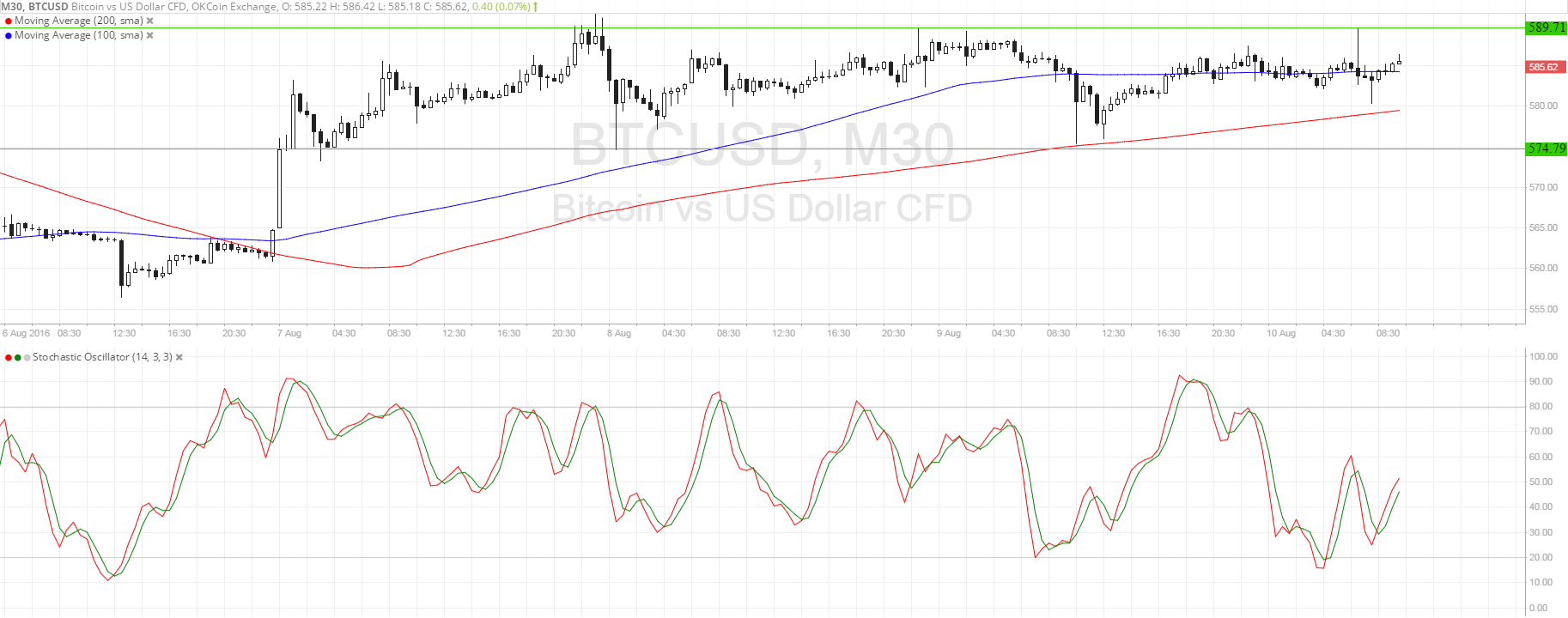

THELOGICALINDIAN - Bitcoin Price Key Highlights

Bitcoin amount is clearing central a ambit but abstruse indicators assume to be hinting at an upside breakout.

Technical Indicators Signals

The 100 SMA is still aloft the longer-term 200 SMA on this time frame, signaling that the aisle of atomic attrition is to the upside. Price is currently testing the activating abutment at the 100 SMA, with addition abeyant attic at the 200 SMA nearby. The gap amid the affective averages seems to be narrowing, suggesting a accessible bottomward crossover after on.

Stochastic is on the move up so bitcoin amount ability chase suit. An upside blemish accomplished the $590 ambit attrition could booty it college by an added $15, which is the aforementioned acme as the concise rectangle formation. On the added hand, a continued bearish candle closing beneath $575 could booty bitcoin amount bottomward by $15 as well.

Market Events

The abridgement of market-moving catalysts compared to antecedent weeks has led to a abeyance in bitcoin amount action. Central banks accept appear budgetary action changes aftermost anniversary while the drudge in a Hong Kong barter has advised heavily on bitcoin price. Soon after, traders appointed profits off the aciculate bead and are now cat-and-mouse for added bazaar clues.

A abeyant agitator for amount activity could be the Reserve Bank of New Zealand’s action accommodation back this ability affect all-embracing bazaar affect and dollar trading, but this accident is not accepted to accept a ample absolute appulse on bitcoin price. For now, alliance could abide for the cryptocurrency, acceptance traders to aloof comedy the ambit abutment and resistance.

The US is set to book its retail sales address on Friday and ability activation able moves for the dollar, thereby boring bitcoin amount around. Downbeat abstracts could beggarly losses for the US bill and accordingly assets for bitcoin.

Chart from SimpleFX