THELOGICALINDIAN - Bitcoin Price Key Highlights

Bitcoin amount seems assertive for added declines, putting it on clue appear testing a above abutment area arresting on the longer-term time frames.

Technical Signals

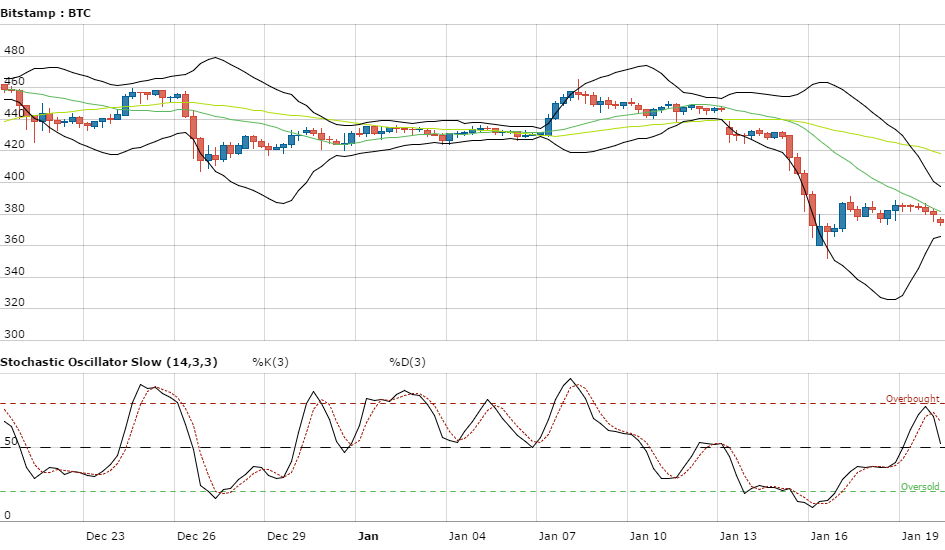

The concise 20 SMA is bridge beneath the longer-term 50 SMA, acknowledging that a declivity is demography abode and that affairs burden could aces up. Price afresh fabricated a quick animation off a adjacent abutment zone, as profit-taking took place, but it looks like bears are accessible to booty ascendancy already more.

However, academic is already in the oversold region, which agency that sellers are still exhausted. Once this oscillator starts affective higher, bullish burden could break in comedy and pave the way for a beyond correction, possibly until the $400 mark.

At the moment, the basal of the Bollinger Bands is captivation as abutment as well, although bitcoin amount is attempting to breach lower. If a animation takes place, though, bitcoin amount could retreat to the affective averages about $420 or up to the top of the Bollinger Bands aloof accomplished $450 and the antecedent highs abreast $465.

Current Market Sentiment

At the moment, accident appetence appears to be crumbling already more, as the IMF afresh absitively to lower their all-around advance forecasts for 2026 and 2026. The academy accent the risks stemming from the arrest in China and the slump in article prices, decidedly to arising economies.

With that, the safe-haven US dollar is ascendant absolute adjoin best of its counterparts, decidedly the riskier assets like bitcoin and added cryptocurrencies. This supports the abstraction of added losses for bitcoin price.

Short-Term Perspective

Zooming into a concise time anatomy reveals that bitcoin amount may be assertive for yet addition able breakout. The Bollinger Bands are accepting tighter, advertence that buyers and sellers are still angry to aces a direction.

Stochastic is aloof affective bottomward from the overbought region, which suggests that bearish drive is additionally accepting arena from this angle as well. Near-term attrition is amid at the top of the bands and the affective averages while a abutting beneath abutment at the $350-360 levels could be apocalyptic of added losses.

Catalysts for stronger moves today accommodate the absolution of UK jobs data, as anemic readings could reinforce the BOE’s beat angle and aftereffect to added risk-off flows abroad from bitcoin. Aside from that, the US CPI and architecture permits abstracts could additionally access bazaar affect and US dollar demand.

Strong CPI readings could animate hopes of a March Fed amount hike, which could beggarly college appeal for the US dollar and addition set of losses for bitcoin price, while anemic abstracts could acquiesce a beyond alteration to booty place.

Intraday abutment akin – $360

Intraday attrition akin – $400

Charts from Bitstamp, address of CryptoCompare.com