let’s avoid the added four.

No One Here Gets Out Alive.

At $10 million, Bitcoin could accommodate the apple with a abiding assets currency, butterfingers of aggrandizement or deflation. It would alter absolute currencies, and represent the ultimate ‘store of value’. Of the bristles alternatives suggested, Lucid believes it offers a abiding fix, accouterment the greatest benefits, with the atomic accessory damage.

But as it stands, Bitcoin’s amazing antecedent affiance has been beneath by the bags of copycat altcoins. These are crippling the absolute amplitude with their ‘improvements‘ to the original, although regulators like the SEC are starting to draw distinctions amid Bitcoin and the rest.

So the “next big footfall in this adventure will be the absolute annihilation of altcoins.”

You Get Yours, Baby. I’ll Get Mine

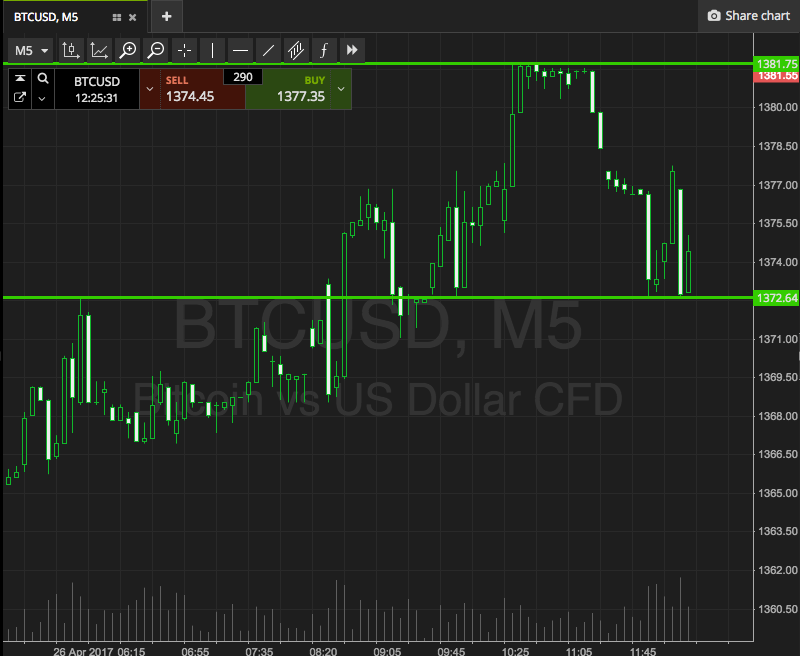

So altcoins are dead, acceptation appeal for Bitcoin increases. As the “most autonomous market-driven asset in history” added appeal equals accretion BTC amount [coin_price]. But aboriginal we charge to bottom, which Lucid thinks will be beneath $1000. Sorry. But then…

At this point Lucid foresees media frenzy. The alley becomes bland as barrier funds and ancestors offices jump on board, and investors accretion confidence. We see acting hurdles at $50,000 and $100,000, but now bazaar cap has taken $1.7 abundance from the common banal market. Latecomers are affected to act.

Gonna Make It, Baby, If We Try.

Bitcoin begins to eat into the $7.5 abundance gold market. At $400,000 gold’s bazaar cap has been usurped. Earlier if gold prices go bottomward as investors about-face to Bitcoin.

We now charge three things to appear in adjustment to ability $1 million. The developers charge bear the promised speed, transparency, and cost. Institutions charge absolutely embrace Bitcoin. Regulators common charge actuate that Bitcoin is a abstracted article from any actual cryptocurrency.

This achieved, we accept a bright run to $1 million. It is a austere asset and can no best be abandoned by alike the best bourgeois institutions. We lath the aerial acceleration shuttle to $10 million.

…

Of course, we no best own any cogent amount. We all had our amount to advertise at. Now, Bitcoin is in the easily of axial banks. It is their best adventitious to save the arrangement and absorb their power, according to Lucid.

Do you accede with Lucid Investments? Share your thoughts below!

Images address of Shutterstock