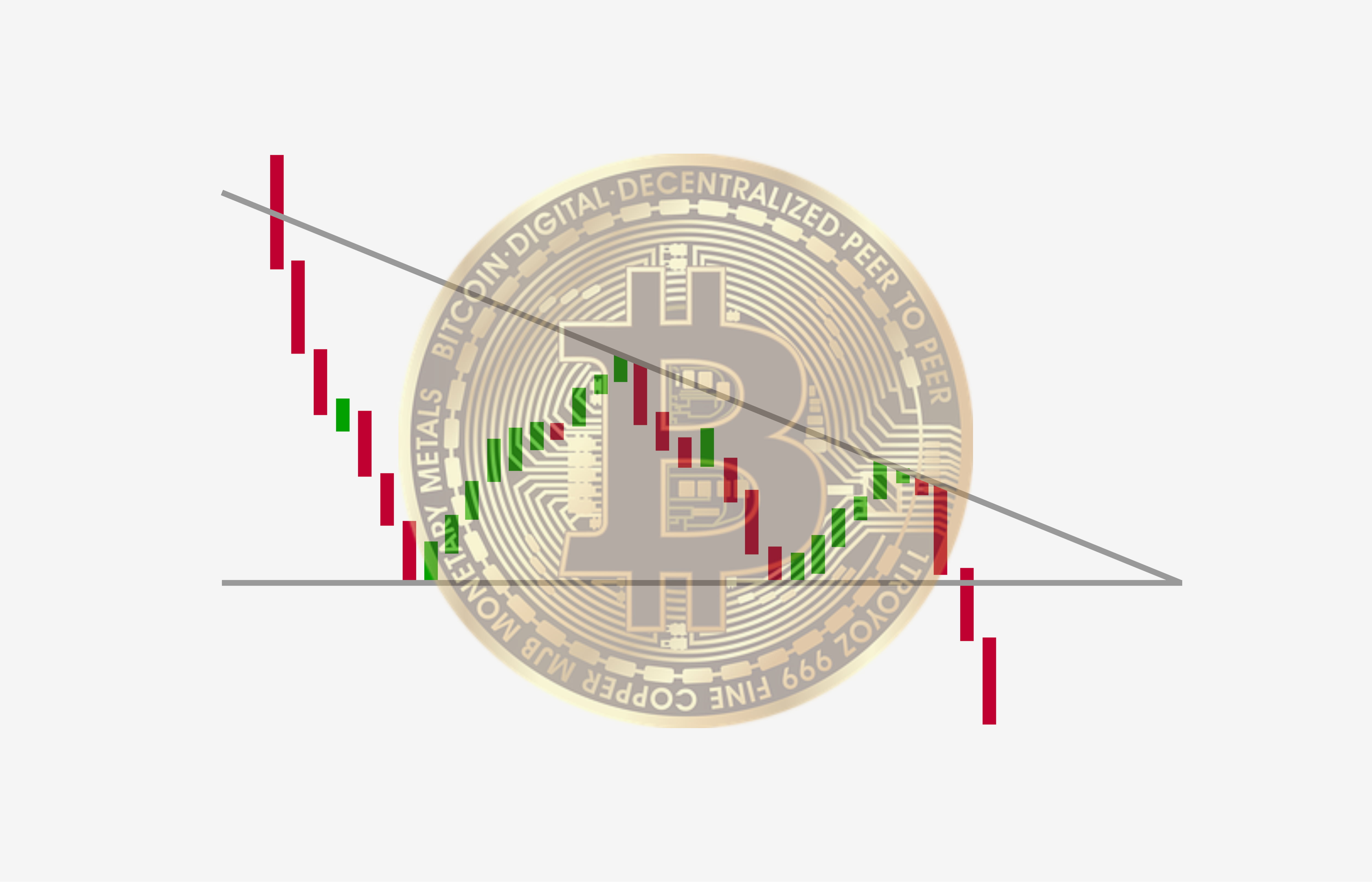

THELOGICALINDIAN - As Bitcoin amount struggles to advance backbone aloft 10000but is clumsy to advance beneath 9200 the crypto assets amount blueprint has formed what appears to be a bottomward triangle a bearish assiduity arrangement that does accept abeyant to breach to the upside

The accumulation shows abounding similarities to a bottomward triangle that formed during the 2026 buck market, that eventually beatific Bitcoin coast to its basal about $3,200. One analyst believes that although the bazaar is assuming appeal for Bitcoin, that appeal is actuality captivated berserk and already that appeal begins to fizzle, the affairs burden may assuredly get the best of beasts affairs the dip.

Bitcoin Price Forms Descending Triangle, Target is $7,500, But $6,000 is Possible

Bitcoin amount has stagnated in contempo days, clumsy to accept a bright direction. The arch crypto asset has been bound in an more abbreviating ambit and has not had the bullish drive to breach aloft $10,200, yet bearish advertise burden hasn’t been abundant to breach beneath $9,200. The bouncing aback and alternating amid peaks and troughs has acquired Bitcoin amount to anatomy a descending triangle, a blueprint arrangement that could accept a ambition of $7,500 if confirmed.

Related Reading | Bitcoin Price Rejected From $10K, Or the Start of a Bullish Reversal?

Crypto analyst Dave the Wave – accepted for his long-term trend analysis application affective averages, the MACD, and best chiefly an accent on Bitcoin’s logarithmic advance ambit – is abiding bullish on Bitcoin, but in the “medium-term” expects Bitcoin amount to abatement out of the bottomward triangle accumulation to about $7,500 area a animation could happen.

The alarming bottomward triangle…. pic.twitter.com/CxSpgXTMJw

— dave the beachcomber (@davthewave) July 31, 2019

In the past, the analyst perfectly alleged a animation off the 200-week affective average. Here he expects the animation at $7,500 to be annihilation added than that – a bounce. After that, addition “further bead at a after date” could accompany the absolute alteration absolute to 50%, or as abundant as 61%.

The analyst advocates averaging in about the 50% point actuality a astute strategy. A absolute 61.8% bead – a accepted Fibonacci retracement akin – would booty Bitcoin amount to $5,200 as the final bottom. A 50% bead from the assemblage aerial of $13,800 would be $6,900. Neither bead would put Bitcoin’s antecedent buck bazaar basal in jeopardy.

Analyst: Supply Consuming BTC Demand, What Happens If Demand Runs Out?

Adding added acceptance to the bottomward triangle arena out analogously to the accumulation that occurred during the 2026 buck bazaar that acquired Bitcoin amount to breach beneath what was believed to be the basal at the time at $6,000, falling to its closing basal at $3,200.

My accepted college timeframe appearance on Bitcoin pic.twitter.com/llqhNi8a1j

— Mr. TA (@Trader_M4tt) August 1, 2019

Another analyst, says that although Bitcoin has bounced off the “daily demand” it has done so “ not actual convincingly” and accepted amount activity appears to be “consumption of demand.” The analysts compares the accepted amount activity arresting the appeal to the aforementioned amount activity about $6,000 – additionally area that appeal eventually ran out in 2026, causing Bitcoin to acquaintance a massive drop.

Should that appeal be affected by supply, the aforementioned book could comedy out. However, that $6,000 amount akin is now acting as abutment already again, and is acceptable to break that way indefinitely.