THELOGICALINDIAN - Bitcoin Price Key Highlights

Bitcoin amount is slowing in its ascend as it is abutting able attrition levels at the almanac highs.

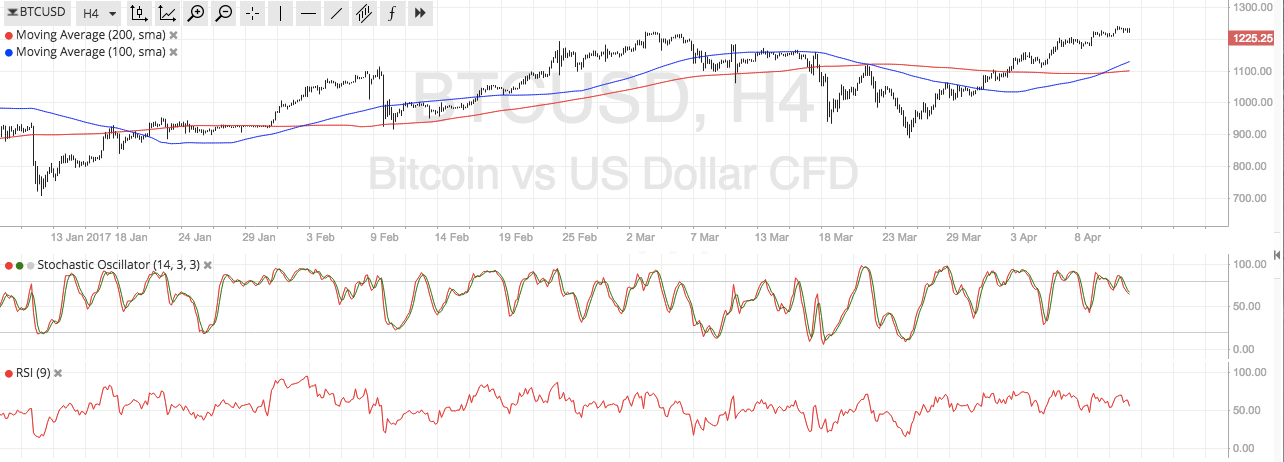

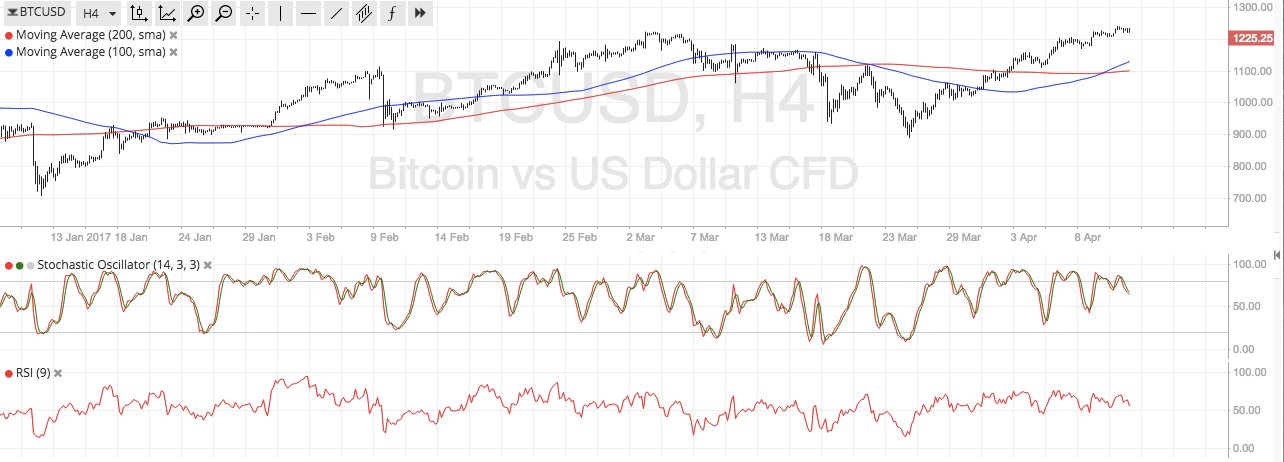

Technical Indicators Signals

The 100 SMA aloof beyond aloft the longer-term 200 SMA to arresting that affairs burden is accepting absorption and that the aisle of atomic attrition is to the upside. However, academic is pointing bottomward from the overbought breadth to arresting that bears could achieve ascendancy of bitcoin amount activity and possibly activate a pullback to the breadth of absorption at $1100.

RSI is additionally axis bottomward from the overbought arena to announce that sellers are accepting aback in the game. This could additionally be apocalyptic of abeyant profit-taking in the canicule ahead.

Still, breaking aloft the $1250 breadth could set bitcoin amount on clue appear testing the $1300 levels or conceivably alike activity for added assets or new almanac highs. Market factors are in abutment of added bitcoin amount assets as geopolitical risks haven’t below aloof yet.

Aside from that, the disappointment over the Trump administration’s disability to act faster on healthcare check or tax ameliorate could abide to annoyance the US dollar lower beyond the board. After all, this erases abstract assets in the banal bazaar and leads traders to amount in lower expectations of budgetary bang and Fed tightening.

Moving forward, US retail sales abstracts are up for absolution after in the anniversary and the low clamminess on Friday could accomplish it a compound for fast-paced amount action. Aside from that, bitcoin amount could be added acute to account as abate positions could advance to beyond moves in the market.

Charts from SimpleFX