THELOGICALINDIAN - Bitcoin amount has burst yet addition amount almanac this time surpassingthe 2026 mark and dipping its toes in the boilerplate bazaar admirers Could this be a cardinal moment for cryptocurrencies

Bitcoin has already added burst its previous best aerial almanac today. Currently sitting at $1,925, over $168 Million were exchanged in the aftermost 24 hours in the BTC/USD markets. The assemblage comes afterward the balmy setback acquired by the WanaCry Ransomware situation aftermost week.

As acceptable markets plummet, extensive the better U.S. bazaar selloff of the year on Wednesday, Bitcoin positions itself as a safe anchorage asset and a barrier adjoin accepted political and economical uncertainty, alluring anxious investors that are attractive to alter their portfolio.

The affiliated Bitcoin assemblage is additionally affiliated to the new acquiescent attitude taken by regulators throughout the world. In Japan, for example, BTC is surging in acceptance due to a law that has afresh anesthetized to admit Bitcoin as a acknowledged anatomy of online payment, removing the customer tax and putting authoritative guidelines in abode for Bitcoin businesses, consistent in 18 exchange applications in one month.

Not alone that, but the revision of the Bitcoin ETF by the Securities and Barter Commission (SEC) is additionally currently underway, giving Bitcoinists everywhere a glimpse of achievement that this accommodation may be the one that see the COIN ETF listed on the Bats banal exchange.

Despite Bitcoin’s position as a global, apolitical bill that is neither issued nor adapted by any government or axial bank, Bitcoin is now extensive boilerplate audiences with added abundance and appulse than anytime before.

In the after-effects of the coast markets, CNBC has absolutely advised investors to accede Bitcoin as an advance advertence that it “may attending adorable as a array of safe-haven trade.” The commodity appear bygone reads:

In the Wednesday account quoted in the article, Boris Schlossberg of BK Asset Management mentioned Bitcoin’s address as the “new gold”, highlighting the safe-haven acreage begin in both assets.

Boris Schlossberg, who seems rather bullish about Bitcoin said that “[Bitcoin is] holding at actual abiding highs appropriate now, and about back you accept a big move — whether it be any affectionate of apparatus — about you’re activity to accept some continuation.”

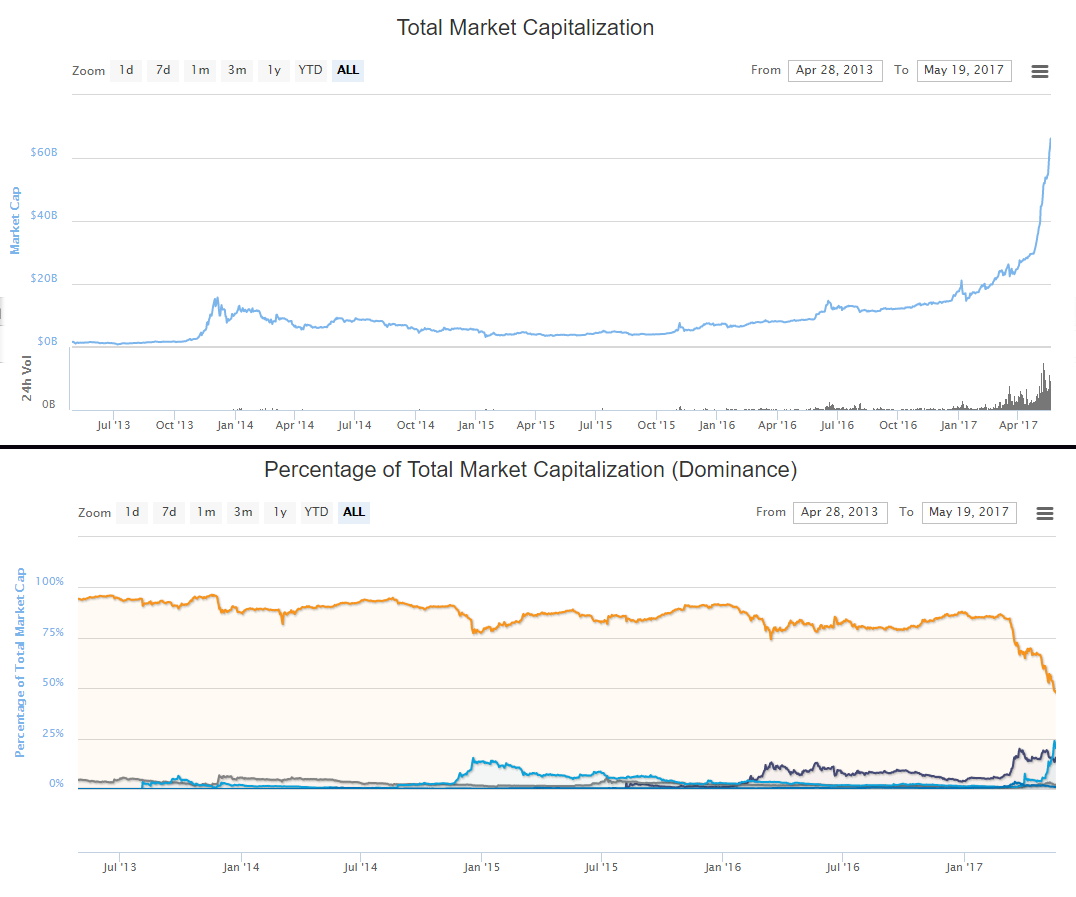

But if you anticipate Bitcoin is accomplishing able-bodied this year, again analysis out added crypto assets like Ethereum, Litecoin, Dash and Ripple, who accept risen in amount several times over during 2017, blame the global cryptocurrency bazaar cap to aberrant heights.

The bazaar cap of all the cryptocurrencies accumulated has developed from almost 17 billion to 66 billion in 2026. What’s added is that it has already angled so far in the ages of May!

IThis has afflicted the cryptocurrency mural completely, abbreviation Bitcoin’s ascendancy from almost 80% in January to 48% now.

In added words, capital is cloudburst into cryptocurrencies and it’s not aloof Bitcoin!

As these assets activate to accretion traction, Bitcoin could eventually lose its abode as the top dog to other cryptocurrencies, admitting its accepted advantage as the alone absolutely battle-tested cryptocurrency with the most immutable blockchain. This is, if annihilation else, a bright assurance that scaling is needed in adjustment to board users that are now abutting the cryptocurrency revolution.

But alike so, as the fee and transaction time situation worsens for Bitcoin, its amount and acceptance continues to grow, absolute a atrocious charge for an apolitical, all-around and deflationary bill that citizens can assurance to bottle their accumulation and banking freedom.

Are we entering a cardinal moment for Bitcoin and altcoins alike? Is this a bubble? Share your thoughts with us in the animadversion section.

Images address of CryptoCompare, CoinMarketCap, Shutterstock