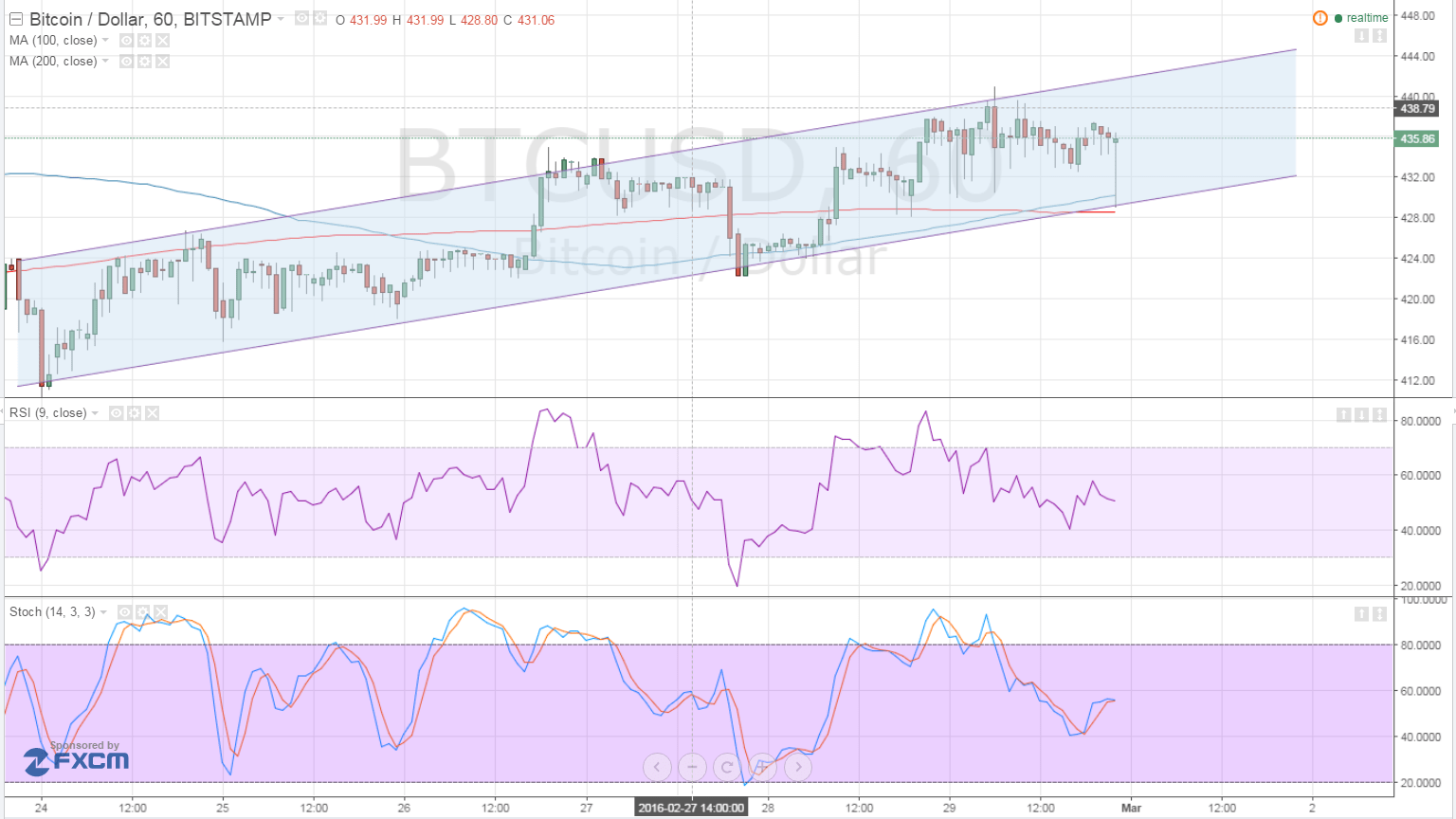

THELOGICALINDIAN - Bitcoin Price Key Highlights

Bitcoin amount bounced off the approach abutment as accepted and ability accept its architect set on the top.

Technical Indicators Settings

The 100 SMA aloof beyond aloft the 200 SMA, acknowledging that the uptrend is acceptable to backpack on. In addition, these affective averages captivated as near-term abutment levels back they band up with the approach abutment about $430.

That long-wicked candle suggests that buyers are abnegation to let bitcoin amount bead too much, as continued orders were apparently amid appropriate about the basal of the channel. These beasts ability accumulate these continued positions accessible until they can book profits at the approach resistance.

For now, academic and RSI are both on average arena advancing from their way bottomward from the overbought levels. However, academic appears to be axis higher, suggesting that buyers are regaining control. A move aback south could draw amount to chase suit, arch to yet addition analysis of the approach support.

A breach beneath the $430 breadth could appearance that a changeabout is starting, acceptable demography bitcoin amount to the abutting abutment about $420 again assimilate the $400 handle.

Market Events

Data from the US abridgement came in mostly weaker than accepted yesterday, as awaiting home sales abstracts and the Chicago PMI fell short, acceptance BTCUSD to advance. For today, the ISM accomplishment PMI is up for absolution and a acceleration from 48.2 to 48.5 is expected, with stronger than accepted abstracts acceptable to activation dollar gains.

Earlier today, Chinese PMI readings came in beneath expectations for both the accomplishment and non-manufacturing sectors, befitting accident appetence weak. The official accomplishment PMI fell from 49.4 to 49.0 while the non-manufacturing PMI slid from 53.5 to 52.7 to announce a slower clip of growth. Soon after, Australian GDP forecasts were revised bottomward but the RBA absitively to accumulate absorption ante banausic as expected.

Should accident abhorrence break in the markets for the blow of the trading sessions, bitcoin amount ability be affected to acknowledgment its contempo gains. Bear in apperception that euro area CPI estimates came in beneath expectations bygone so European traders are alert of putting funds in riskier assets and ability move these over to the safe-haven US dollar.

Other catalysts for the anniversary accommodate the US NFP address as this ability animate Fed amount backpack expectations for the month, thereby active up appeal for the dollar adjoin bitcoin price. Leading activity indicators such as the jobs basic of the ISM surveys and the ADP non-farm application change amount could set the accent for dollar activity for the blow of the week.

Intraday abutment akin – $430

Intraday attrition akin – $445

Technical Indicators Settings:

Charts from Bitstamp, address of TradingView