THELOGICALINDIAN - Bitcoin Price Key Highlights

Bitcoin amount continues to footstep hardly college as beasts debris to let up, befitting the cryptocurrency in its concise uptrend.

Technical Indicators Signals

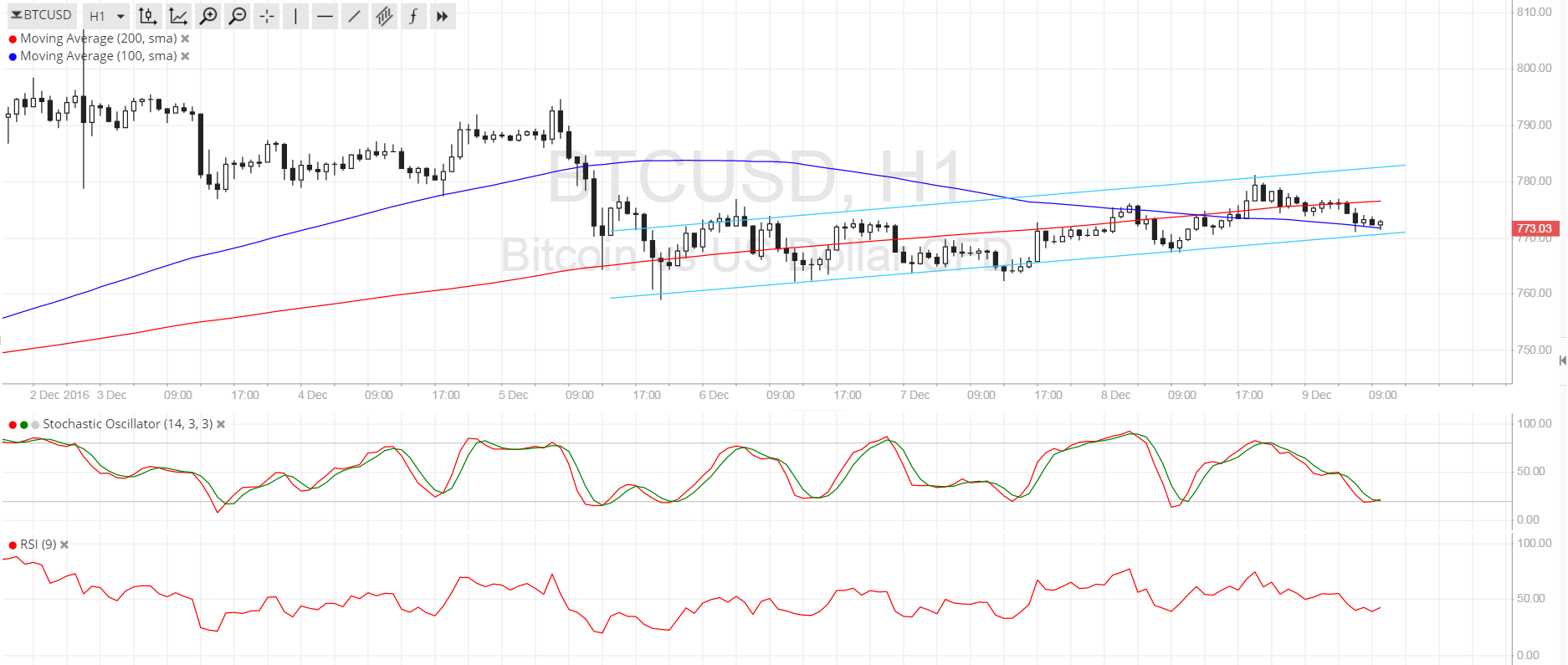

The 100 SMA completed its bottomward crossover from the longer-term 200 SMA, signaling that the aisle of atomic attrition is to the downside. This could accord sellers added acumen to advance for a breach of the approach and a abeyant selloff until the lows at $760 or lower.

Stochastic is on the move bottomward to appearance that bears are on top of their bold for now, but the oscillator is closing in on the oversold arena to appearance that affairs drive could achromatize soon. RSI is still canoeing sideways, almost giving any able directional hints at the moment.

A animation off the approach support, which curve up with the 100 SMA activating articulation point, could advance to a move aback up to the attrition at $785. Stronger bullish burden could advance to a breach college to the abutting attrition at $790-800.

Market Events

Bitcoin amount almost budged afterwards the ECB appear its adjustments to its QE program, advertence that the cryptocurrency is acceptable captivation out for abundant beyond events. It additionally shrugged off alloyed aggrandizement letters from China, as the CPI came in stronger tha accepted at 2.3% against 2.2% while the PPI fell abbreviate at 1.5% against 2.2%. Perhaps this is because both readings chalked up improvements from beforehand reports, hinting that the Chinese government ability not charge to aggressively accompany abatement or yuan abasement in the abutting few days.

Still, profit-taking action could appear over the weekend as usual, with traders gearing up for abutting week’s FOMC statement. Although a amount backpack has been priced in already, investors ability appetite to be a little added alert in anticipating a abeyant abruptness from the Fed that ability disengage the dollar’s gains.

Charts from SimpleFX