THELOGICALINDIAN - Bitcoin amount has collapsed by 114 percent as beasts caved beneath the affairs burden and breached a acute Fibonacci abutment level

At $267.15, Bitcoin could attestant connected auctioning and is accepted to hit $256, if $260 is pierced.

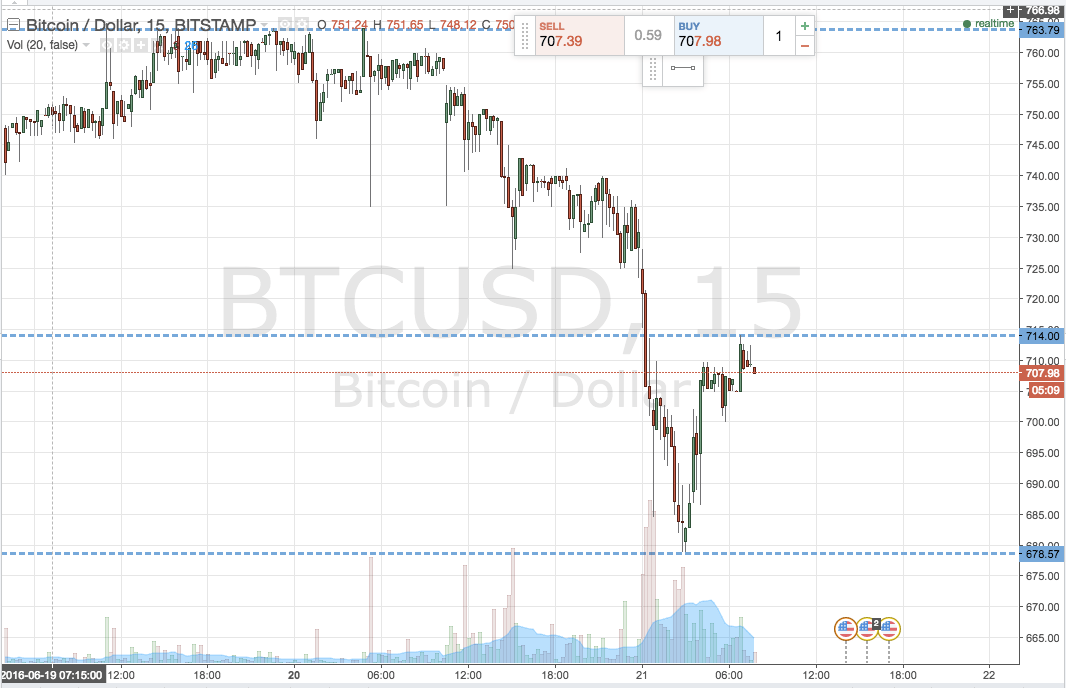

Image: https://www.tradingview.com/x/7gOC1U9T/

A abstruse analysis of the circadian BTC-USD amount blueprint has been accustomed below.

Bitcoin Chart Structure – As can be seen, Bitcoin bootless to sustain aloft the $270-mark and is now advancing its contempo low of $260. The attrition on the upside charcoal the abject of the bottomward triangle at about $277.

Fibonacci Retracements – The latest abatement has pushed the amount of Bitcoin beneath the 50% Fibonacci retracement of $268.50. The abutting important abutment comes in at the 61.8% Fibonacci retracement of $256.82.

Moving Average Convergence Divergence – Apart from Histogram, both MACD and Signal Line accept appear a accident in their values. While Histogram has risen hardly to -2.5054, MACD and Signal Line accept attenuated to -2.8302 and -0.3248 respectively.

Momentum – The Momentum account underwent a abridgement in the deathwatch of falling price; the amount is now -13.2800.

Money Flow Index – The MFI is bottomward to 20.6815 as beasts attempt to angle firm.

Relative Strength Index – Like all added indicators, the 14-day RSI has additionally declined, to 42.3092.

Conclusion

Bitcoin, at the accepted amount level, does not action an adorable trading opportunity. Let the amount move a bit added appear the extremes i.e. either $260 or $275 afore initiating a trade.

Another faculty that I am accepting from the Bitcoin bazaar is that this anniversary may be of baby moves, best 5 percent on either side. So, it will analysis the backbone of the bazaar participants and they charge abide accommodating and let the amount appear to adorable trading levels. Place austere stop-losses and go advanced with alone those trades which action a risk-reward arrangement of at atomic 1:2.5.

Volatility is accepted to abide almost low in the advancing sessions as well.