THELOGICALINDIAN - Bitcoin Price Key Highlights

Bitcoin amount ability be in for a beyond bead based on the concise changeabout accumulation but abstruse indicators are giving a altered signal.

Technical Indicators Signals

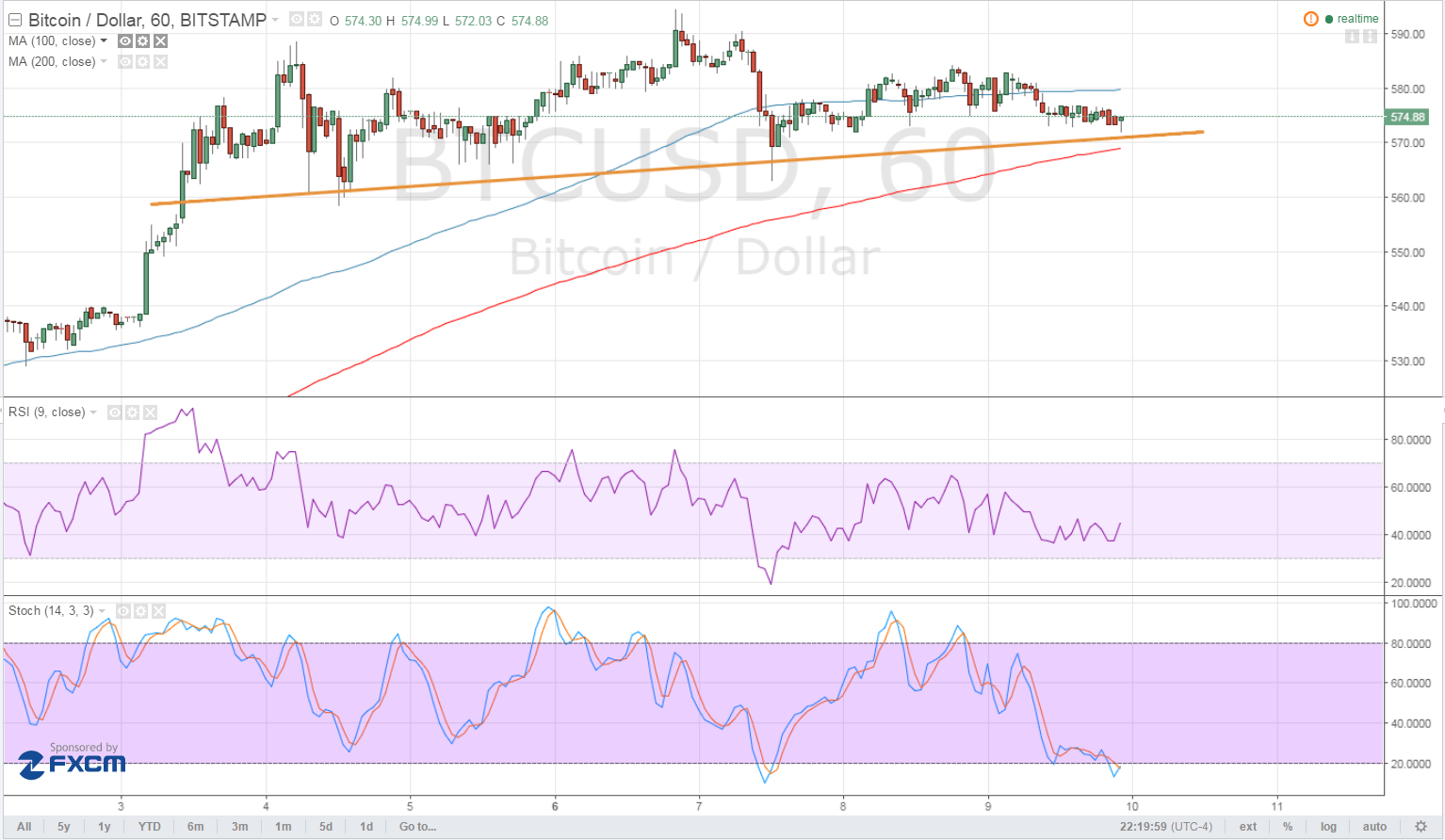

The 100 SMA is aloft the 200 SMA so the aisle of atomic attrition is still to the upside. This suggests that the ascent abutment akin about $570 ability serve as a floor, abnormally back it curve up with the 200 SMA activating support.

RSI is pointing up and ability be accessible to arch arctic so bitcoin amount could chase suit. Stochastic is advertence oversold altitude so sellers ability charge to booty it accessible from actuality and acquiesce buyers to booty control. If so, bitcoin could arch aback to the latest highs at $595.

Market Events

The anemic NFP address has advised on the US dollar at the alpha of June, arch traders to amount in lower allowance of Fed abbreviating this ages or the next. However, the safe-haven bill has managed to achieve arena at the alpha of this week, possibly as risk-off accordance accept remained in the banking markets.

For one, the looming EU election could accept traders absorption to added authorization currencies such as the US dollar and abroad from European currencies. Still, added investors ability be added absorbed to move their funds to another assets like bitcoin and added basic currencies, which are not afflicted by budgetary authorities.

In addition, beat CPI after-effects from China could already afresh activation speculations of yuan abasement and drive added Chinese investors appear bitcoin. Recall that these factors were one of the capital affidavit for the aciculate billow in bitcoin in backward May. The FOMC account abutting anniversary could be acute for free dollar administration and accordingly bitcoin amount activity so be on the anchor for abeyant breakouts or rallies.

Charts from TradingView