THELOGICALINDIAN - Bitcoin Price Key Highlights

Bitcoin amount is affective central a tiny triangle alliance arrangement but may be due for a blemish eventually or later.

Technical Indicators Signals

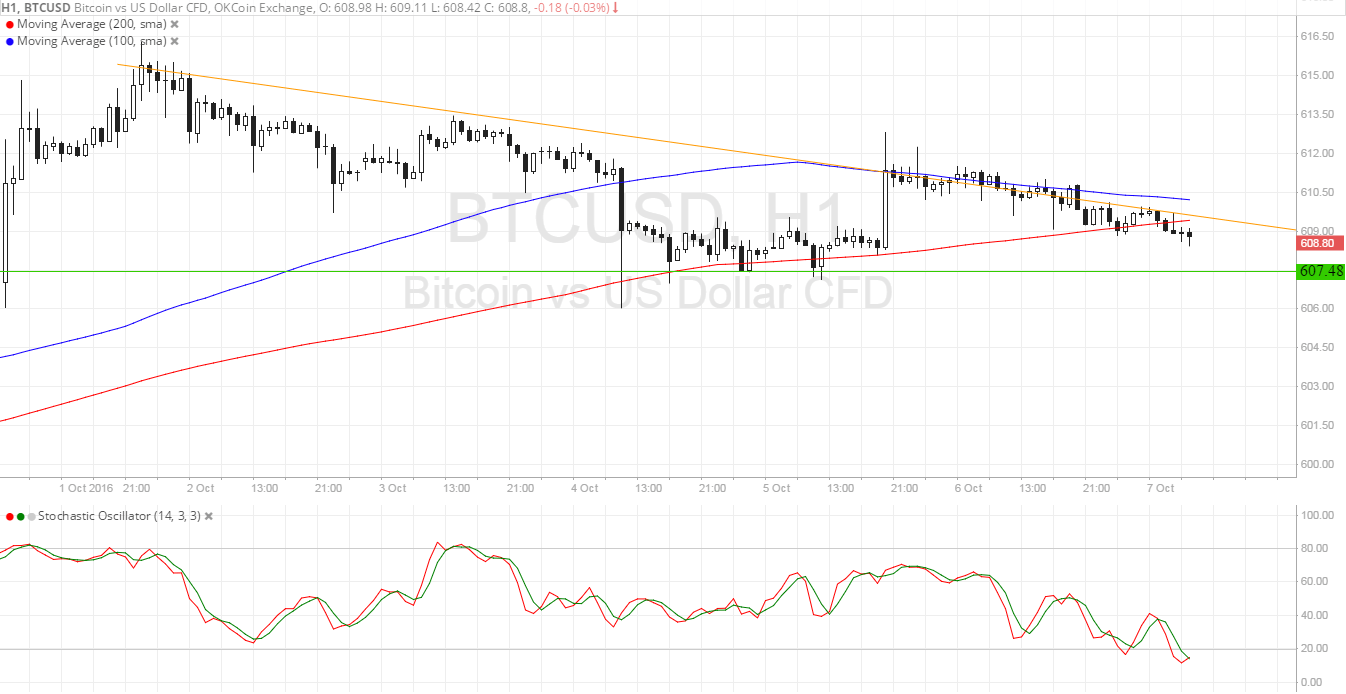

The 100 SMA is aloft the longer-term 200 SMA, which suggests that the aisle of atomic attrition is to the upside. For now, the 100 SMA has captivated as concise activating resistance, and the absorption gap amid the affective averages suggests that a bottomward crossover ability be imminent. If so, sellers could booty ascendancy of bitcoin amount action.

Stochastic is ample down, additionally advertence that bearish drive is in play. With that, bitcoin bulk could breach beneath the $607.50 abutment breadth and arch appear the abutting abutment at $601.50. Note that the triangle arrangement spans $607.50 to $615 so any consistent blemish could aftermost by the aforementioned amount.

Market Events

The capital accident for the day is the NFP release, as this would accomplish or breach Fed amount backpack expectations. Market participants are ambience expectations up for an upside abruptness back arch indicators such as the ISM surveys and Challenger job cuts accept printed improvements in hiring. Meanwhile, the ADP non-farm application change address reflected a arrest in employment.

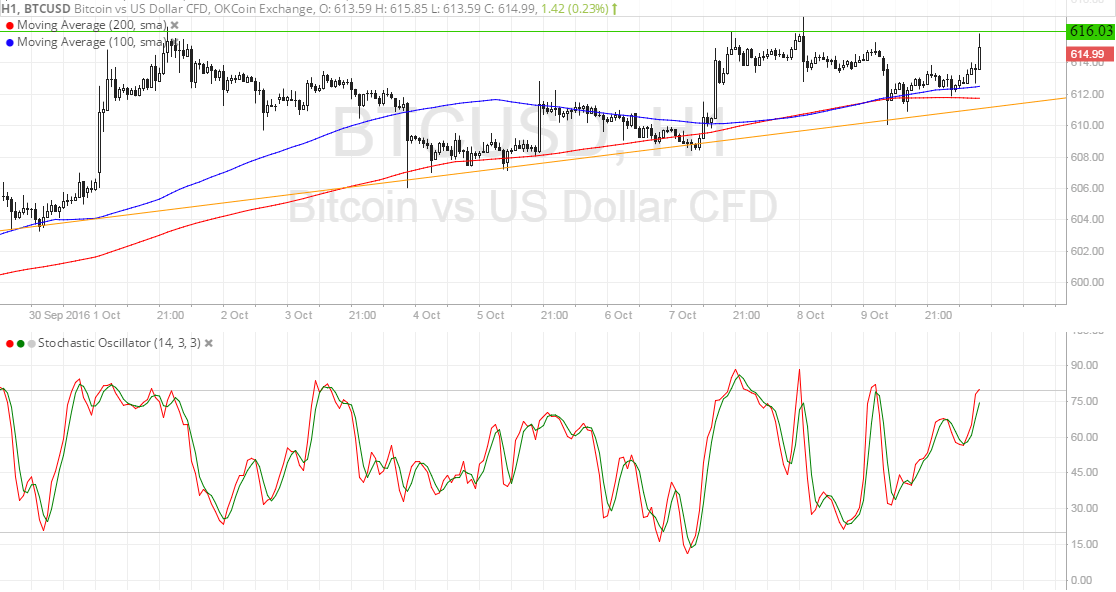

A stronger than accepted account accomplished the 171K accord could reinforce expectations for a November backpack and drive dollar appeal adjoin bitcoin price, thereby triggering a downside triangle breach and a acceptable selloff. On the added hand, a beat aftereffect could advance to defalcation of dollar continued positions and acquiesce bitcoin amount to booty advantage and breach accomplished the triangle attrition about $610.

Liquidity appears to be attenuate for bitcoin recently, which suggests that animation could aces up already ample orders are seen, active added traders to hop in able moves as well. Keep in apperception that this blazon of amount activity about occurs about the weekend so don’t balloon to accomplish adjustments for exposure.

Charts from SimpleFX