THELOGICALINDIAN - Bitcoin Price Key Highlights

Bitcoin amount could cull aback as low as the burst triangle attrition afore resuming its climb, as abstruse indicators are hinting at a quick selloff.

Technical Indicators Signals

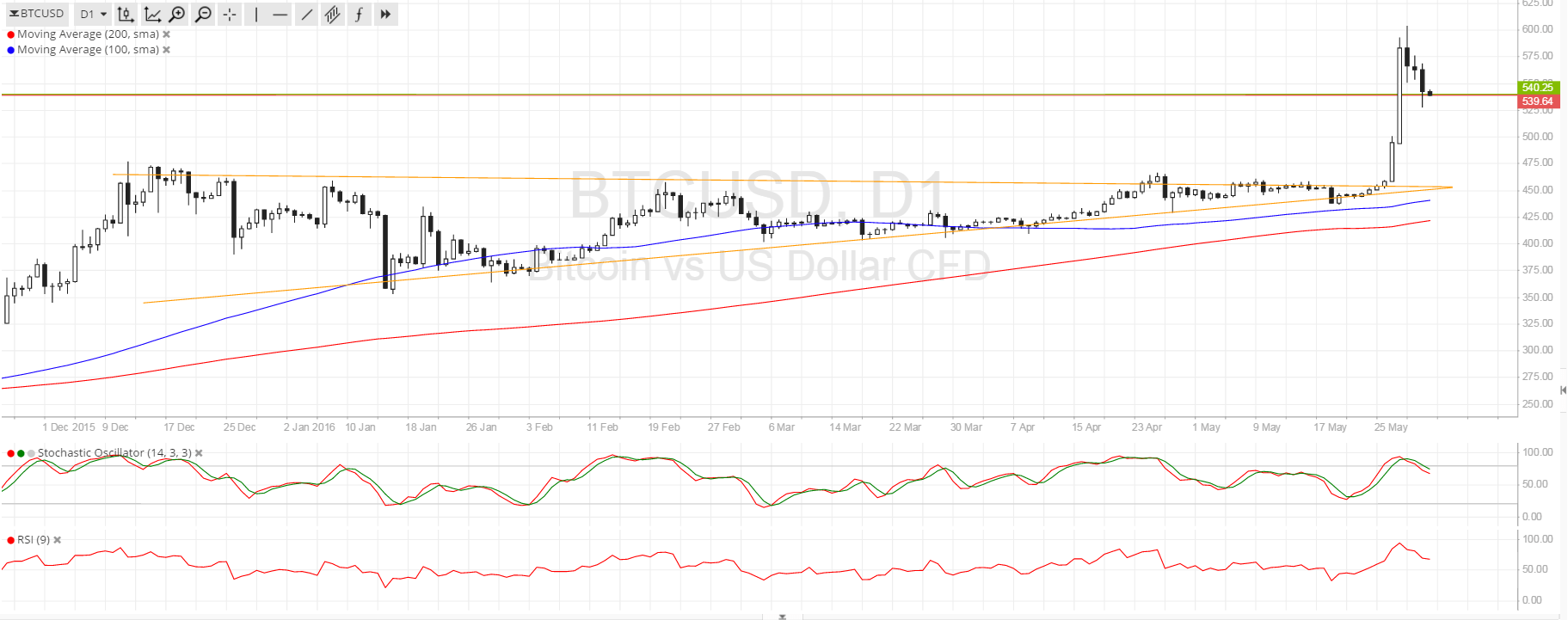

The 100 SMA is aloft the 200 SMA for now, acknowledging that the longer-term aisle of atomic attrition is to the upside. However, the gap amid the affective averages is absorption so a bottomward crossover could be imminent. Still, the affective averages are abutting to the above triangle support, and this ability be the band in the beach for any ample correction.

Stochastic is on the move down, which agency that bears are demography ascendancy of bitcoin amount or that profit-taking amid buyers is happening. Similarly, RSI is on the move bottomward to announce the attendance of bearish momentum. This could go on until the burst triangle attrition about $450-475 or until the antecedent year highs at $500. Once beasts are aback in the game, a ascend aback to the $600 mark could be in order.

Market Events

The acknowledgment of US and UK traders from their continued weekend holidays accept active appeal for the safe-haven US dollar, decidedly back assessment acclamation appropriate a about-face in favor of a Brexit. This could beggarly added ambiguity for the UK and all-around economy, thereby propping up appeal for lower-yielding and beneath chancy backing like the dollar.

Still, appeal for cryptocurrencies charcoal intact, abnormally afterwards Chinese investors accept put a lot of funds in bitcoin attributable to the government’s efforts to abate the yuan and appoint basic controls.

Moving forward, US abstracts releases could add animation to the mix, as the non-farm payrolls address is due on Friday and traders are on the anchor for able abstracts which ability allowance the accord for a Fed amount backpack this ages or the next.

Charts from SimpleFX