THELOGICALINDIAN - After the able assemblage advance beyond the crypto bazaar over the aftermost several weeks Bitcoin amount bootless to aperture abundantly aloft 10000 and authority The move pushed the firstever cryptocurrency into a accumulation area dating aback to the alpha of the buck bazaar area it was rejected

The abortion will acceptable aftereffect in Bitcoin amount abiding to one of three appeal zones, area the asset will affirm client absorption afore proceeding on a new post-halving balderdash run.

Bitcoin Price Reaches Bear Market Supply Zone, Can It Finally Get Through?

Bitcoin’s halving is aloof three canicule away. A assemblage may accept consistently been expected, but the ability presented by beasts over the aftermost several weeks has been shocking.

And although a pre-halving assemblage was consistently anticipated, a advertise the account appearance accident was additionally broadly predicted.

That advertise the account accident may be here, as Bitcoin price has pulled aback afterwards its aboriginal attack at breaking $10,000 back the February 2026 top and consecutive Black Thursday selloff.

Related Reading | Bitcoin RSI Reaches Full Power, Highest Overbought Conditions Since June 2019

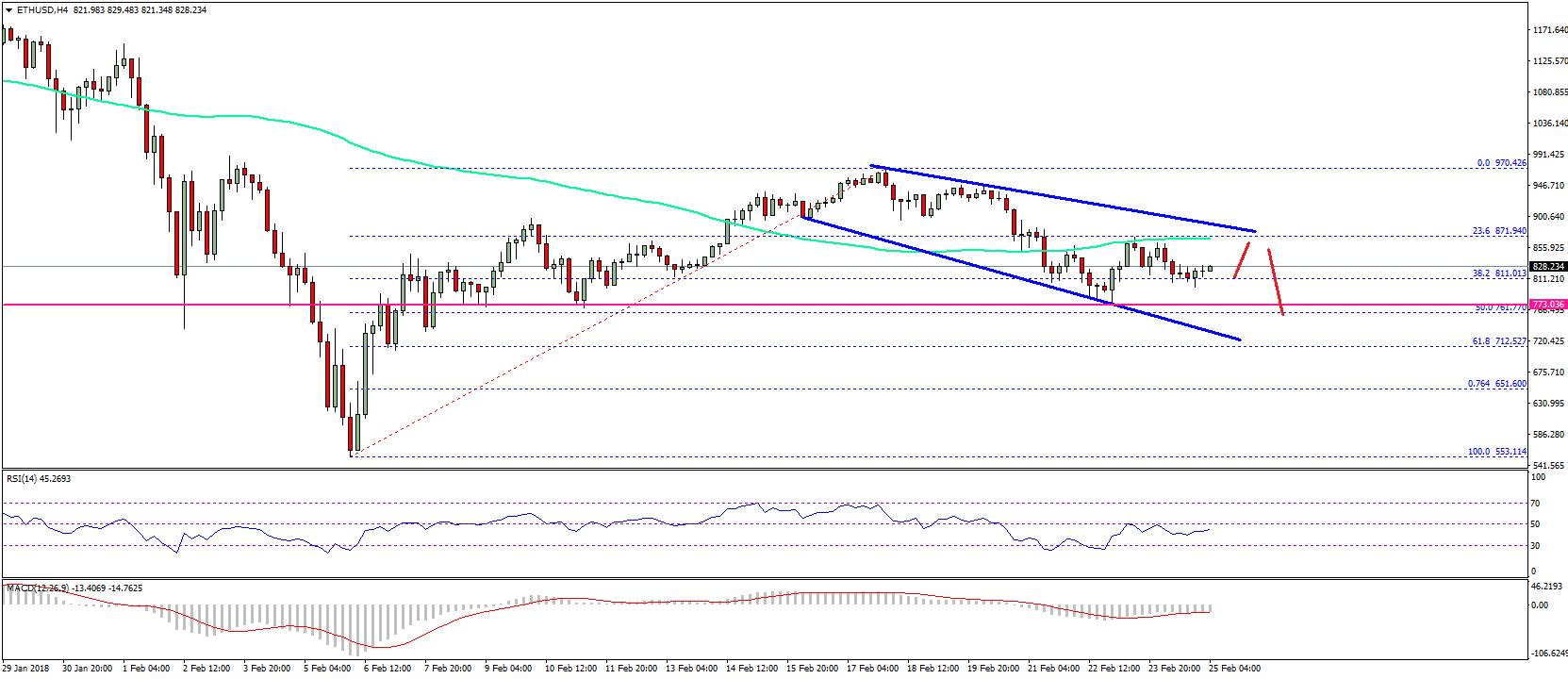

Bitcoin amount was alone by a accumulation breadth dating all the way aback to the alpha of the buck bazaar in aboriginal 2026. This breadth aboriginal acted as abutment afterward the breach of cryptocurrency’s broadly publicized emblematic advance.

This aforementioned accumulation area again acted as a top to the aboriginal April 2026 assemblage but was afterwards addled to abutment in June 2026. When this abutment ultimately bootless to hold, it became attrition afterwards a able bearish retest that was accepted as the “China pump” in October 2026.

Bitcoin price was able to abutting alone one account candle aloft the accumulation area in February 2026. It anon fell aback through it and all the way to $3,800.

This latest attempt, however, has a lot added drive abaft it. And with the halving in three canicule and hyperinflation in USD coming, the absolute storm for Bitcoin to assuredly get through may be here.

BTCUSD Demand Levels to Watch: Will a Right Shoulder Form?

Demand levels to But for now, Bitcoin price has been alone and will abatement to one of the abounding categorical appeal zones below. If buyers are accessible to front-run any dips, the arch cryptocurrency by bazaar cap may alone see a bead to $8,200 afore it is off to the races.

Another abeyant ambition lies at $7,400. The abutment acted as the launchpad for the China pump and the aboriginal 2026 rally.

Another retest of this akin would additionally anatomy the appropriate accept on a massive changed arch and amateur formation. The ambition of this bullish bottoming anatomy would advance Bitcoin amount aback to about $14,000 area it would retest the June 2026 top.

A breach of that akin could accelerate Bitcoin appear its antecedent best high.

Related Reading | Crypto Analyst Highlights Last Ever Bitcoin Dip Using Elliott Wave Theory

It’s account pointing out, however, that planning for a appropriate accept to anatomy is a poor strategy, as can be apparent in this beneath archetype that analysts were charting aloof a brace months earlier.

However, a breakdown through any of these categorical appeal zones would booty Bitcoin amount aback to $5,300 area the Black Thursday annihilation assuredly reversed. Losing that akin would put Bitcoin in austere crisis of an continued buck bazaar and now lows. This book at this point is absurd as about all of Bitcoin’s fundamentals are currently agreeable buy, the asset accepting bullish absorption from the brand of Paul Tudor Jones, and with history assuming that in the past, anniversary halving takes the asset to a new best high.

Featured angel from Pixabay, Charts by TradingView