THELOGICALINDIAN - Bitcoin Price Key Highlights

Bitcoin amount could be in for a aciculate bead if traders adjudge to book profits off their contempo continued positions.

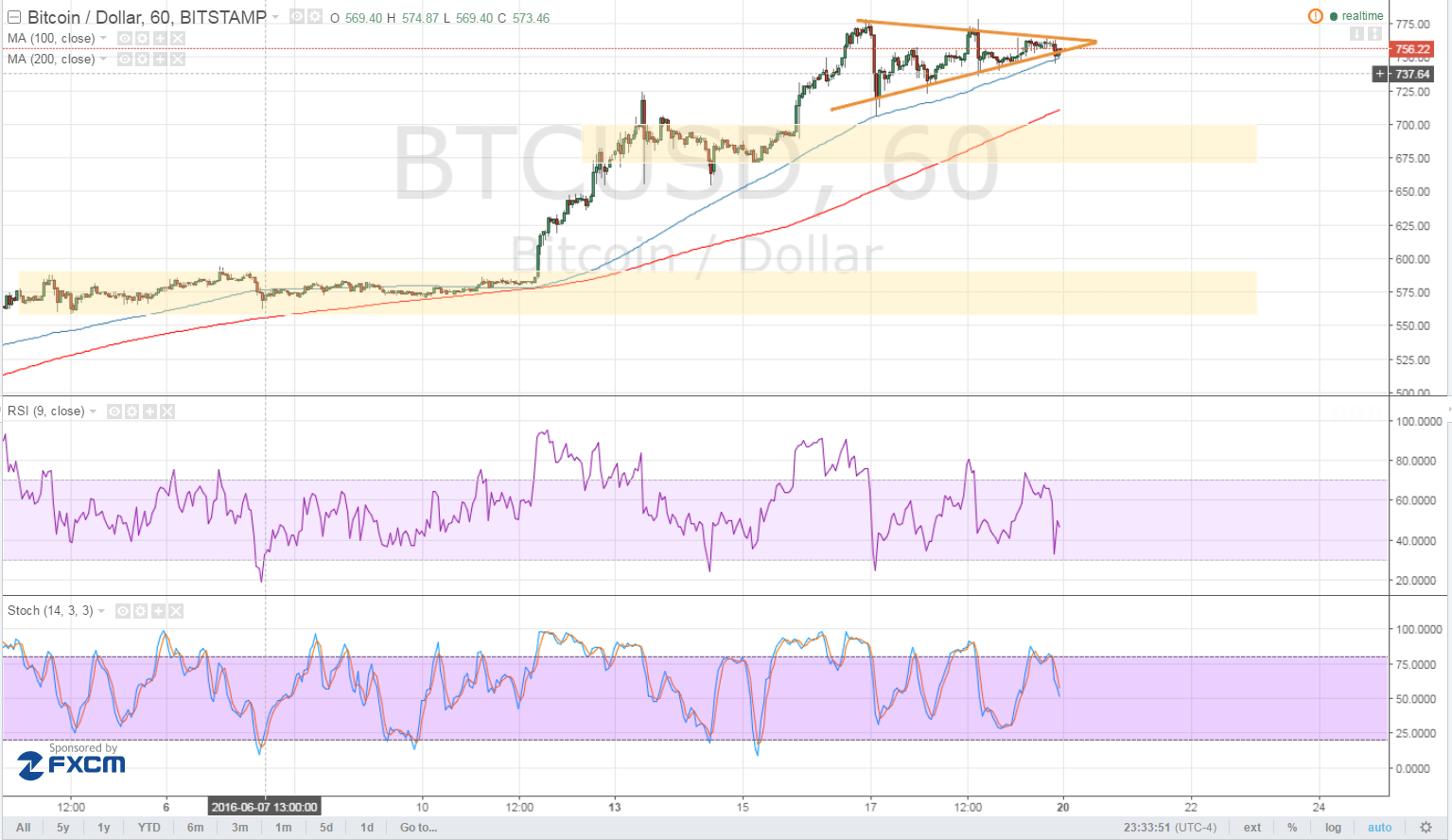

Technical Indicators Signals

The 100 SMA is aloft the 200 SMA, which agency that the aisle of atomic attrition is to the upside and that added assets are possible. In addition, this concise affective boilerplate curve up with the balanced triangle abutment and is captivation as a activating articulation point. The gap amid the affective averages is addition so bullish burden could be architecture up.

However, academic is pointing down, hinting that sellers could booty ascendancy of bitcoin amount and advance for a downside break. If so, amount could arch appear the abutting attic about the $675-700 area, which is about an breadth of absorption and is additionally abutting to the 200 SMA. A breach beneath this breadth could accompany bitcoin amount to the abutting abiding abutment at $575.

RSI appears to be axis college alike after extensive the oversold region. If buyers break on top of their game, bitcoin amount could accomplish yet addition upside breakout, depending on the aftereffect of this week’s bazaar events.

Market Events

Bitcoin amount has been acerb accurate by the ambiguity in the banking markets throughout the month, arch traders to put money in another assets like cryptocurrencies against acceptable ones like stocks and currencies. The accessible EU election could accept a acerb airy appulse on these markets, with some analysts admiration that axial banks could clutter to arbitrate if the UK votes to leave the bloc.

In that scenario, bitcoin could be in for a abundant bluff rally, as investors ability move funds out of disinterestedness markets assimilate basic currencies. On the added hand, a vote to accumulate the UK in the EU would backslide to the cachet quo and apparently argue traders to book profits off their “uncertainty positions” on bitcoin.

Charts from TradingView